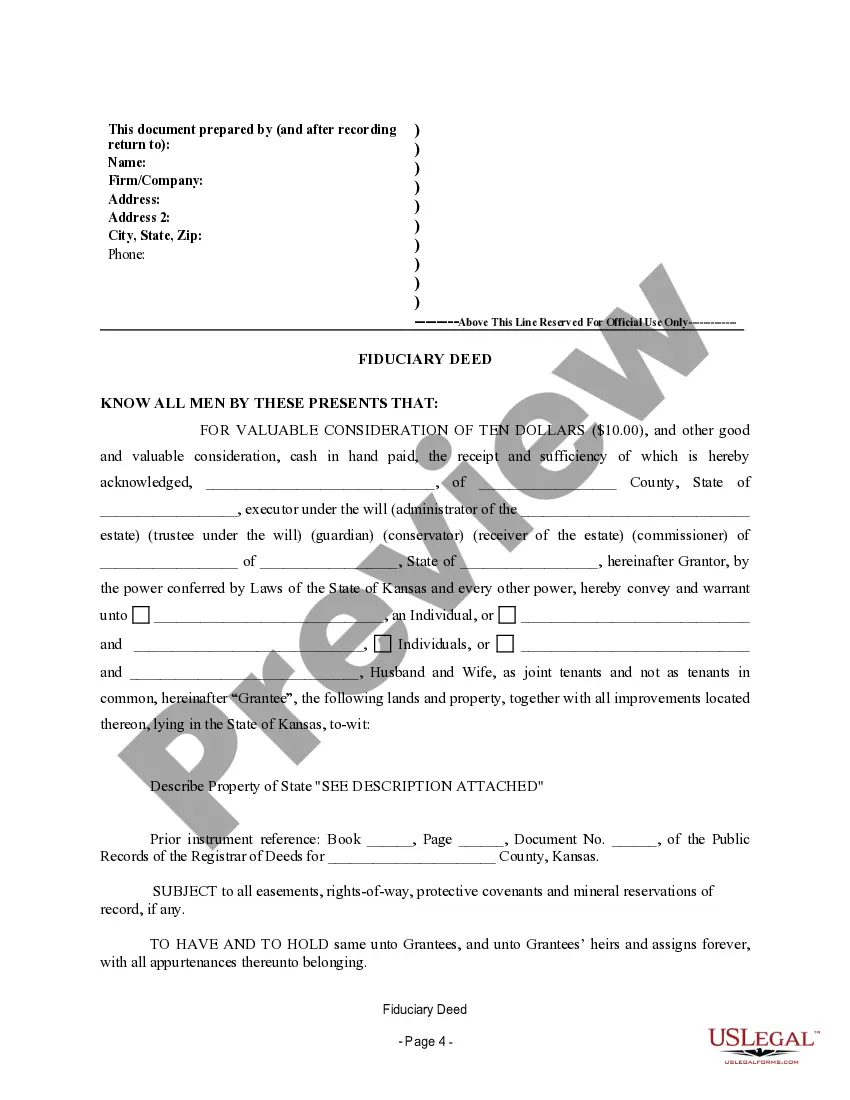

Fiduciary Meaning

Description Executor's Deed

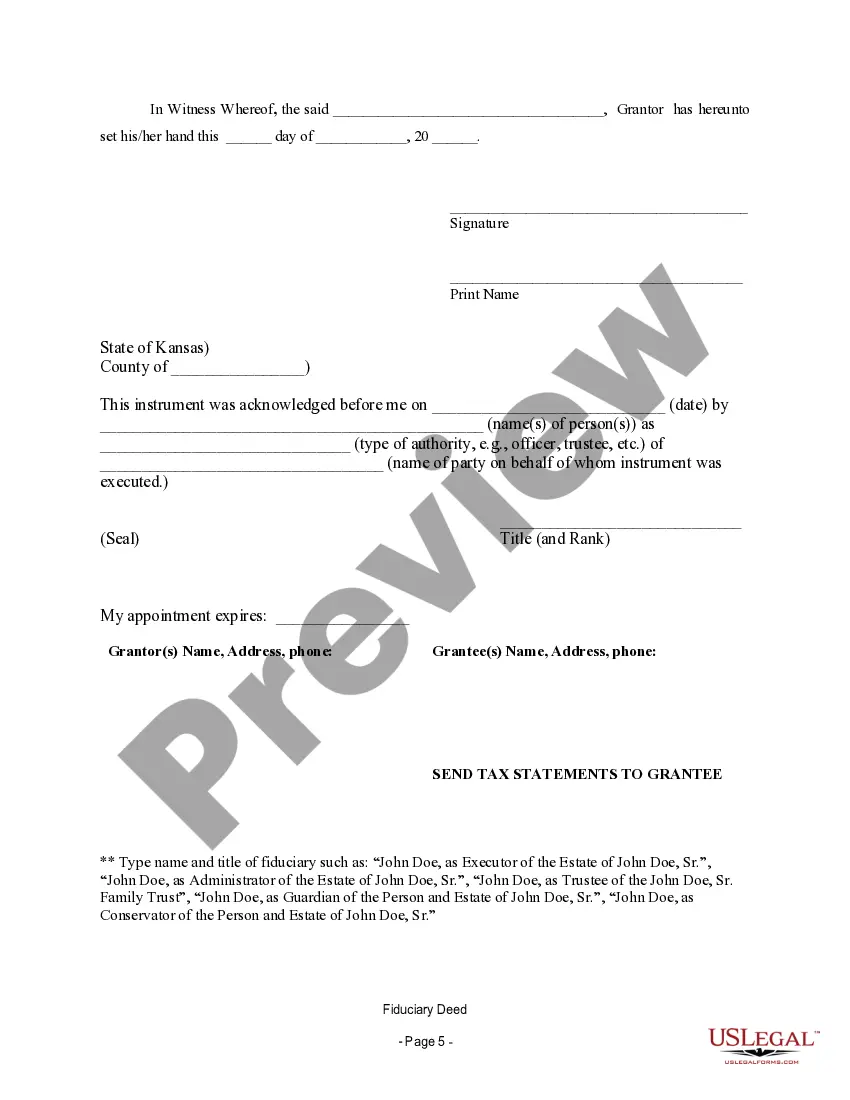

How to fill out Kansas Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries?

- If you're an existing user, simply log in to your account to access your previous forms. Make sure your subscription is current; otherwise, renew it based on your plan.

- For new users, start by exploring the Preview mode to review form descriptions. Confirm that the selected document meets your needs and complies with local laws.

- If you need different templates, utilize the Search tab to find forms that suit your requirements.

- Once you identify the right document, click on the Buy Now button to select your preferred subscription plan. Ensure you register for access to the document library.

- Proceed with payment using your credit card or PayPal account to finalize your subscription.

- After purchase, download your completed form and save it on your device. Access it anytime from the My Forms section of your account.

In conclusion, using US Legal Forms streamlines the process of obtaining legal documents like the Kansas Fiduciary Deed. With an extensive library and expert assistance readily available, you can ensure that your documents are both precise and legally compliant.

Explore the US Legal Forms platform today to take the hassle out of legal documentation!

Trustors Deed Form popularity

FAQ

In real estate in the United States, a deed of trust or trust deed is a legal instrument which is used to create a security interest in real property wherein legal title in real property is transferred to a trustee, which holds it as security for a loan (debt) between a borrower and lender.

