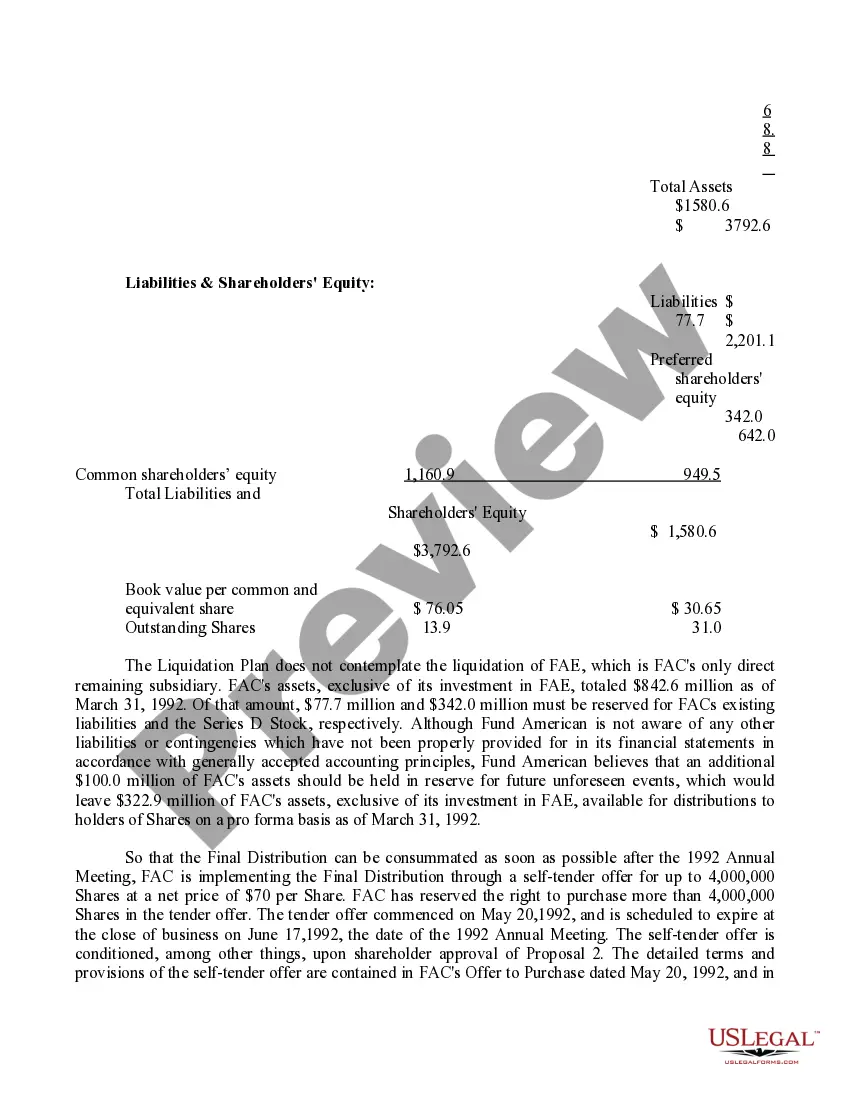

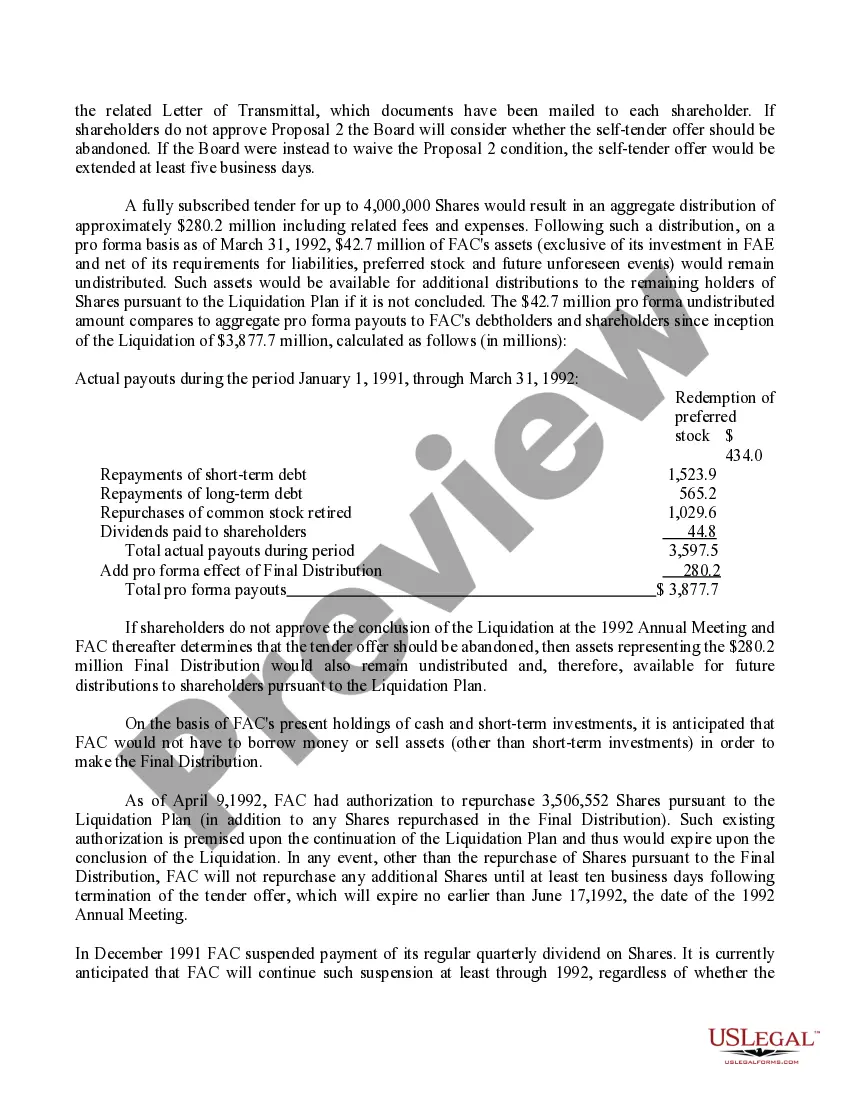

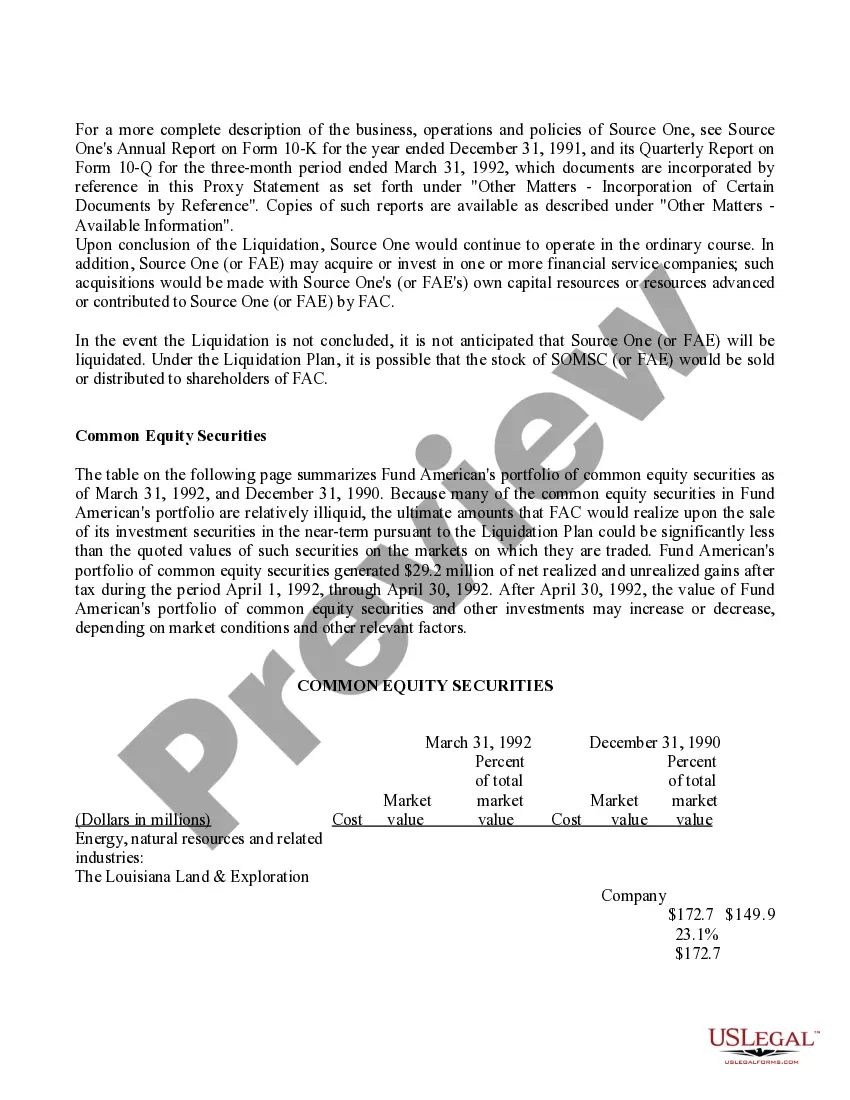

Indiana Proposal — Conclusion of the Liquidation with Exhibit: A Detailed Description In the state of Indiana, a proposal for the conclusion of the liquidation process with an exhibit is a crucial legal document presented to the concerned parties involved in the liquidation of a business or entity. This proposal aims to finalize and bring closure to the liquidation proceedings while providing a comprehensive overview of the liquidated assets, liabilities, and any related exhibiting documentation. The Indiana Proposal — Conclusion of the Liquidation is an essential part of the liquidation process, ensuring transparency, accountability, and adherence to legal procedures. This document outlines the final steps and actions required to dissolve the business or entity effectively, while distributing the remaining assets among the creditors, shareholders, or partners. Keywords: Indiana proposal, liquidation conclusion, exhibit, liquidation process, legal document, liquidated assets, liabilities, distributing assets, creditors, shareholders, partners. Different Types of Indiana Proposal — Conclusion of the Liquidation with Exhibit: 1. Corporate Liquidation Proposal: This type of proposal is used when a corporation is involved in the liquidation process. It provides specific information about the corporation's assets, including properties, investments, stocks, and accounts receivable. The exhibit accompanying the proposal displays financial statements, balance sheets, and other relevant documentation. 2. Partnership Liquidation Proposal: When a partnership is dissolving, a liquidation proposal specific to partnerships is generated. This proposal includes details about the partnership's assets, such as shared properties, accounts, and investments. The accompanying exhibit may showcase partnership agreements, financial records, and the distribution plan for the remaining assets. 