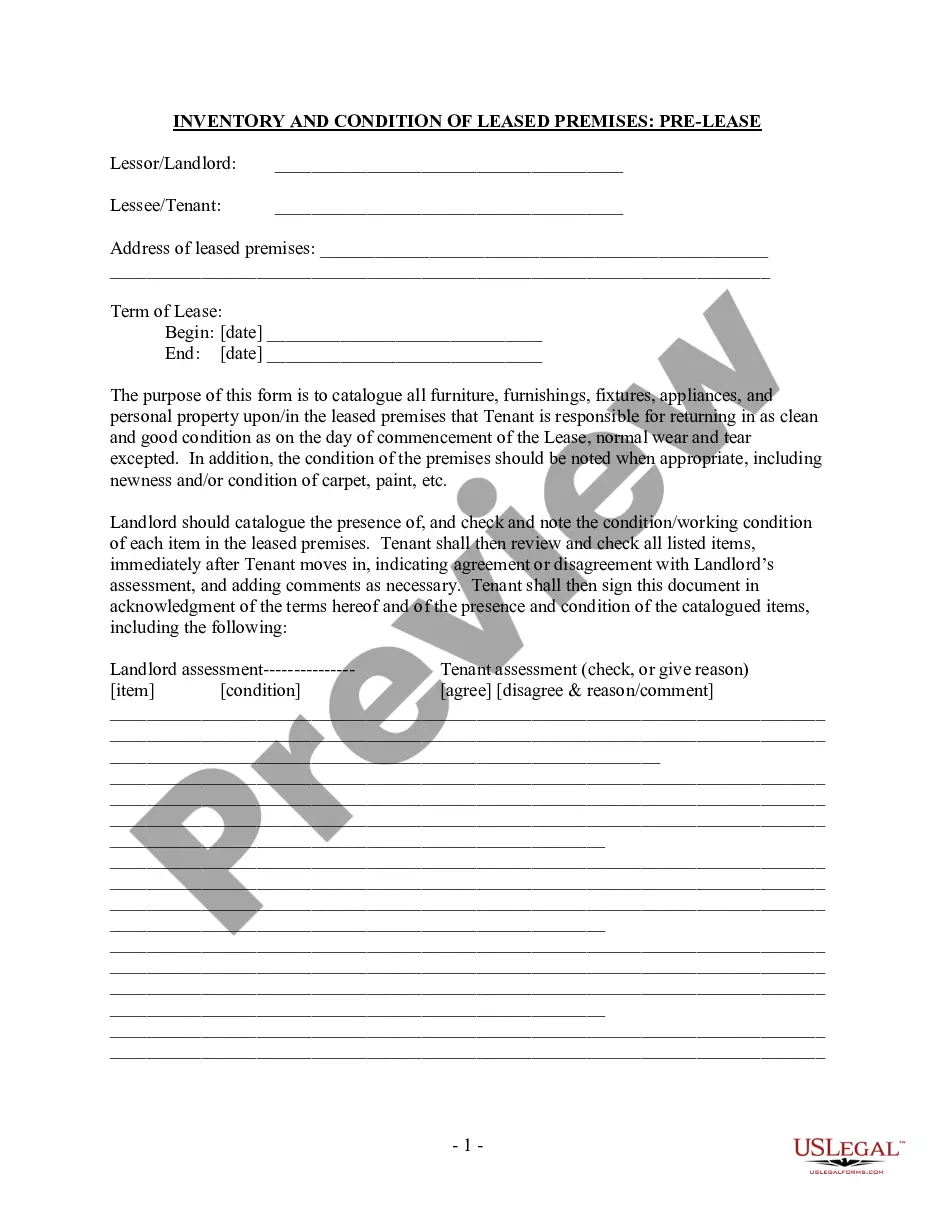

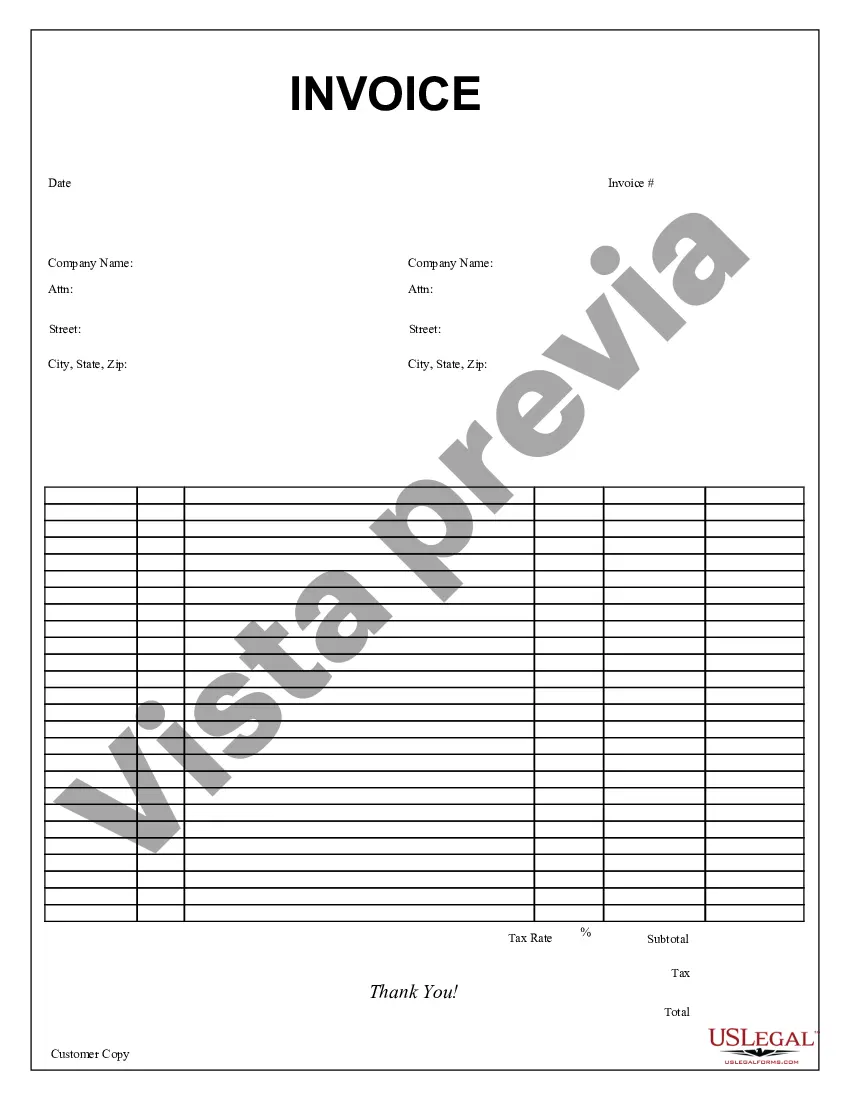

Indiana Purchase Invoice is a document that serves as a legal proof of purchase for goods or services acquired by an individual or company in the state of Indiana, United States. It outlines the details of the transaction, including the specific items or services purchased, their quantities, prices, and any applicable taxes. The Indiana Purchase Invoice typically contains crucial information such as the name, address, and contact details of the buyer and seller. It also includes the date of purchase, invoice number, payment terms, and the preferred method of payment. This document acts as an official record of the purchase and is essential for financial record-keeping, tax compliance, and future reference. There are different types of Indiana Purchase Invoices depending on the nature of the transaction or the specific industry. Some common types include: 1. Standard Purchase Invoice: This is the most basic type of invoice used in any type of business transaction, involving the purchase of goods or services. It includes details about the buyer, seller, items purchased, quantities, prices, and any applicable taxes or discounts. 2. Recurring Purchase Invoice: This type of invoice is used for regular or recurring purchases made by businesses. It is often used for ongoing services or subscription-based purchases, providing details of the specific period covered, payment terms, and any adjustments or changes from previous invoices. 3. Consolidated Purchase Invoice: In cases where multiple purchases are made within a specific period, a consolidated purchase invoice may be issued. This type of invoice summarizes all the individual transactions made during a particular period, making it convenient for accounting and payment purposes. 4. Credit Purchase Invoice: This type of invoice is issued when a seller allows the buyer to purchase goods or services on credit. It includes details of the credit terms, such as the agreed-upon payment due date and any interest or late payment penalties. 