Upon the return receipt of the Address Verification Letter, the property reconveyance process will begin. Once all the paperwork has been received by the Administrative Office, it may take up to thirty (30) calendar days to process. The deeds of trust are processed in the sequence received.

A satisfaction of mortgage is a signed document confirming that the borrower has paid off the mortgage in full and that the mortgage is no longer a lien on the property.

In financed real estate transactions, trust deeds transfer the legal title of a property to a third partysuch as a bank, escrow company, or title companyto hold until the borrower repays their debt to the lender. Trust deeds are used in place of mortgages in several states.

When you sign a trust deed, you agree to make affordable monthly payments over a fixed period of up to four years to reduce your debts. At the end of the four-year period, any remaining debts will be written off. In other words, you will have nothing more to pay.

In order to clear the Deed of Trust from the title to the property, a Deed of Reconveyance must be recorded with the Country Recorder or Recorder of Deeds. If the Trustee/Beneficiary fails to record a satisfaction within the set time limits, the Trustee/Beneficiary may be responsible for damages as set out by statute.

Reconveyance is the transfer of a title to the borrower after a mortgage has been fully paid.

A deed of reconveyance refers to a document that transfers the title of a property to the borrower from the bank or mortgage holder once a mortgage is paid off. It is used to clear the deed of trust from the title to the property.

(c) The Mortgagor has paid off all the dues of the Mortgagee under the said Deed in full and the Mortgage debt stands satisfied in full. (d) In the circumstances, the Mortgagor has requested the Mortgagee to execute the reconveyance of Mortgaged property to which the Mortgagee has agreed as appearing hereinafter.