Full text of legislative history behind the Insurers Rehabilitation and Liquidation Model Act.

Indiana Insurers Rehabilitation and Liquidation Model Act Legislative History

Description

How to fill out Insurers Rehabilitation And Liquidation Model Act Legislative History?

Are you within a place the place you need to have paperwork for sometimes organization or specific uses virtually every day time? There are plenty of lawful file templates available on the Internet, but locating ones you can trust isn`t simple. US Legal Forms offers a large number of form templates, just like the Indiana Insurers Rehabilitation and Liquidation Model Act Legislative History, that are written to satisfy state and federal demands.

When you are previously familiar with US Legal Forms site and have an account, basically log in. Next, you may obtain the Indiana Insurers Rehabilitation and Liquidation Model Act Legislative History web template.

If you do not provide an bank account and would like to begin to use US Legal Forms, abide by these steps:

- Obtain the form you want and make sure it is for that proper city/region.

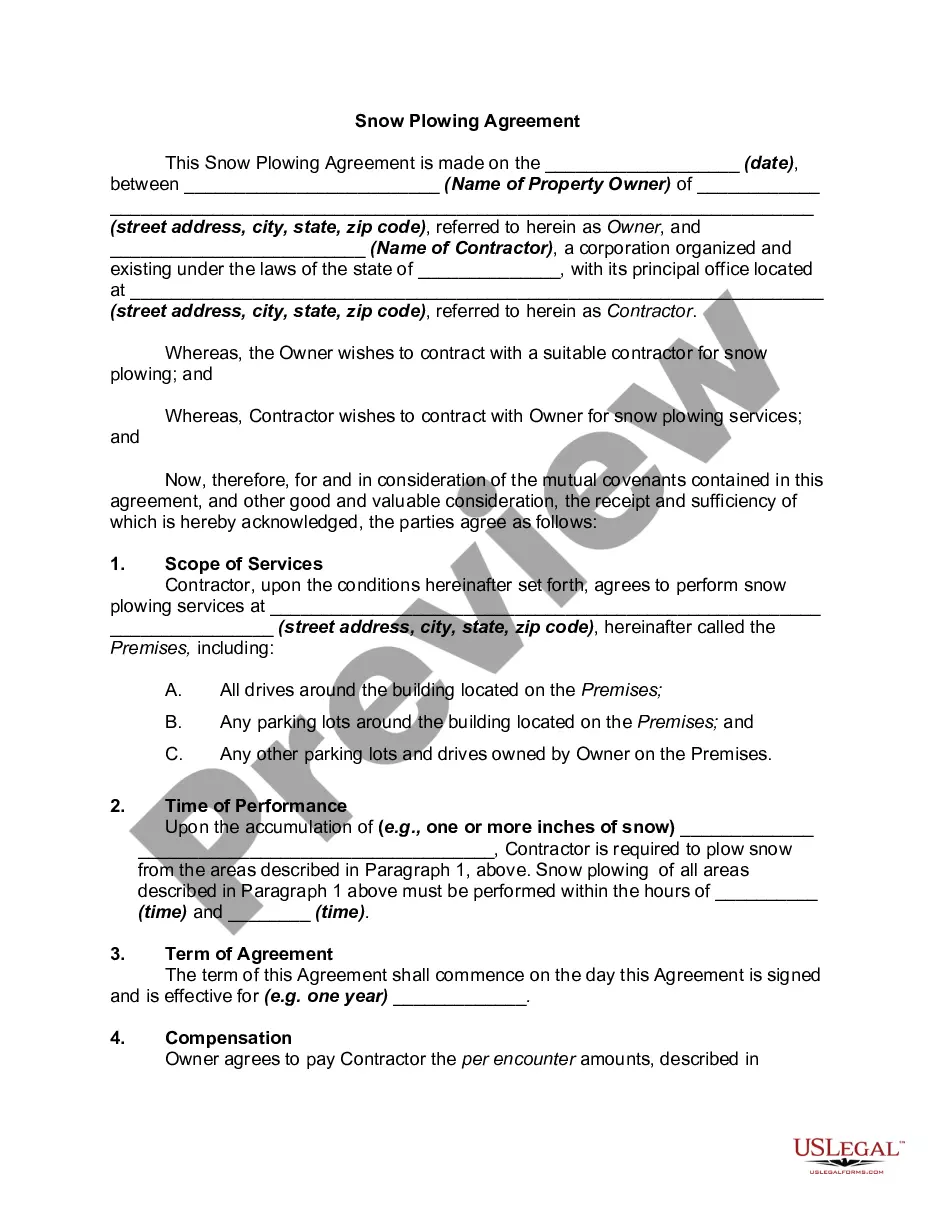

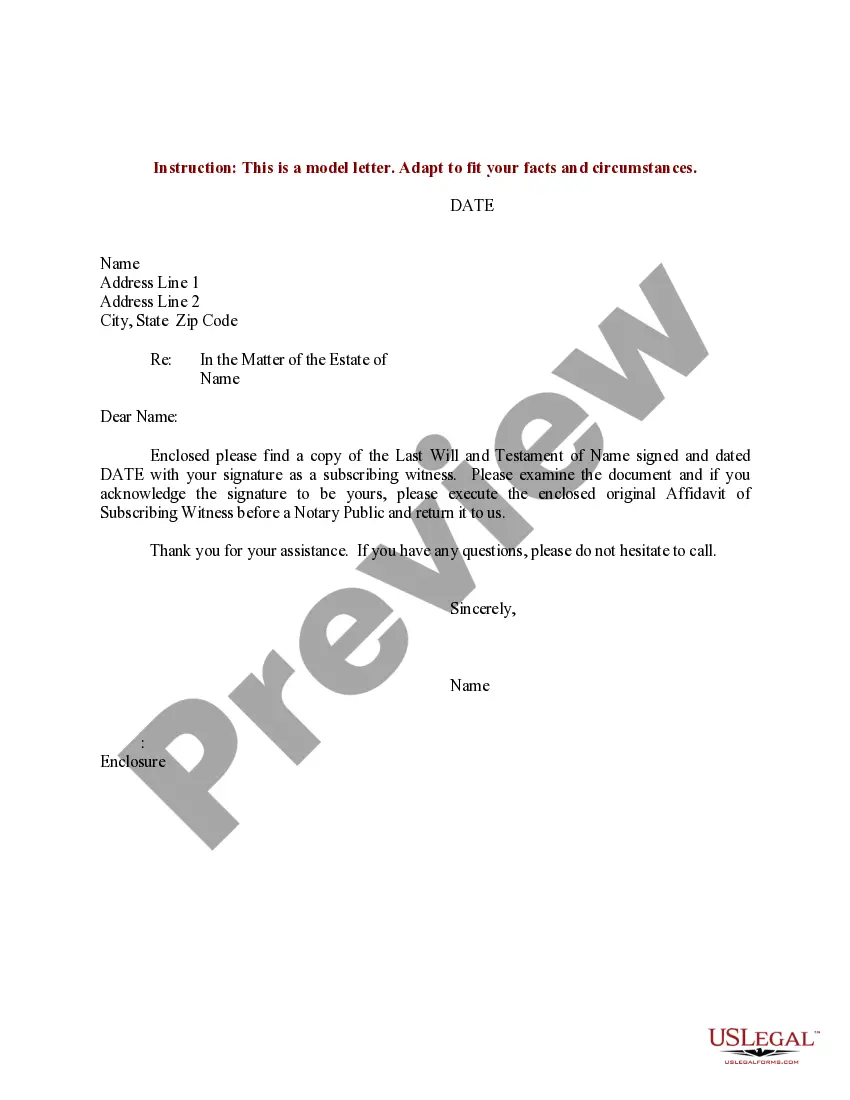

- Take advantage of the Review option to analyze the form.

- Look at the outline to actually have chosen the correct form.

- When the form isn`t what you are searching for, use the Lookup industry to get the form that fits your needs and demands.

- When you obtain the proper form, click Purchase now.

- Pick the pricing plan you would like, fill in the desired information and facts to produce your money, and pay for the order with your PayPal or Visa or Mastercard.

- Choose a practical paper file format and obtain your backup.

Find each of the file templates you may have bought in the My Forms menus. You can aquire a further backup of Indiana Insurers Rehabilitation and Liquidation Model Act Legislative History anytime, if possible. Just go through the required form to obtain or produce the file web template.

Use US Legal Forms, probably the most substantial variety of lawful varieties, in order to save time and steer clear of faults. The service offers professionally manufactured lawful file templates which can be used for a variety of uses. Produce an account on US Legal Forms and begin generating your life easier.