5. Prepayment Purchase Invoice: In situations where a buyer makes an advance payment for goods or services, a prepayment purchase invoice is generated. It specifies the amount paid in advance, the remaining balance, and the timeline for the remaining payment(s). These are just a few examples of different types of Indiana Purchase Invoices. The specific type and format of the invoice may vary depending on the industry, regulations, or individual preferences. It is always advisable to consult with an accountant or legal professional to ensure compliance with relevant laws and requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Indiana Factura de compra - Purchase Invoice

Description

How to fill out Indiana Factura De Compra?

Are you presently in a position where you need documents for either business or personal uses virtually every day time? There are plenty of authorized papers web templates available on the Internet, but getting ones you can rely is not effortless. US Legal Forms delivers thousands of develop web templates, just like the Indiana Purchase Invoice, that happen to be composed to meet federal and state requirements.

Should you be presently acquainted with US Legal Forms web site and possess your account, merely log in. After that, you may download the Indiana Purchase Invoice template.

Should you not provide an account and want to begin using US Legal Forms, follow these steps:

- Obtain the develop you want and ensure it is to the appropriate metropolis/county.

- Utilize the Review switch to check the form.

- See the explanation to actually have chosen the appropriate develop.

- When the develop is not what you are trying to find, use the Look for area to get the develop that suits you and requirements.

- When you obtain the appropriate develop, simply click Get now.

- Opt for the prices prepare you need, submit the specified info to produce your account, and pay money for the order utilizing your PayPal or charge card.

- Decide on a hassle-free document structure and download your version.

Get all the papers web templates you might have bought in the My Forms food list. You may get a additional version of Indiana Purchase Invoice any time, if required. Just select the necessary develop to download or print the papers template.

Use US Legal Forms, one of the most extensive variety of authorized varieties, to save some time and steer clear of mistakes. The services delivers professionally created authorized papers web templates which can be used for a variety of uses. Generate your account on US Legal Forms and commence making your way of life easier.