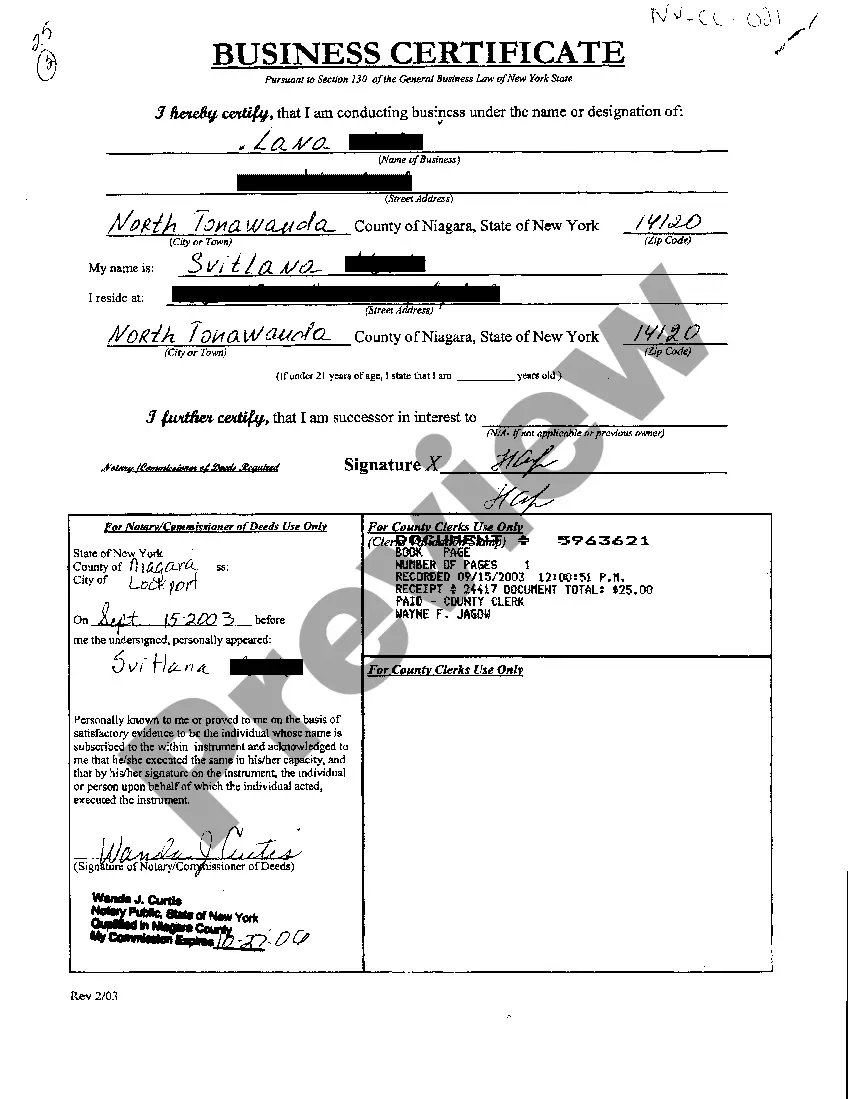

The Indiana Form of Anti-Money Laundering Compliance Policy is a crucial document designed to prevent and detect money laundering and other financial crimes within organizations operating within the state of Indiana. This comprehensive policy outlines a set of procedures and protocols that organizations must adapt to ensure compliance with state and federal anti-money laundering (AML) laws and regulations. The Indiana Form of Anti-Money Laundering Compliance Policy includes various sections that encompass different aspects of AML compliance. These sections may include: 1. Risk Assessment: Organizations are required to conduct a thorough risk assessment to identify and evaluate the potential risks associated with money laundering and terrorist financing. This assessment helps in implementing appropriate mitigation measures. 2. Customer Due Diligence (CDD): The policy outlines the procedures organizations must follow to verify the identity of their customers and assess the potential risks associated with them. This process may involve collecting and verifying customer information, conducting background checks, and monitoring customer transactions. 3. Suspicious Activity Reporting: The policy mandates organizations to establish strict protocols for monitoring and reporting suspicious activities that may indicate potential money laundering or financing of illegal activities. Employees are required to be trained in recognizing these activities and reporting them to the appropriate authorities. 4. Record Keeping: The policy lays out the requirements for maintaining accurate and accessible records of all transactions, customer due diligence, and suspicious activity reports. These records should be retained for a specific period as dictated by the law. 5. Employee Training: To ensure effective compliance, organizations must provide comprehensive training programs to educate employees about AML laws, regulations, and the organization's AML policies. This training equips employees with the necessary knowledge to identify and report any suspicious activity. 6. Internal Controls and Auditing: The policy emphasizes the importance of implementing robust internal controls, including periodic audits and independent testing. Such controls help in evaluating the effectiveness of the AML compliance program and implementing any necessary improvements. It is important to note that the Indiana Form of Anti-Money Laundering Compliance Policy may vary depending on the nature and size of the organization. For instance, financial institutions may have specific AML policies that align with the requirements of federal regulators like the Financial Crimes Enforcement Network (Fin CEN) or the Office of the Comptroller of the Currency (OCC). In summary, the Indiana Form of Anti-Money Laundering Compliance Policy is a crucial framework that provides guidance to organizations operating in Indiana to prevent and detect money laundering and other financial crimes. It encompasses various key aspects such as risk assessment, customer due diligence, suspicious activity reporting, record keeping, employee training, and internal controls. Compliance with this policy helps organizations maintain transparency and integrity in their financial operations, contributing to the overall stability and security of the financial system in Indiana.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Indiana Formulario de Política de Cumplimiento contra el Lavado de Dinero - Form of Anti-Money Laundering Compliance Policy

Description

How to fill out Indiana Formulario De Política De Cumplimiento Contra El Lavado De Dinero?

You can spend hrs online looking for the legal file template that meets the federal and state requirements you need. US Legal Forms offers thousands of legal kinds which can be analyzed by professionals. It is possible to down load or produce the Indiana Form of Anti-Money Laundering Compliance Policy from the assistance.

If you currently have a US Legal Forms account, it is possible to log in and click on the Obtain key. Afterward, it is possible to comprehensive, modify, produce, or indicator the Indiana Form of Anti-Money Laundering Compliance Policy. Each legal file template you get is yours for a long time. To obtain another duplicate for any acquired type, visit the My Forms tab and click on the related key.

If you use the US Legal Forms internet site the first time, stick to the simple instructions below:

- Very first, ensure that you have selected the correct file template to the county/area that you pick. Browse the type information to make sure you have picked the appropriate type. If readily available, utilize the Review key to search from the file template as well.

- In order to find another edition from the type, utilize the Look for industry to discover the template that fits your needs and requirements.

- When you have located the template you want, click Get now to move forward.

- Find the prices strategy you want, key in your accreditations, and register for a merchant account on US Legal Forms.

- Total the deal. You can use your credit card or PayPal account to pay for the legal type.

- Find the structure from the file and down load it in your device.

- Make alterations in your file if necessary. You can comprehensive, modify and indicator and produce Indiana Form of Anti-Money Laundering Compliance Policy.

Obtain and produce thousands of file web templates utilizing the US Legal Forms web site, that provides the greatest collection of legal kinds. Use expert and state-particular web templates to deal with your business or person requires.