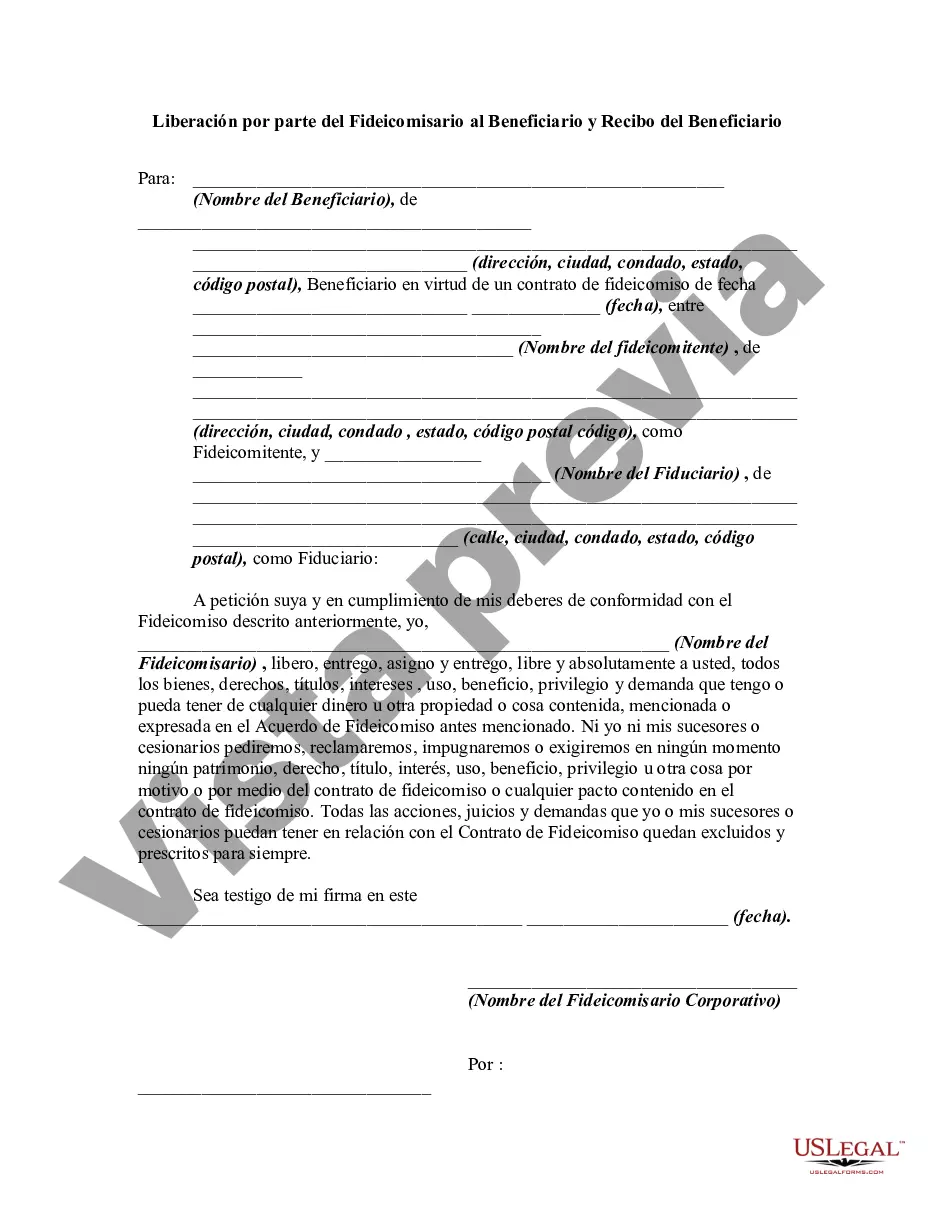

This form is a sample of a release given by the trustee of a trust agreement transferring all property held by the trustee pursuant to the trust agreement to the beneficiary and releasing all claims to the said property. This form assumes that the trust has ended and that the beneficiary has requested release of the property to him/her. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Kansas Release by Trustee to Beneficiary and Receipt from Beneficiary is a legal document that establishes the transfer of assets or property from a trust to its designated beneficiary. It serves as proof that the beneficiary has received their rightful share and absolves the trustee of any further obligations. This document is crucial for both parties involved to ensure a smooth and transparent process. There are several types of Kansas Release by Trustee to Beneficiary and Receipt from Beneficiary, including: 1. Partial Release: This type of release occurs when the trustee transfers a portion of the assets or property held in the trust to the beneficiary. It may happen during the lifetime of the trust or as stipulated in the trust agreement. 2. Full Release: A full release takes place when the trust is terminated and the trustee transfers all remaining assets or property to the beneficiary. This typically occurs upon the death of the trust or when the trust agreement expires. 3. Conditional Release: In some cases, the release may be subject to certain conditions outlined in the trust agreement. These conditions can relate to the beneficiary's age, completion of education, or meeting certain milestones. Once these conditions are met, the trustee can release the assets to the beneficiary. The Kansas Release by Trustee to Beneficiary and Receipt from Beneficiary document includes various key elements to ensure its validity: 1. Names and Addresses: The full legal names and addresses of both the trustee and the beneficiary should be clearly stated at the beginning of the document. 2. Trust Information: Details about the trust, such as its name, date of establishment, and relevant identification numbers, should be provided. 3. Description of Assets or Property: A comprehensive description of the assets or property being released should be included. This may entail real estate, financial accounts, investments, or any other type of property specified in the trust agreement. 4. Transfer Method: The document should specify the method by which the assets will be transferred. This could be through physical delivery, account transfers, or any other legally recognized means. 5. Release of Liability: The trustee should state that they have fulfilled their duties and obligations as outlined in the trust agreement, thereby releasing themselves from any further liability. 