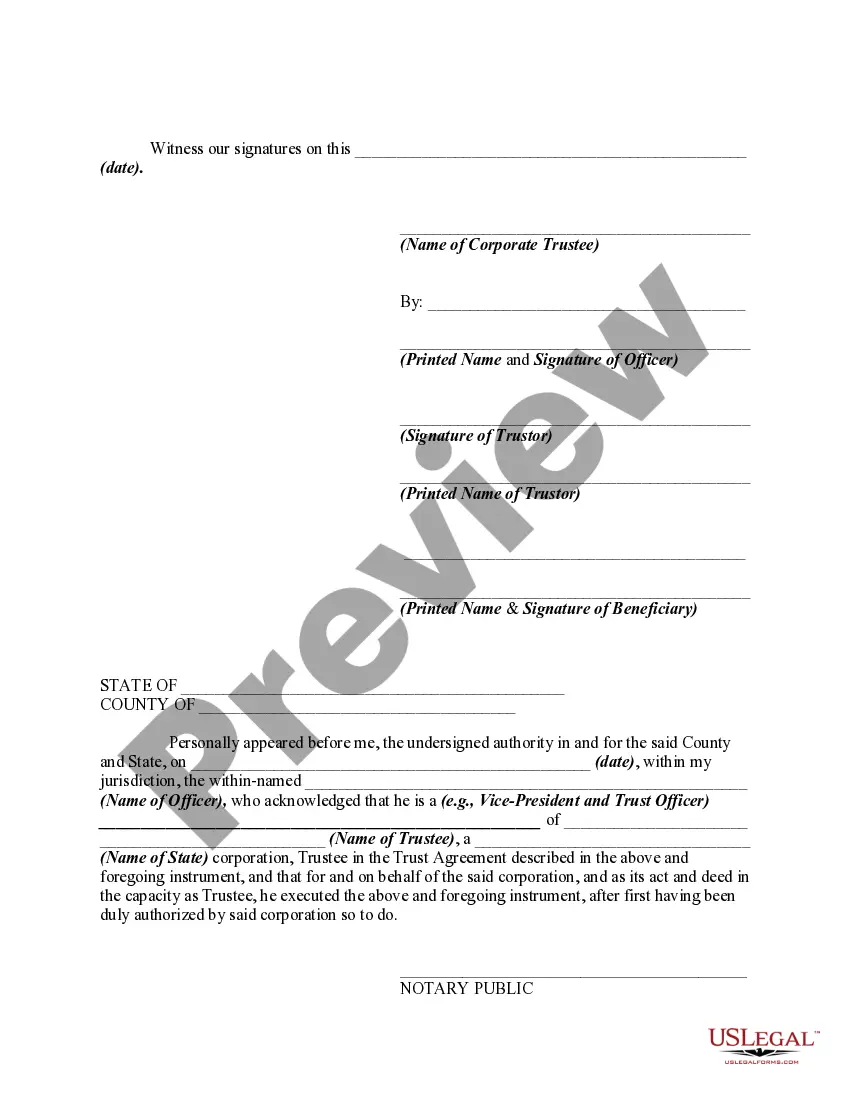

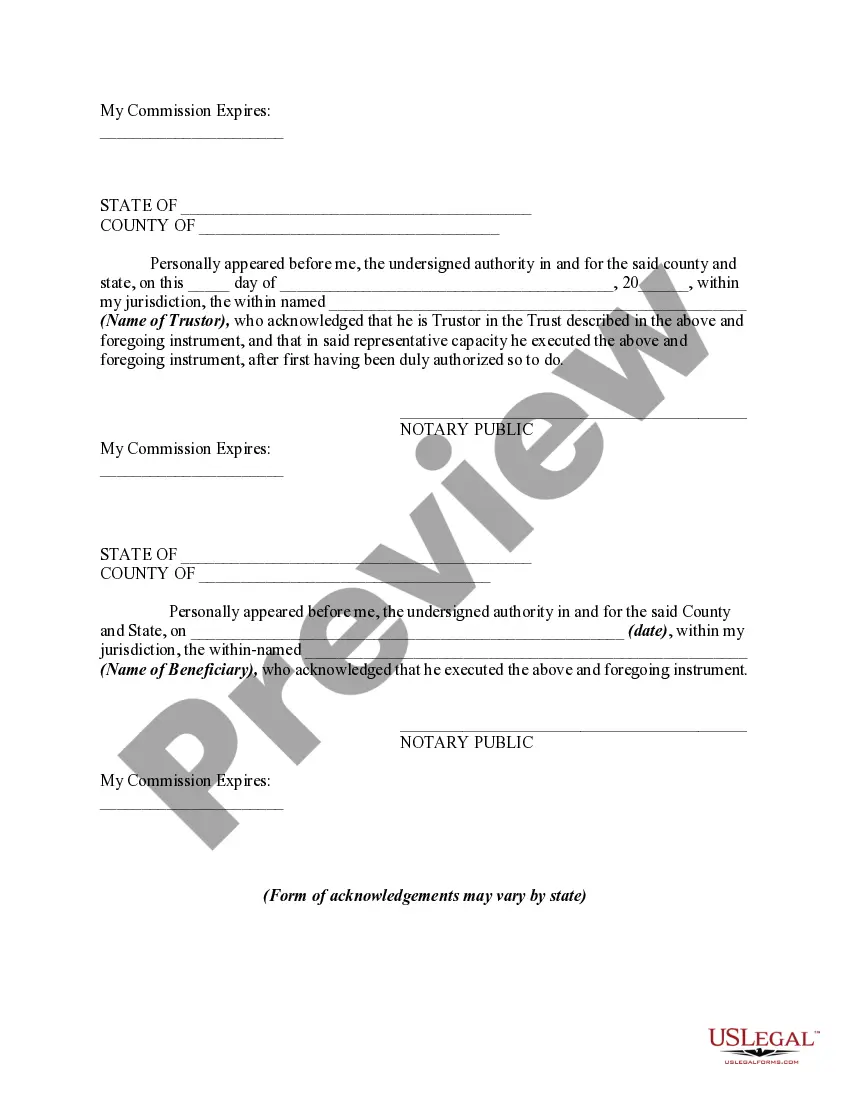

This form is a sample of an agreement to renew (extend) the term of a trust agreement. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Kansas Agreement to Renew Trust Agreement is a legal document that governs the renewal and continuation of a trust in the state of Kansas. This agreement outlines the terms and conditions under which the trust will be extended, ensuring the smooth and efficient management of assets and the distribution of benefits. The primary purpose of the Kansas Agreement to Renew Trust Agreement is to provide clarity and legal validity to the ongoing existence of the trust. It serves as an extension to the original trust agreement, allowing for its continuation beyond its specified duration or expiration date. By executing this agreement, the settler and the trustee affirm their intention to maintain and operate the trust for an extended period. This renewal agreement typically includes various essential elements that ensure the trust's effectiveness and adherence to applicable laws. These elements may encompass the identification of the trust and its original terms, parties involved in the agreement (settler, trustee, and beneficiaries), renewal period, fiduciary duties, modifications or amendments to the trust terms, as well as provisions for termination or further renewals. It is important to note that there may be different types or variations of the Kansas Agreement to Renew Trust Agreement, depending on individual circumstances and specific trust provisions. Some common types include: 1. Irrevocable Trust Renewal Agreement: This type of agreement is used for irrevocable trusts, which are trusts that cannot be altered after their creation without the consent of all involved parties. The agreement establishes the continuation of an existing irrevocable trust beyond its original term. 2. Revocable Trust Renewal Agreement: Unlike irrevocable trusts, revocable trusts can be modified or revoked by the settler at any time. The renewal agreement for a revocable trust affirms the settler's intention to extend the trust and provides an updated framework for its management. 3. Testamentary Trust Renewal Agreement: A testamentary trust is established through the provisions of a person's will and takes effect upon their death. The renewal agreement for a testamentary trust ensures the ongoing administration of the trust beyond its initial term, as dictated by the deceased's will. In conclusion, the Kansas Agreement to Renew Trust Agreement is a crucial legal document that allows for the continuation of a trust beyond its original term. It provides a framework for trust management, outlines the parties' roles and responsibilities, and may vary depending on the type of trust being renewed, such as irrevocable, revocable, or testamentary trusts.