Indiana Clauses Relating to Dividends, Distributions

Description

How to fill out Clauses Relating To Dividends, Distributions?

Are you currently in the place the place you require paperwork for sometimes business or person purposes almost every day? There are tons of legal file web templates available online, but finding kinds you can depend on is not simple. US Legal Forms gives 1000s of develop web templates, like the Indiana Clauses Relating to Dividends, Distributions, which can be composed to satisfy federal and state specifications.

In case you are presently acquainted with US Legal Forms website and possess your account, merely log in. After that, it is possible to down load the Indiana Clauses Relating to Dividends, Distributions web template.

If you do not provide an account and need to start using US Legal Forms, follow these steps:

- Discover the develop you will need and make sure it is for the appropriate area/region.

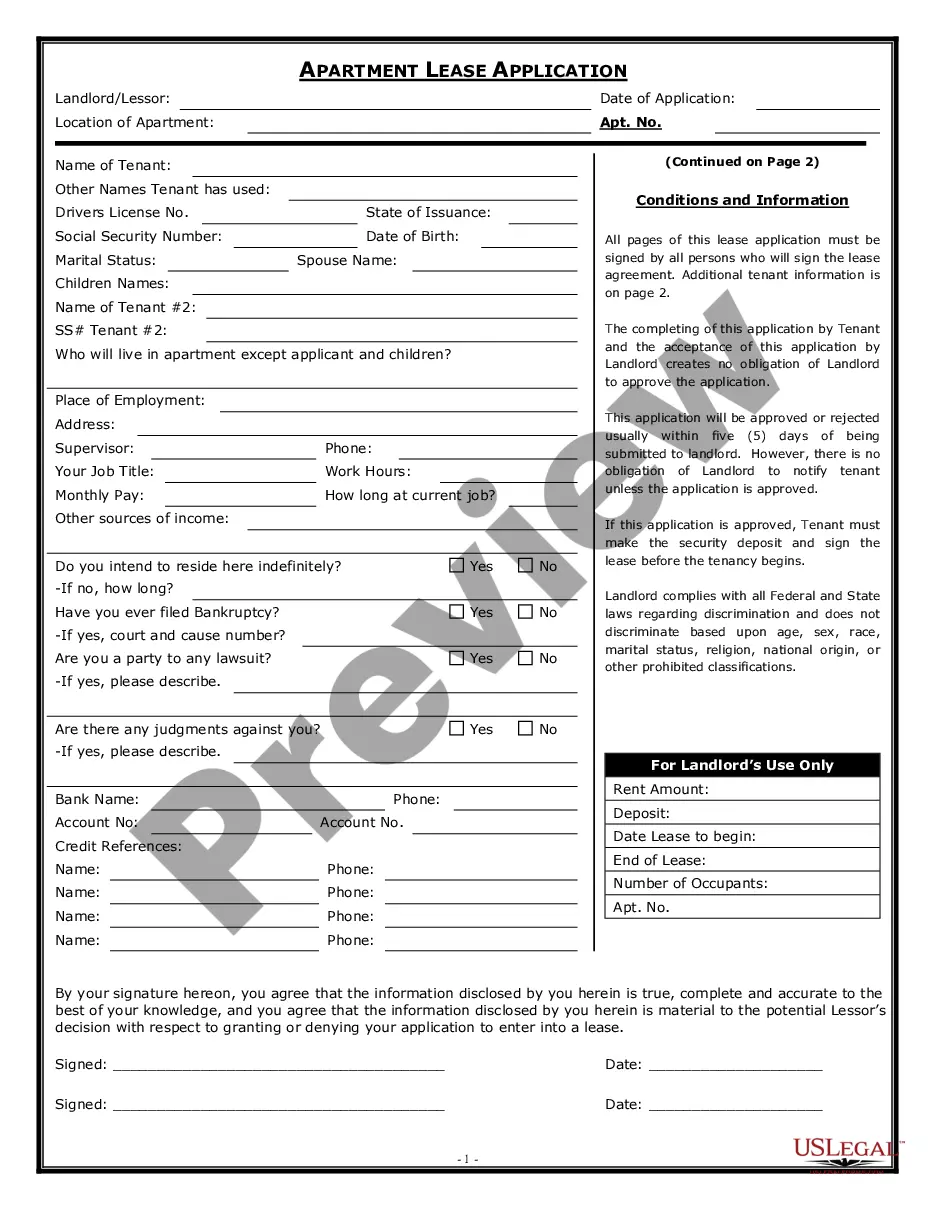

- Utilize the Preview switch to analyze the form.

- Browse the explanation to actually have chosen the right develop.

- In the event the develop is not what you`re searching for, utilize the Lookup area to get the develop that suits you and specifications.

- Once you discover the appropriate develop, just click Get now.

- Opt for the costs prepare you desire, complete the required information to make your bank account, and buy an order utilizing your PayPal or charge card.

- Decide on a convenient file format and down load your duplicate.

Discover every one of the file web templates you might have purchased in the My Forms menu. You can get a further duplicate of Indiana Clauses Relating to Dividends, Distributions anytime, if possible. Just click on the necessary develop to down load or produce the file web template.

Use US Legal Forms, the most substantial assortment of legal kinds, to save time and prevent blunders. The services gives skillfully created legal file web templates which you can use for an array of purposes. Make your account on US Legal Forms and initiate generating your lifestyle a little easier.

Form popularity

FAQ

Any defendant may appeal the interlocutory order overruling the objections and appointing appraisers in the manner that appeals are taken from final judgments in civil actions. (f) All the parties shall take notice of and be bound by the judgment in the appeal.

Business and Other Associations § 23-1-35-1. (3) in a manner the director reasonably believes to be in the best interests of the corporation. (3) a committee of the board of directors of which the director is not a member if the director reasonably believes the committee merits confidence.

The right-of-way, air, light, or other easement from, in, upon, or over land owned by a person may not be acquired by another person by adverse use unless the use is uninterrupted for at least twenty (20) years.

Indiana Code Section 23-0.5-2-13 requires LLCs to submit a biennial business entity report to the Secretary of State every other year. You can file online for a $31 fee or by mail for a $50 fee.

A Limited Liability Partnership (LLP) is formed and governed based on the Indiana Uniform Partnership Act. An LLP is considered a blend of a corporation and a partnership. Beyond the assets that were invested in the partnership, none of the partners may be held personally responsible for the actions of other parties.

A credit restricted felon is anyone who is: (1) at least 21 years old and has been convicted of child molesting involving sexual intercourse or deviate sexual conduct involving a child under 12; (2) convicted of child molest resulting in serious bodily injury or death; or.

CHAPTER 1. Assumed Business Names. 23-15-1-1. Filing of certificate of assumed name; record; applicability entities; consistent entity indicator; notice of discontinuance of use; fees.

Indiana Code § 23-0.5-3-1. Permitted Names; Falsely Implying Government Agency Status or Connection :: 2022 Indiana Code :: US Codes and Statutes :: US Law :: Justia.