A Kansas Agreement to Repay Cash Advance on Credit Card is a legal document that outlines the terms and conditions associated with obtaining and repaying a cash advance on a credit card in the state of Kansas. This agreement is crucial for both the credit card issuer and the cardholder as it ensures proper communication, transparency, and compliance with state laws. Keywords: Kansas, agreement, repay, cash advance, credit card The Kansas Agreement to Repay Cash Advance on Credit Card typically includes the following information: 1. Parties involved: The agreement identifies the credit card issuer (usually a financial institution or credit card company) and the cardholder who intends to obtain a cash advance. 2. Amount and method of cash advance: The agreement specifies the maximum amount the cardholder can borrow as a cash advance. It also denotes the different methods available to access this advance, such as ATM withdrawals or over-the-counter transactions. 3. Interest rates and fees: The agreement clearly mentions the applicable interest rate, which is generally higher for cash advances compared to regular credit card purchases. It also itemizes any additional fees associated with the cash advance, such as transaction fees or cash advance fees. 4. Repayment terms: The agreement outlines the repayment terms for the cash advance. It specifies the minimum monthly payments required and the due date for these payments. Additionally, it highlights the consequences of late or missed payments, including the possibility of increased interest rates or additional penalties. 5. Grace period and interest accrual: The agreement details whether a grace period exists for the cash advance. If there is no grace period, interest begins accruing immediately on the borrowed amount. This provision is crucial for cardholders to understand the potential costs associated with carrying a cash advance balance. 6. State-specific regulations: As the agreement is specific to Kansas, it refers to relevant state laws and regulations that govern cash advances on credit cards in this jurisdiction. These regulations ensure fair practices, consumer protection, and compliance with Kansas state statutes. Types of Kansas Agreement to Repay Cash Advance on Credit Card: 1. Standard Kansas Agreement to Repay Cash Advance: This is the most common type of agreement, covering typical cash advances on credit cards issued in the state of Kansas. 2. Kansas Agreement to Repay Cash Advance for Specific Institutions: Some credit card issuers may have their unique agreement templates, which provide additional terms and conditions specific to their institution. These agreements may include extra clauses or provisions tailored to the policies and regulations of the issuing organization operating in Kansas. In conclusion, a Kansas Agreement to Repay Cash Advance on Credit Card is a legally binding document that governs the terms and conditions of obtaining and repaying cash advances on credit cards issued in the state of Kansas. Understanding the details of this agreement is crucial for both the credit card issuer and the cardholder to ensure compliance, transparency, and efficient communication throughout the cash advance process.

