Indiana Employee News Form

Description

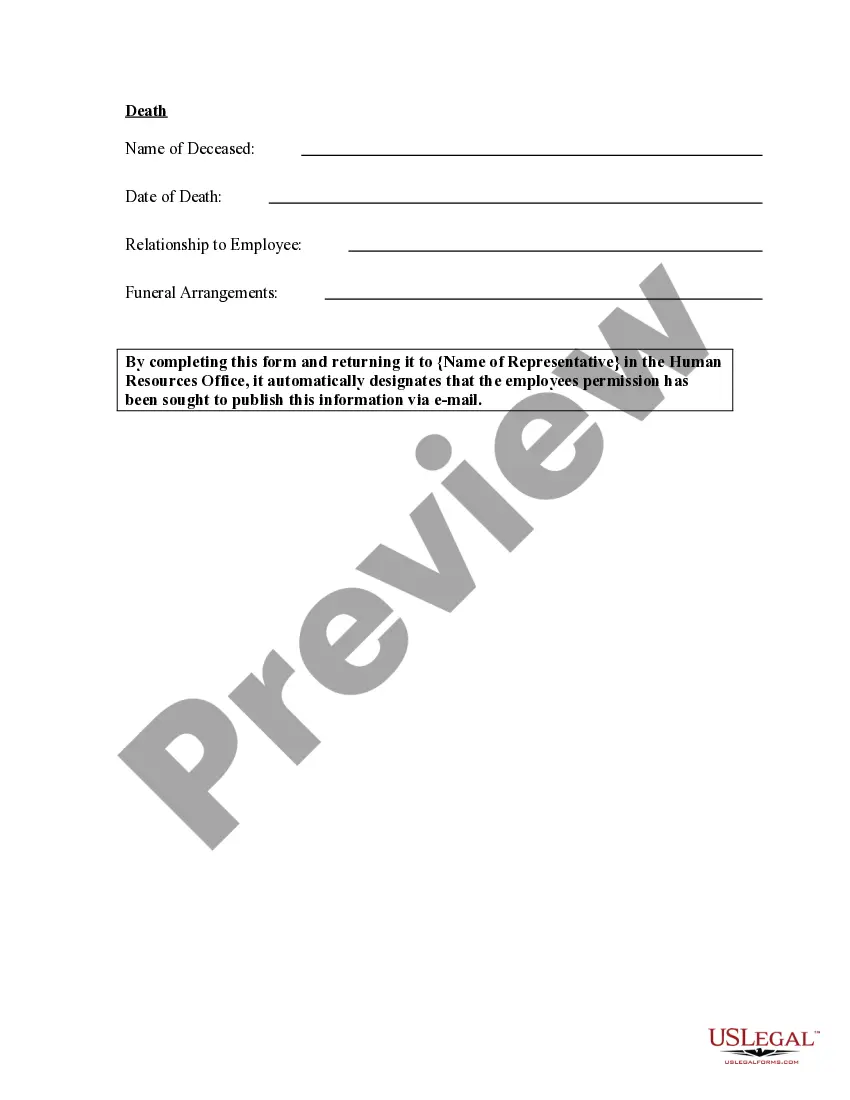

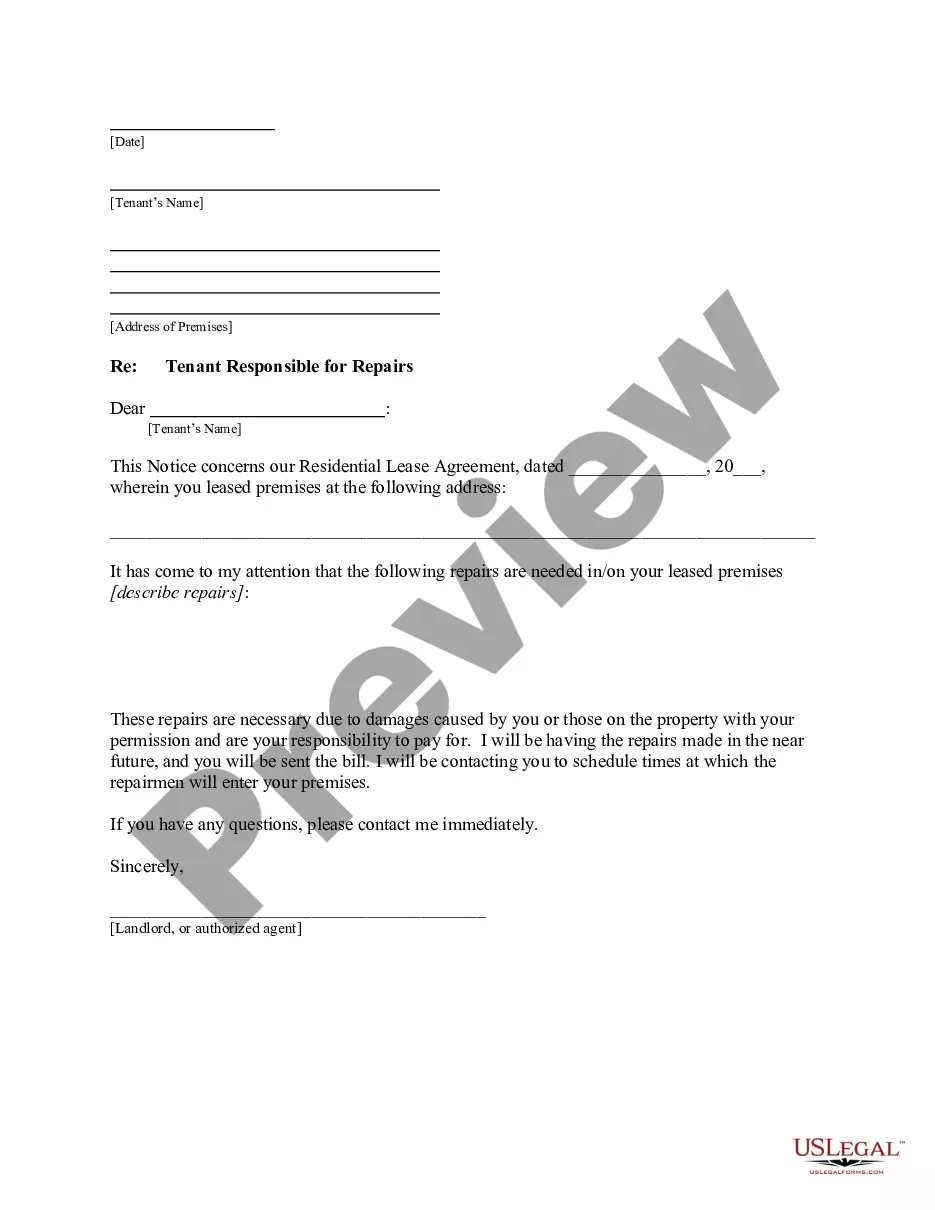

How to fill out Employee News Form?

Are you currently in a placement where you need to have documents for possibly organization or specific functions nearly every day time? There are plenty of authorized file themes available on the Internet, but finding ones you can rely isn`t straightforward. US Legal Forms provides thousands of kind themes, like the Indiana Employee News Form, which are written to satisfy federal and state needs.

If you are already informed about US Legal Forms site and possess a free account, basically log in. Following that, it is possible to obtain the Indiana Employee News Form template.

Should you not come with an accounts and wish to begin to use US Legal Forms, adopt these measures:

- Discover the kind you require and make sure it is to the correct town/area.

- Make use of the Review option to review the shape.

- See the outline to actually have chosen the correct kind.

- In case the kind isn`t what you are trying to find, use the Look for field to obtain the kind that suits you and needs.

- If you find the correct kind, click on Buy now.

- Choose the rates plan you want, submit the required information to produce your bank account, and pay for your order making use of your PayPal or Visa or Mastercard.

- Pick a convenient paper structure and obtain your version.

Find every one of the file themes you might have bought in the My Forms food selection. You may get a more version of Indiana Employee News Form whenever, if necessary. Just go through the needed kind to obtain or print out the file template.

Use US Legal Forms, the most extensive selection of authorized varieties, to save lots of time and steer clear of mistakes. The support provides skillfully made authorized file themes which you can use for a range of functions. Generate a free account on US Legal Forms and start creating your life a little easier.

Form popularity

FAQ