Form popularity

FAQ

?Total adjusted capital? means the sum of: (1) An insurer's statutory capital and surplus as determined in ance with the statutory. accounting applicable to the annual financial statements required to be filed under [cite. appropriate statute]; and.

One way they do this is by imposing a risk-based capital (RBC) requirement. The RBC requirement is a statutory minimum level of capital that is based on two factors: 1) an insurance company's size; and 2) the inherent riskiness of its financial assets and operations.

A bank is considered "well-capitalized" if it has a tier 1 ratio of 8% or greater and a total risk-based capital ratio of at least 10%, and a tier 1 leverage ratio of at least 5%.

?Authorized Control Level Event? means any of the following events: (1) The filing of an RBC report by the health organization that indicates that the health organization's. total adjusted capital is greater than or equal to its Mandatory Control Level RBC but less than its.

One way they do this is by imposing a risk-based capital (RBC) requirement. The RBC requirement is a statutory minimum level of capital that is based on two factors: 1) an insurance company's size; and 2) the inherent riskiness of its financial assets and operations.

Company Action Level means the designation given by either the National Association of Insurance Commissioners or the state department of insurance of the state of domicile of the insurance company in question of a level or range of levels of Risk-Based Capital Ratios as the Risk-Based Capital Ratio or Ratios, as ...

The authorized control level occurs if surplus falls below 100 percent of the RBC amount. The fourth action level is the mandatory control level as defined by the NAIC, which requires the relevant insurance commissioner to place the insurer under regulatory control if surplus falls below 70 percent of the RBC amount.

The regulatory action level occurs if surplus falls below 150 percent of the RBC amount. The authorized control level occurs if surplus falls below 100 percent of the RBC amount.