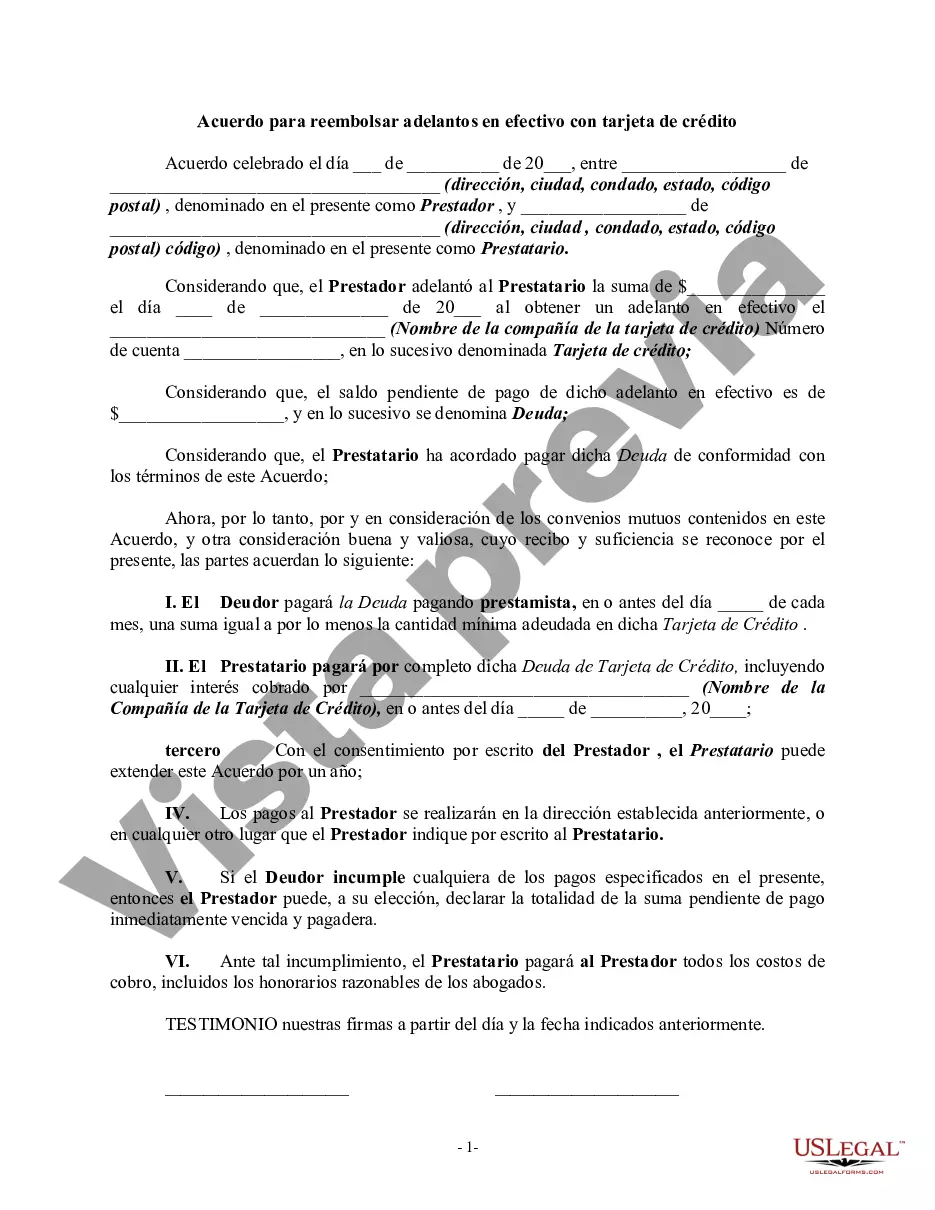

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Kansas Acuerdo para reembolsar adelantos en efectivo con tarjeta de crédito - Agreement to Repay Cash Advance on Credit Card

Description

How to fill out Kansas Acuerdo Para Reembolsar Adelantos En Efectivo Con Tarjeta De Crédito?

If you have to total, download, or print legitimate papers templates, use US Legal Forms, the biggest variety of legitimate kinds, which can be found online. Use the site`s easy and practical lookup to get the documents you will need. A variety of templates for company and personal purposes are categorized by groups and suggests, or keywords. Use US Legal Forms to get the Kansas Agreement to Repay Cash Advance on Credit Card with a few click throughs.

In case you are presently a US Legal Forms buyer, log in to your bank account and click on the Down load switch to find the Kansas Agreement to Repay Cash Advance on Credit Card. You can also entry kinds you earlier saved from the My Forms tab of the bank account.

If you work with US Legal Forms the first time, refer to the instructions under:

- Step 1. Make sure you have selected the form for that correct town/land.

- Step 2. Take advantage of the Preview solution to look through the form`s information. Don`t forget to learn the information.

- Step 3. In case you are unsatisfied with the form, utilize the Research discipline towards the top of the display screen to get other versions in the legitimate form design.

- Step 4. After you have discovered the form you will need, click on the Acquire now switch. Pick the pricing prepare you like and add your references to sign up on an bank account.

- Step 5. Procedure the purchase. You should use your bank card or PayPal bank account to finish the purchase.

- Step 6. Pick the format in the legitimate form and download it on the gadget.

- Step 7. Total, modify and print or indicator the Kansas Agreement to Repay Cash Advance on Credit Card.

Every legitimate papers design you acquire is yours for a long time. You have acces to every form you saved with your acccount. Click the My Forms area and select a form to print or download again.

Remain competitive and download, and print the Kansas Agreement to Repay Cash Advance on Credit Card with US Legal Forms. There are millions of skilled and state-particular kinds you can use for your company or personal demands.