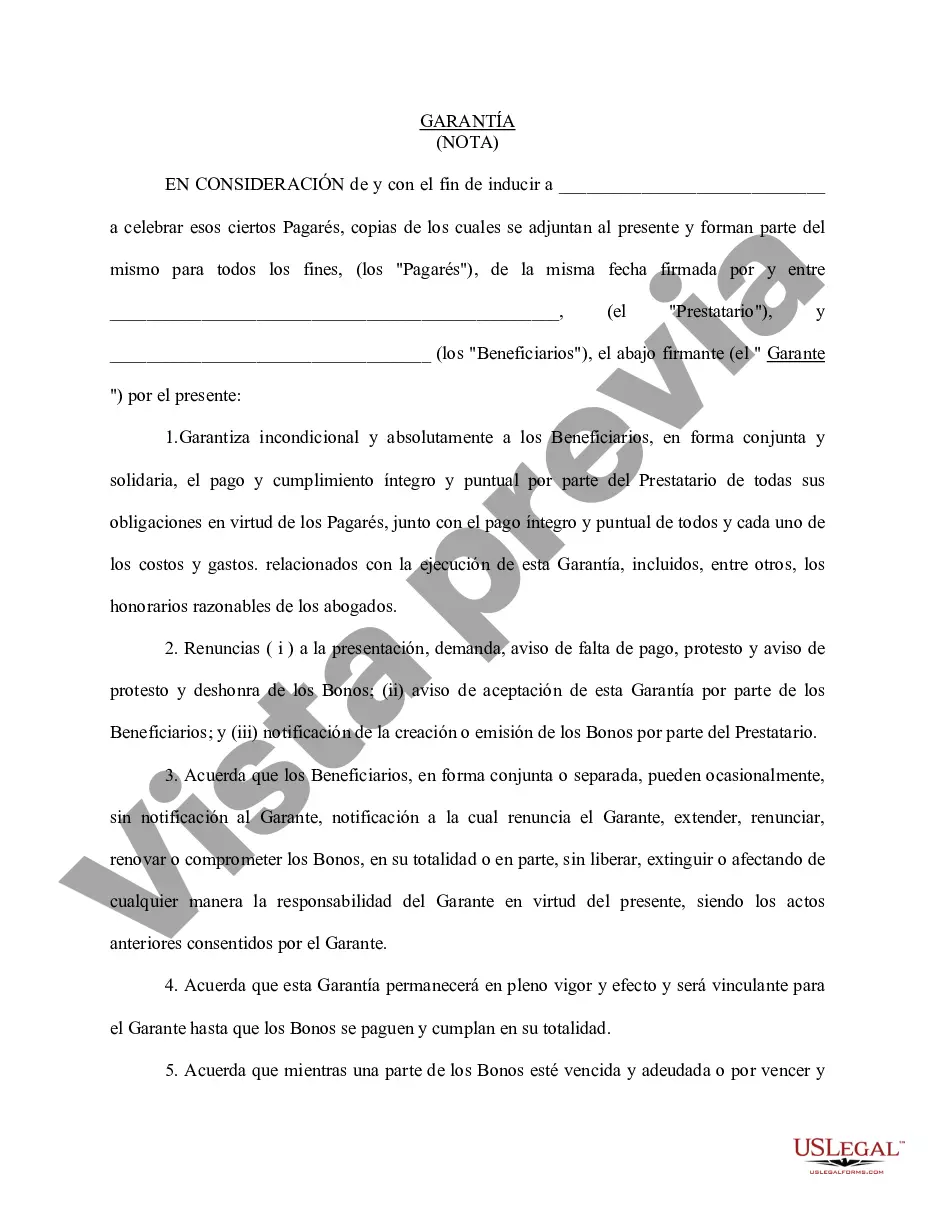

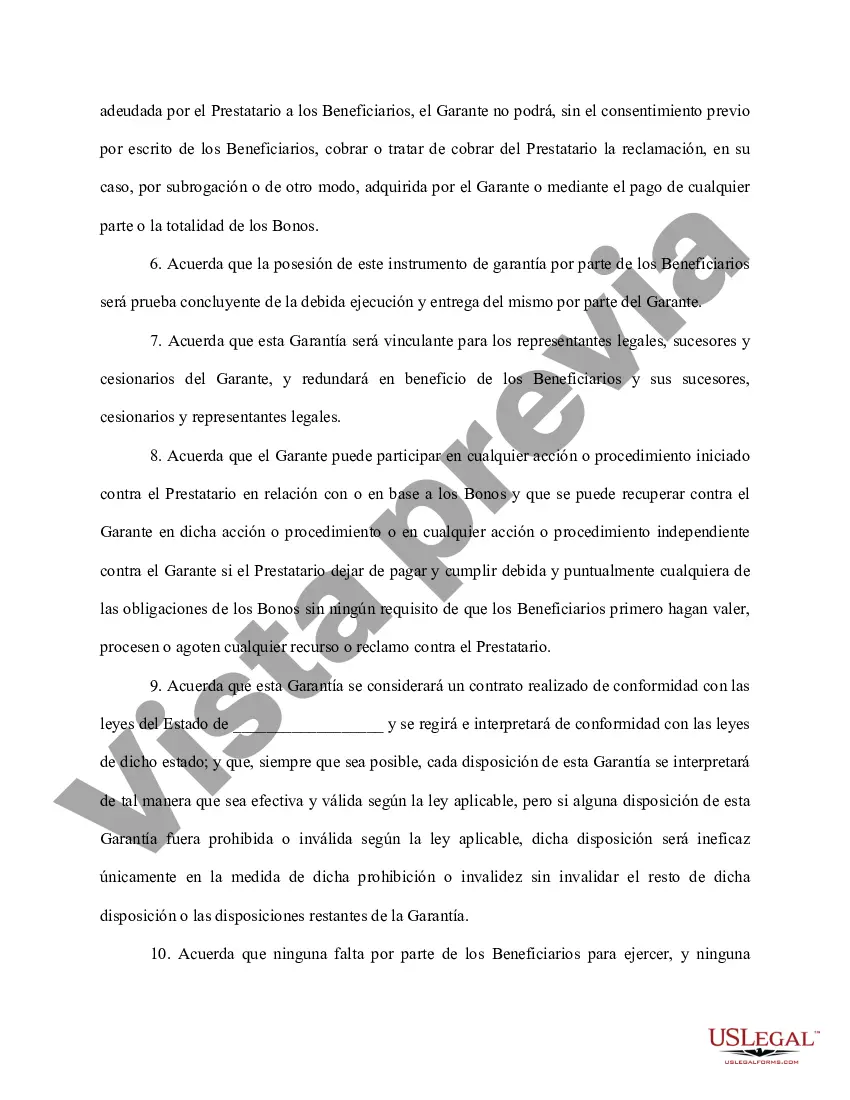

The Kansas Guaranty of Promissory Note by Corporation — Individual Borrower is a legal document that outlines the agreement between a corporation and an individual borrower. The purpose of this document is to secure a personal guarantee from the individual borrower for a promissory note issued by the corporation. In this arrangement, the corporation acts as the borrower and is responsible for paying off the promissory note. However, to provide additional security for the lender, the individual borrower agrees to guarantee the repayment of the promissory note in case the corporation fails to honor its obligations. This guaranty is enforceable under the laws of Kansas, and it is essential to clearly define the terms and conditions of the guaranty to avoid any potential disputes in the future. The document typically includes key components such as: 1. Parties Involved: The document identifies the corporation and the individual borrower as the parties entering into the guaranty agreement. 2. Promissory Note Details: The document identifies the promissory note for which the guaranty is being provided, including the principal amount, interest rate, repayment terms, and any other relevant details. 3. Guarantor's Obligations: The document specifies the guarantor's obligations, stating that the guarantor shall be fully liable for the prompt payment, full performance, and satisfaction of all the obligations under the promissory note. 4. Waiver of Defenses: The guarantor typically waives any rights to assert any claims, counterclaims, or defenses that they may have against the corporation or the lender concerning the promissory note. 5. Indemnification: The document may include provisions for the guarantor to indemnify the lender for any costs, expenses, or damages incurred due to the borrower's default on the promissory note. 6. Governing Law and Venue: The document specifies that Kansas law governs the guaranty agreement and designates a specific jurisdiction or venue in Kansas where any disputes arising from the agreement shall be resolved. Different types of Kansas Guaranty of Promissory Note by Corporation — Individual Borrower may exist based on variations in specific terms and conditions, the nature of the promissory note, or the context of the borrowing arrangement. However, these variations mainly concern the specifics of the underlying promissory note and may not significantly impact the general structure and purpose of the guaranty agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Kansas Garantía de Pagaré por Corporación - Prestatario Individual - Guaranty of Promissory Note by Corporation - Individual Borrower

