Title: Understanding Kansas Receipt as Payment in Full: Types and Legal Considerations Introduction: In the state of Kansas, a receipt as payment in full is a legal concept that holds significance in commercial transactions. This article aims to provide a detailed explanation of what Kansas Receipt as Payment in Full entails, its types, and relevant legal aspects. Keywords: Kansas, receipt as payment in full, types, legal considerations 1. Kansas Receipt as Payment in Full: — A Kansas receipt as payment in full is a legal document that signifies the acceptance of full and final settlement of a debt or obligation. — It serves as evidence that the debtor has fulfilled their payment obligations, releasing them from further liabilities related to the specific debt. 2. Types of Kansas Receipt as Payment in Full: a. Written Receipt as Payment in Full: — A written receipt is a formal document issued by the creditor confirming that a specific payment received is considered as full and final settlement. — It should clearly state the complete monetary amount paid, the date of payment, and mention that it is "payment in full." — This type of receipt provides strong legal protection to the debtor, preventing future claims regarding the debt. b. Oral Receipt as Payment in Full: — An oral receipt, also known as an implied receipt, occurs when a creditor verbally acknowledges acceptance of a payment as full settlement. — While it might be more challenging to prove in a legal dispute compared to a written receipt, it can still hold some weight if sufficient evidence supports it. 3. Legal Considerations: a. Accurate Documentation: — Both parties involved should make efforts to accurately document the payment, including details such as date, amount, and purpose. — It is advisable to keep a copy of the receipt and any related correspondence for future reference, in case any disputes arise later. b. Mutual Agreement: — The creditor and debtor must mutually agree that the payment is acknowledged as full and final settlement. — Ideally, this agreement should be reached prior to making the payment or at the time of payment. — If the creditor accepts the payment without an agreement in place, it may not be considered a receipt as payment in full. c. Legal Waivers: — It is essential to note that issuing a receipt as payment in full does not absolve one from other obligations related to the transaction, such as warranties or future claims arising from the same debt. — Both parties should ensure that their rights and liabilities are clearly defined in the agreement to avoid any confusion. Conclusion: Understanding Kansas Receipt as Payment in Full is vital to protect both debtors and creditors in commercial transactions. Whether documented in writing or agreed upon orally, this concept offers a legal safeguard for resolving debts. Parties involved must give careful consideration to accurate documentation and mutual agreement to ensure the receipt's validity and protection under Kansas law. Keywords: Kansas, receipt as payment in full, types, legal considerations

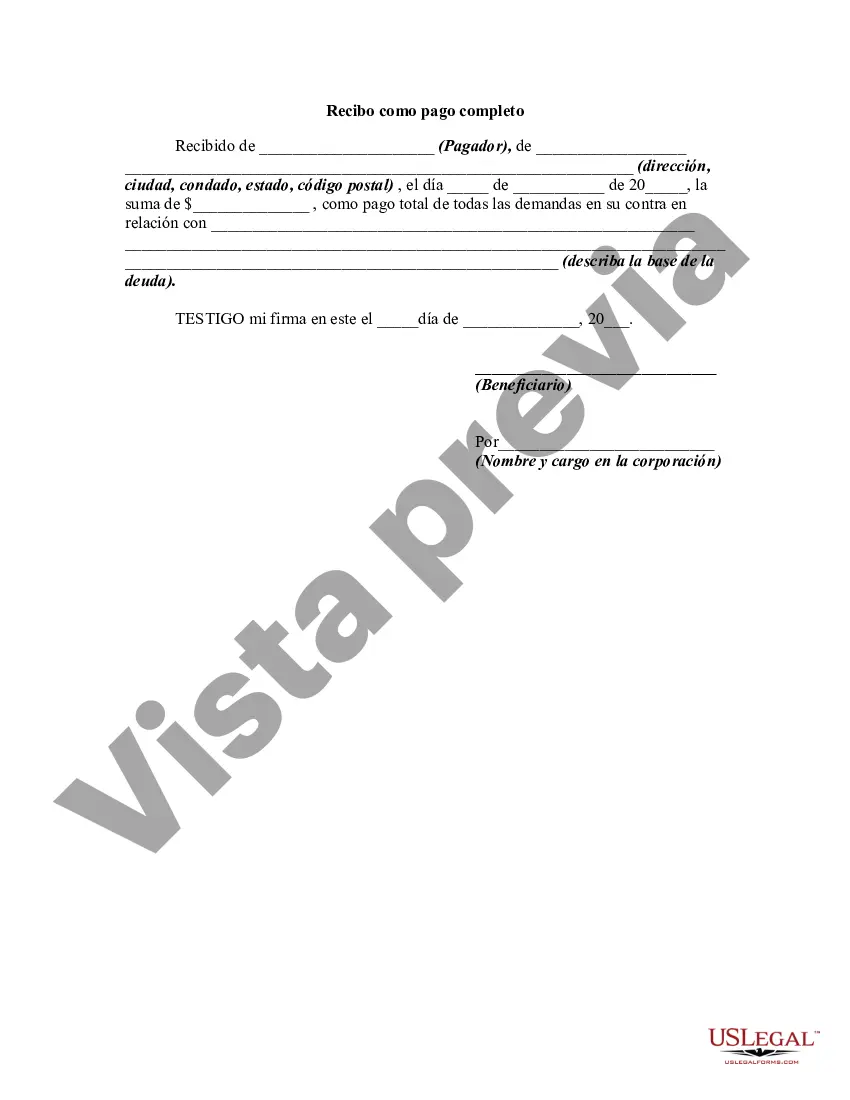

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Kansas Recibo como pago completo - Receipt as Payment in Full

Description

How to fill out Kansas Recibo Como Pago Completo?

US Legal Forms - one of several biggest libraries of legitimate kinds in the United States - delivers an array of legitimate papers web templates you may down load or produce. Using the internet site, you may get a huge number of kinds for business and specific reasons, sorted by groups, states, or keywords.You can get the newest models of kinds such as the Kansas Receipt as Payment in Full in seconds.

If you currently have a monthly subscription, log in and down load Kansas Receipt as Payment in Full in the US Legal Forms collection. The Download option can look on every single form you see. You have access to all earlier acquired kinds inside the My Forms tab of the account.

If you want to use US Legal Forms the very first time, listed below are easy guidelines to help you started out:

- Make sure you have picked out the correct form to your town/region. Go through the Preview option to review the form`s articles. Read the form explanation to ensure that you have selected the right form.

- If the form does not suit your specifications, utilize the Search area on top of the display screen to find the one that does.

- In case you are satisfied with the shape, validate your option by clicking the Get now option. Then, pick the costs plan you favor and offer your accreditations to sign up on an account.

- Method the transaction. Make use of your credit card or PayPal account to finish the transaction.

- Choose the file format and down load the shape on your own device.

- Make modifications. Fill up, revise and produce and indication the acquired Kansas Receipt as Payment in Full.

Every template you put into your bank account lacks an expiration date and it is your own property eternally. So, if you wish to down load or produce one more backup, just go to the My Forms portion and then click in the form you require.

Gain access to the Kansas Receipt as Payment in Full with US Legal Forms, probably the most extensive collection of legitimate papers web templates. Use a huge number of expert and condition-specific web templates that satisfy your business or specific needs and specifications.