3. Sole Proprietorship Liquidation Proposal: In the case of a sole proprietorship, a liquidation proposal tailored to its unique characteristics is prepared. This proposal outlines the individual assets of the sole proprietor, such as equipment, inventory, and accounts. The exhibit may include personal financial statements, bank statements, and an inventory register. 4. Nonprofit liquidation Proposal: For nonprofit organizations in Indiana, a specific liquidation proposal is required to conclude their operations. This proposal focuses on the liquidation of nonprofit assets, including funds, donations, and properties owned by the organization. The accompanying exhibit may include financial records, donor acknowledgments, and details of asset disbursement to other relevant nonprofit entities. Regardless of the entity type, an Indiana Proposal — Conclusion of the Liquidation with an exhibit serves as a crucial tool to outline the final steps of the liquidation process. It ensures an organized, legal, and fair distribution of assets, satisfying the interests of creditors, partners, shareholders, or other relevant stakeholders. Note: It is important to consult with a legal professional or attorney experienced in Indiana corporate law while preparing an Indiana Proposal — Conclusion of the Liquidation with an exhibit to ensure compliance with all applicable regulations and legal requirements.

Indiana Proposal - Conclusion of the Liquidation with exhibit

Description

How to fill out Indiana Proposal - Conclusion Of The Liquidation With Exhibit?