Description

How to fill out Kansas Garantía De Pagaré Por Corporación - Prestatario Individual?

Have you been in the place the place you will need documents for either business or individual purposes almost every day? There are a lot of legitimate file templates accessible on the Internet, but discovering ones you can rely on isn`t straightforward. US Legal Forms offers a huge number of type templates, such as the Kansas Guaranty of Promissory Note by Corporation - Individual Borrower, that are written to fulfill federal and state needs.

If you are presently knowledgeable about US Legal Forms internet site and also have an account, merely log in. Next, it is possible to down load the Kansas Guaranty of Promissory Note by Corporation - Individual Borrower template.

If you do not have an accounts and would like to begin to use US Legal Forms, follow these steps:

- Find the type you require and ensure it is to the proper metropolis/county.

- Take advantage of the Review button to review the form.

- See the explanation to actually have chosen the right type.

- In case the type isn`t what you`re looking for, use the Research industry to discover the type that fits your needs and needs.

- If you find the proper type, just click Purchase now.

- Choose the rates strategy you would like, fill in the necessary info to create your bank account, and buy the order utilizing your PayPal or bank card.

- Pick a convenient file file format and down load your version.

Locate each of the file templates you have purchased in the My Forms food selection. You can get a further version of Kansas Guaranty of Promissory Note by Corporation - Individual Borrower at any time, if possible. Just click the essential type to down load or produce the file template.

Use US Legal Forms, the most considerable assortment of legitimate types, to save lots of time as well as avoid mistakes. The services offers expertly made legitimate file templates which can be used for a range of purposes. Generate an account on US Legal Forms and commence producing your life easier.