6. Acknowledgment by Beneficiary: The beneficiary must sign the document to acknowledge receipt of the assets or property and confirm their satisfaction with the transfer. It is important to consult with a legal professional or estate planning attorney to ensure compliance with Kansas state laws and to tailor the document to specific trust arrangements. Creating a clear, detailed, and legally binding Kansas Release by Trustee to Beneficiary and Receipt from Beneficiary is essential for a smooth and transparent transfer of trust assets.Kansas Release by Trustee to Beneficiary and Receipt from Beneficiary is a legal document that establishes the transfer of assets or property from a trust to its designated beneficiary. It serves as proof that the beneficiary has received their rightful share and absolves the trustee of any further obligations. This document is crucial for both parties involved to ensure a smooth and transparent process. There are several types of Kansas Release by Trustee to Beneficiary and Receipt from Beneficiary, including: 1. Partial Release: This type of release occurs when the trustee transfers a portion of the assets or property held in the trust to the beneficiary. It may happen during the lifetime of the trust or as stipulated in the trust agreement. 2. Full Release: A full release takes place when the trust is terminated and the trustee transfers all remaining assets or property to the beneficiary. This typically occurs upon the death of the trust or when the trust agreement expires. 3. Conditional Release: In some cases, the release may be subject to certain conditions outlined in the trust agreement. These conditions can relate to the beneficiary's age, completion of education, or meeting certain milestones. Once these conditions are met, the trustee can release the assets to the beneficiary. The Kansas Release by Trustee to Beneficiary and Receipt from Beneficiary document includes various key elements to ensure its validity: 1. Names and Addresses: The full legal names and addresses of both the trustee and the beneficiary should be clearly stated at the beginning of the document. 2. Trust Information: Details about the trust, such as its name, date of establishment, and relevant identification numbers, should be provided. 3. Description of Assets or Property: A comprehensive description of the assets or property being released should be included. This may entail real estate, financial accounts, investments, or any other type of property specified in the trust agreement. 4. Transfer Method: The document should specify the method by which the assets will be transferred. This could be through physical delivery, account transfers, or any other legally recognized means. 5. Release of Liability: The trustee should state that they have fulfilled their duties and obligations as outlined in the trust agreement, thereby releasing themselves from any further liability. 6. Acknowledgment by Beneficiary: The beneficiary must sign the document to acknowledge receipt of the assets or property and confirm their satisfaction with the transfer. It is important to consult with a legal professional or estate planning attorney to ensure compliance with Kansas state laws and to tailor the document to specific trust arrangements. Creating a clear, detailed, and legally binding Kansas Release by Trustee to Beneficiary and Receipt from Beneficiary is essential for a smooth and transparent transfer of trust assets.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.