The Kansas Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price is a legally binding document that outlines the terms and conditions for the sale of a business from a sole proprietor to a buyer, with a portion of the purchase price being financed by the seller. This agreement is specific to the state of Kansas and is designed to protect the rights and interests of both parties involved in the transaction. Keywords: Kansas, Agreement for Sale of Business, Sole Proprietorship, Seller, Finance, Purchase Price. Types of Kansas Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price: 1. Kansas Agreement for Sale of Business by Sole Proprietorship with Seller Financing: This type of agreement involves the seller offering financing to the buyer for the purchase of the business. The terms and conditions of the financing, including interest rates, repayment schedule, and any collateral required, are clearly outlined in the agreement. 2. Kansas Agreement for Sale of Business by Sole Proprietorship with Installment Payments: In this type of agreement, the buyer agrees to make installment payments to the seller over a specified period. The seller may finance a portion of the purchase price, and the agreement will detail the terms of the installments, including amounts, frequency, and duration. 3. Kansas Agreement for Sale of Business by Sole Proprietorship with Promissory Note: This type of agreement involves the seller providing a promissory note to the buyer, which represents a promise to pay a specific sum of money at a predetermined time or on-demand. The note constitutes a legally binding document that outlines the terms of repayment, interest rates, and any additional terms agreed upon by the parties. 4. Kansas Agreement for Sale of Business by Sole Proprietorship with Balloon Payment: This type of agreement includes a provision where the buyer agrees to make regular payments to the seller for a specified period, followed by a larger lump sum payment, known as a balloon payment, due at the end of the term. The seller finances part of the purchase price, and the agreement outlines the amount and due date of the balloon payment. It is important to note that each of these types of agreements may vary in their specific terms and conditions, and it is crucial for both the seller and buyer to carefully review the agreement and consult legal professionals to ensure their understanding and protection of their rights during the sale of the business.

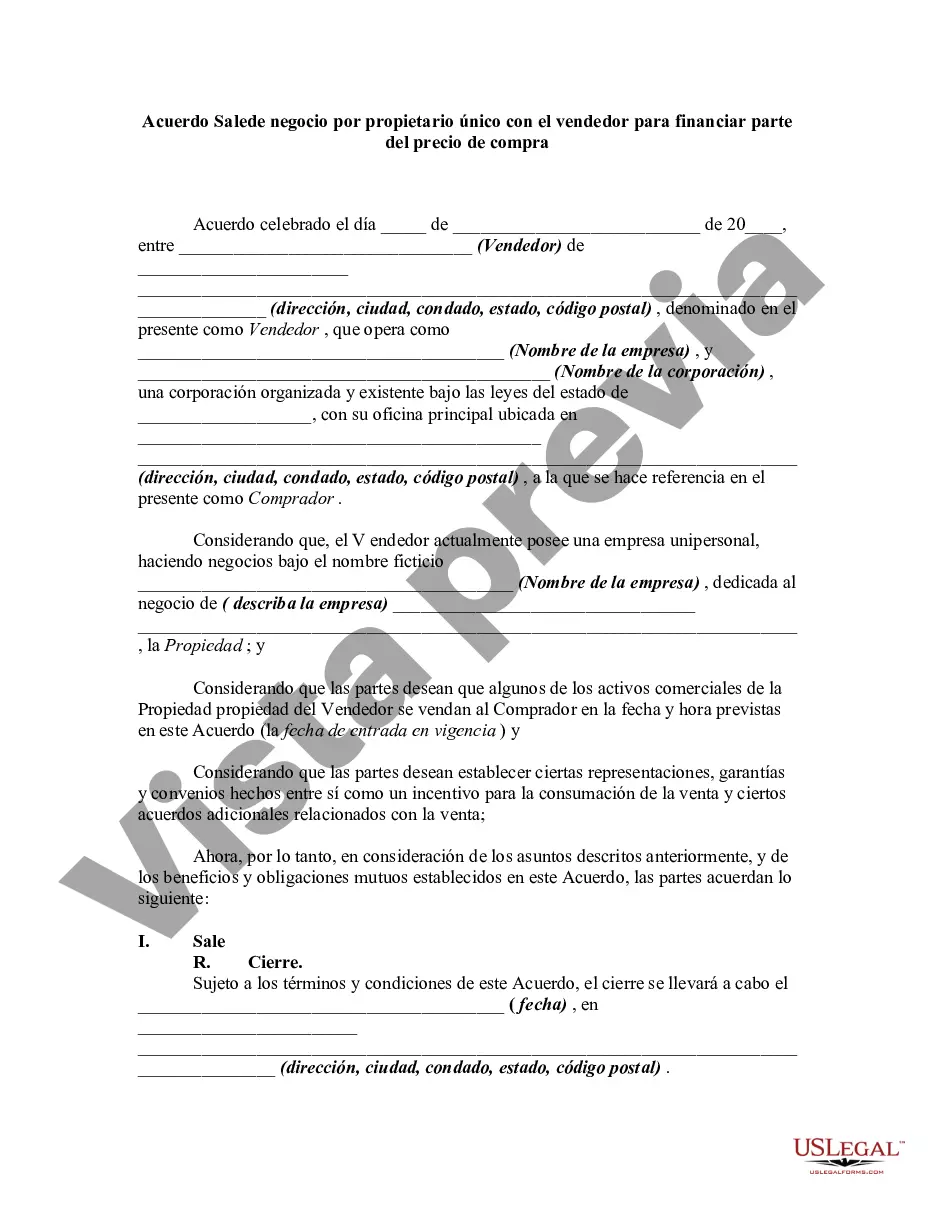

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Kansas Acuerdo de Venta de Negocio por Propietario Único con el Vendedor para Financiar Parte del Precio de Compra - Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price

Description

How to fill out Kansas Acuerdo De Venta De Negocio Por Propietario Único Con El Vendedor Para Financiar Parte Del Precio De Compra?

US Legal Forms - among the largest libraries of authorized varieties in the United States - provides an array of authorized papers themes you may download or printing. While using web site, you will get thousands of varieties for organization and personal uses, categorized by categories, states, or keywords and phrases.You will discover the most recent variations of varieties like the Kansas Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price within minutes.

If you currently have a monthly subscription, log in and download Kansas Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price from your US Legal Forms library. The Download switch will show up on every form you see. You have access to all in the past downloaded varieties inside the My Forms tab of the profile.

If you want to use US Legal Forms for the first time, listed here are easy directions to help you get started out:

- Ensure you have chosen the right form for your personal area/area. Go through the Preview switch to examine the form`s articles. See the form outline to actually have chosen the right form.

- When the form does not satisfy your needs, utilize the Look for industry towards the top of the screen to discover the one that does.

- Should you be pleased with the form, verify your option by simply clicking the Buy now switch. Then, pick the prices plan you favor and give your references to sign up for an profile.

- Approach the deal. Utilize your bank card or PayPal profile to finish the deal.

- Pick the format and download the form on your own device.

- Make alterations. Complete, revise and printing and indicator the downloaded Kansas Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price.

Every single template you put into your bank account does not have an expiry date and is your own forever. So, if you want to download or printing yet another copy, just go to the My Forms area and click in the form you want.

Gain access to the Kansas Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price with US Legal Forms, one of the most comprehensive library of authorized papers themes. Use thousands of professional and express-particular themes that satisfy your company or personal requirements and needs.