The employee's first day of employment is the date the employee begins working in exchange for wages or other remuneration. The employee's first day of employment is recorded in Section 2 of Form I-9.

Paperwork. The tax documents and Form I-9 must be completed on or before your first day of employment. To comply with federal law, we must verify the identity and employment authorization of each person we hire, and retain a Form I-9 for each employee. Indiana state government is an E-verify employer.

Proof of employment can include: paycheck stubs, 2022 earnings and leave statements showing the employer's name and address, and 2022 W-2 forms when available.

You can upload proof of employment. click on the blue box that says, Go to DWD Secure File Exchange. to submit your proof of employment or self-employment to become eligible or to continue to be eligible for Pandemic Unemployment Assistance (PUA) benefits.

Please contact the reporting center at (866) 879-0198 or contact@in-newhire.com for more information or assistance in verifying your file layout.

Please visit to report new hires. Find Frequently Asked Questions on New Hire reporting here.

Steps to Hiring your First Employee in IndianaStep 1 Register as an Employer.Step 2 Employee Eligibility Verification.Step 3 Employee Withholding Allowance Certificate.Step 4 New Hire Reporting.Step 5 Payroll Taxes.Step 6 Workers' Compensation Insurance.Step 7 Labor Law Posters and Required Notices.More items...?

The law defines a "newly hired employee" as (i) an employee who has not previously been employed by the employer; or (ii) was previously employed by the employer but has been separated from such prior employment for at least 60 consecutive days.

The Indiana Department of Workforce Development (DWD) has announced that the unemployment quarterly contribution (Form UC-1) and wage (Form UC-5) reports must be filed electronically by all employers, beginning with the first quarter 2019 reports.

Form ME UC-1 QUARTERLY REPORT OF UNEMPLOYMENT CONTRIBUTIONS must be filed by all employers registered to remit unemployment contributions.