You may commit time on-line trying to find the lawful file template which fits the federal and state requirements you will need. US Legal Forms offers thousands of lawful forms which can be reviewed by specialists. It is simple to obtain or produce the Indiana Proposal - Conclusion of the Liquidation with exhibit from our assistance.

If you currently have a US Legal Forms profile, you are able to log in and click the Acquire option. Next, you are able to total, revise, produce, or indication the Indiana Proposal - Conclusion of the Liquidation with exhibit. Each lawful file template you purchase is yours permanently. To obtain an additional backup of any bought form, check out the My Forms tab and click the corresponding option.

Should you use the US Legal Forms website the first time, stick to the easy directions listed below:

- Initial, make sure that you have chosen the right file template for that county/town of your choice. Look at the form description to make sure you have chosen the proper form. If offered, utilize the Review option to look through the file template at the same time.

- In order to get an additional variation of the form, utilize the Search area to get the template that fits your needs and requirements.

- Upon having discovered the template you would like, simply click Purchase now to proceed.

- Pick the prices plan you would like, type in your qualifications, and sign up for a free account on US Legal Forms.

- Complete the purchase. You may use your bank card or PayPal profile to fund the lawful form.

- Pick the file format of the file and obtain it for your product.

- Make changes for your file if necessary. You may total, revise and indication and produce Indiana Proposal - Conclusion of the Liquidation with exhibit.

Acquire and produce thousands of file layouts using the US Legal Forms web site, that offers the largest selection of lawful forms. Use expert and status-specific layouts to take on your small business or personal needs.