The Indiana Agreement that Statement of Account is True, Correct and Settled is a legal document that verifies the accuracy and completeness of a statement of account. This agreement is often used in business transactions or financial matters to ensure that both parties involved agree on the account balance and acknowledge that it is accurate and final. It serves as a formal confirmation that the account has been reviewed and settled, providing a clear understanding of the financial standing between the parties. Keywords: Indiana Agreement, Statement of Account, True, Correct, Settled There are different types of Indiana Agreements that can be used to state that the Statement of Account is True, Correct, and Settled. These may include: 1. Business-to-Business Agreement: This type of agreement is commonly utilized when companies engage in transactions with one another. It confirms that the statement of account provided is accurate, and both organizations agree that the account is settled. 2. Vendor-Customer Agreement: In this context, a vendor (supplier) and a customer (buyer) enter into an agreement to validate the accuracy of the statement of account and settle any outstanding payments. It establishes a clear understanding between the parties and prevents future disputes regarding the account balance. 3. Lender-Borrower Agreement: This agreement type is crucial in financial transactions where a lender and borrower interact. It ensures transparency and accountability by confirming that the statement of account accurately reflects the amounts owed and that the account is settled. 4. Landlord-Tenant Agreement: In rental transactions, a landlord and tenant may enter into an Indiana Agreement to validate the statement of account related to the lease. This agreement would certify that the tenant has paid all due rent, fees, and charges, bringing the account to a settled state. Regardless of the specific type of Indiana Agreement used, its essential purpose is to provide legal assurance that the statement of account is true, correct, and settled. It acts as a binding contract between concerned parties, ensuring trust and accuracy in financial matters. Please note that before using any legal document or agreement, it is advisable to consult with an attorney or professional familiar with the laws and regulations in Indiana to ensure compliance with local statutes and guidelines.

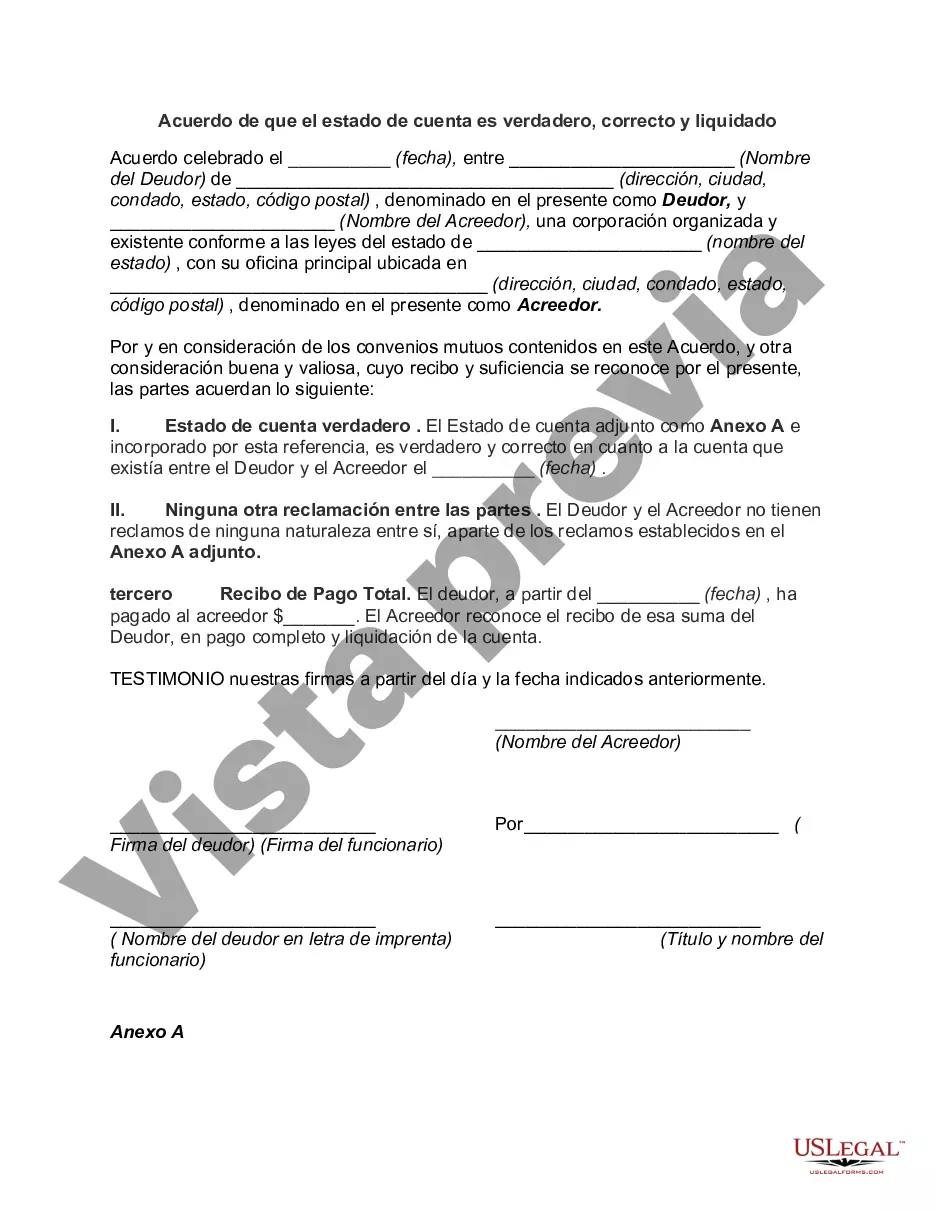

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Indiana Acuerdo de que el estado de cuenta es verdadero, correcto y liquidado - Agreement that Statement of Account is True, Correct and Settled

Description

How to fill out Indiana Acuerdo De Que El Estado De Cuenta Es Verdadero, Correcto Y Liquidado?

If you have to total, download, or printing legitimate papers layouts, use US Legal Forms, the biggest assortment of legitimate types, that can be found on-line. Utilize the site`s simple and convenient lookup to discover the documents you will need. Different layouts for enterprise and specific functions are sorted by types and states, or keywords and phrases. Use US Legal Forms to discover the Indiana Agreement that Statement of Account is True, Correct and Settled in a couple of mouse clicks.

When you are already a US Legal Forms consumer, log in to the bank account and click on the Down load switch to have the Indiana Agreement that Statement of Account is True, Correct and Settled. Also you can accessibility types you in the past saved from the My Forms tab of your own bank account.

If you are using US Legal Forms for the first time, follow the instructions under:

- Step 1. Ensure you have chosen the form for your right metropolis/region.

- Step 2. Use the Preview method to check out the form`s articles. Never neglect to see the description.

- Step 3. When you are unhappy with the type, make use of the Lookup discipline near the top of the display to discover other versions of the legitimate type template.

- Step 4. After you have located the form you will need, select the Acquire now switch. Pick the rates program you prefer and add your qualifications to sign up for an bank account.

- Step 5. Process the purchase. You can use your bank card or PayPal bank account to complete the purchase.

- Step 6. Pick the formatting of the legitimate type and download it on your own device.

- Step 7. Comprehensive, change and printing or signal the Indiana Agreement that Statement of Account is True, Correct and Settled.

Every legitimate papers template you purchase is the one you have permanently. You might have acces to every type you saved in your acccount. Click on the My Forms area and select a type to printing or download once more.

Compete and download, and printing the Indiana Agreement that Statement of Account is True, Correct and Settled with US Legal Forms. There are many specialist and state-distinct types you can use for your personal enterprise or specific demands.