The Kansas Corporate Resolution for Bank Account is a legal document that outlines the decision-making process within a corporation regarding the opening or closing of a bank account. This resolution is important because it helps establish the authorization and responsibility of the corporation's officers to conduct financial transactions on behalf of the entity. The Kansas Corporate Resolution for Bank Account typically contains essential elements such as the corporation's name, address, and tax identification number. It also identifies the officers or individuals authorized to act as signatories for the corporation's bank account. These authorized signatories may include the president, vice president, treasurer, and other relevant officers. The resolution specifies the powers granted to the authorized officers, which may include the authority to open, close, endorse checks, deposit or withdraw funds, and perform other related banking activities. Furthermore, it may include language stating that the authorized officer(s) have the power to enter into, modify, or terminate any agreements with the bank. It is essential for the corporation to maintain accurate and up-to-date corporate resolutions to ensure compliance with banking institutions and to prevent unauthorized individuals from accessing or controlling the corporation's finances. Additionally, the presence of a corporate resolution may be required by banks when opening new accounts or making significant changes to existing accounts. While the Kansas Corporate Resolution for Bank Account generally follows a standard format, there may be slight variations depending on the specific needs or requirements of the corporation. Some variations may arise from the type or size of the corporation, whether it is a nonprofit organization, a limited liability company (LLC), or a partnership. Some types of Kansas Corporate Resolutions for Bank Account may include: 1. General Corporate Resolution: This resolution is the most common and is applicable to most corporations, regardless of their specific structure or purpose. 2. Nonprofit Corporate Resolution: This resolution is tailored for nonprofit organizations, encompassing any additional requirements or stipulations specific to their tax-exempt status or governance structure. 3. LLC Corporate Resolution: Limited liability companies follow a unique set of rules and often require a specific resolution that aligns with their operational structure. 4. Partnership Corporate Resolution: Partnerships may have specific resolutions that address the authority of individual partners to make decisions related to the bank account and financial matters. In summary, the Kansas Corporate Resolution for Bank Account is a crucial legal document for corporations operating within the state. It authorizes specific individuals to act on behalf of the corporation in regard to its banking activities and ensures compliance with legal and financial requirements. The different types of resolutions cater to the specific needs and structures of various corporations, such as nonprofits, LCS, and partnerships.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Kansas Resolución Corporativa para Cuenta Bancaria - Corporate Resolution for Bank Account

Description

How to fill out Kansas Resolución Corporativa Para Cuenta Bancaria?

Choosing the best legal document format can be a battle. Naturally, there are a variety of layouts available on the net, but how would you discover the legal develop you will need? Utilize the US Legal Forms website. The assistance delivers 1000s of layouts, like the Kansas Corporate Resolution for Bank Account, which you can use for company and personal demands. Each of the varieties are examined by pros and meet state and federal specifications.

When you are presently authorized, log in in your accounts and click the Acquire button to find the Kansas Corporate Resolution for Bank Account. Use your accounts to check with the legal varieties you may have bought previously. Proceed to the My Forms tab of your own accounts and get one more backup from the document you will need.

When you are a whole new customer of US Legal Forms, listed below are basic directions so that you can comply with:

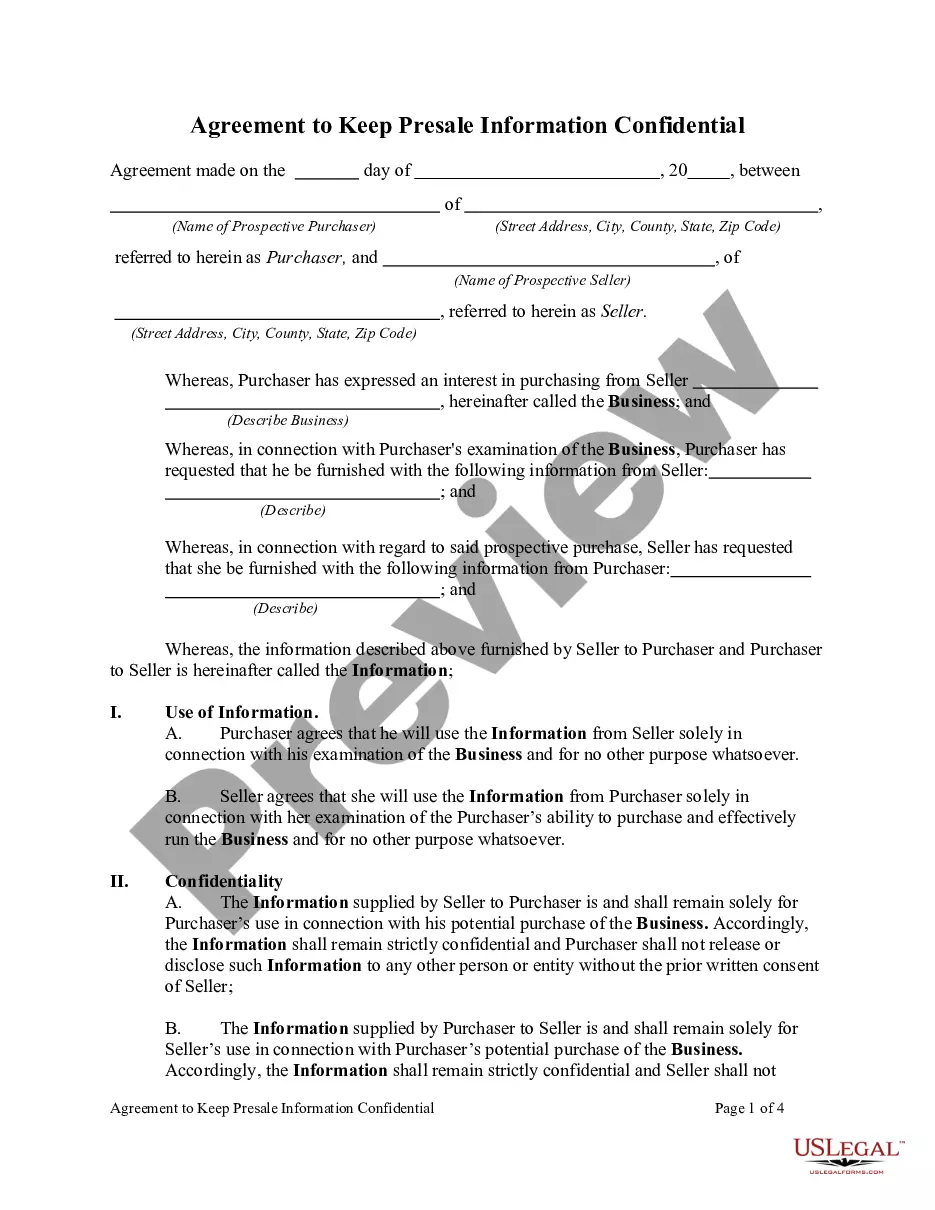

- Very first, be sure you have selected the proper develop for your city/county. You can check out the form utilizing the Preview button and study the form information to make certain it will be the right one for you.

- When the develop is not going to meet your needs, utilize the Seach industry to find the proper develop.

- Once you are sure that the form is suitable, select the Buy now button to find the develop.

- Select the costs prepare you would like and type in the essential information. Create your accounts and pay for the transaction using your PayPal accounts or Visa or Mastercard.

- Opt for the submit formatting and obtain the legal document format in your product.

- Total, edit and printing and indication the acquired Kansas Corporate Resolution for Bank Account.

US Legal Forms is the largest local library of legal varieties that you can find different document layouts. Utilize the company to obtain skillfully-made papers that comply with express specifications.