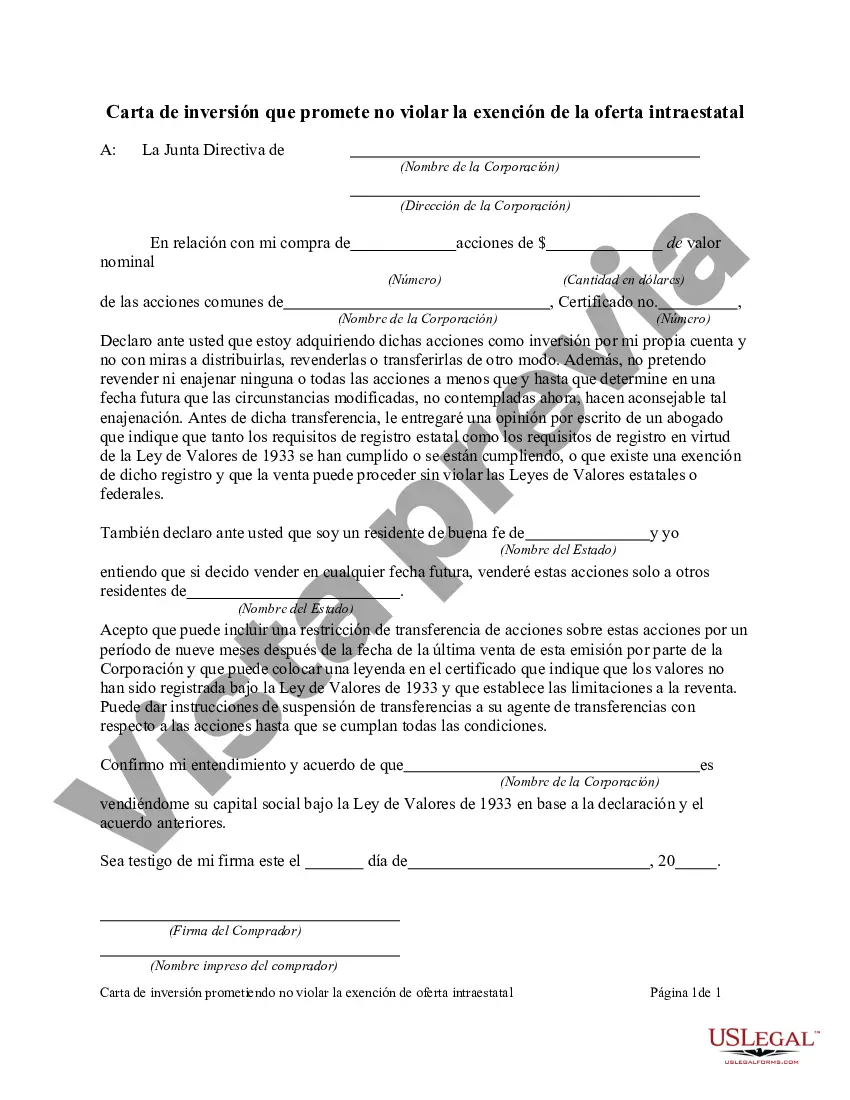

Kansas Investment Letter Promising not to Violate Exemption of Intrastate Offering The Kansas Investment Letter Promising not to Violate Exemption of Intrastate Offering is a legal document that is used in the state of Kansas to provide assurance that an investment opportunity being offered complies with the exemption requirements of intrastate offerings. This letter serves as a commitment by the issuer and signifies their dedication to following the regulations set forth by the Kansas Securities Act. Intended to facilitate local investments and economic growth within the state, intrastate offerings are limited to residents of Kansas and businesses that operate solely within the state. These offerings are exempt from federal registration under the Securities Act of 1933, with the condition that strict guidelines are adhered to. The Kansas Investment Letter Promising not to Violate Exemption of Intrastate Offering is an essential tool utilized by businesses seeking capital from in-state investors. By submitting this document, issuers declare their intent to satisfy the requirements of the exemption, providing potential investors with a level of confidence in their compliance. Types of Kansas Investment Letter Promising not to Violate Exemption of Intrastate Offering: 1. Kansas LLC Investment Letter: This type of letter is specific to limited liability companies (LCS) seeking investments within Kansas. It outlines the commitment of the LLC to fulfill the exemption criteria and align with the Kansas Securities Act. 2. Kansas Corporation Investment Letter: Similar to the LLC Investment Letter, the Kansas Corporation Investment Letter caters specifically to corporations operating in Kansas. It assures compliance with the exemption regulations and serves as a pledge to potential investors. 3. Kansas Partnership Investment Letter: Partnerships operating in Kansas can also utilize the Kansas Partnership Investment Letter. This letter provides a guarantee that the partnership will not violate the exemption provisions and demonstrates a commitment to legal compliance. 4. Kansas Non-profit Investment Letter: Non-profit organizations within Kansas may utilize the Kansas Non-profit Investment Letter. This document ensures that the non-profit will strictly adhere to the stipulations of the exemption, allowing in-state residents to invest with confidence. In order to successfully obtain investments through intrastate offerings in Kansas, issuers must submit the relevant investment letter alongside other required documentation. This commitment solidifies the issuer's dedication to operating within the legal boundaries set forth by the state and instills trust in potential investors.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Kansas Carta de inversión que promete no violar la exención de la oferta intraestatal - Investment Letter Promising not to Violate Exemption of Intrastate Offering

Description

How to fill out Kansas Carta De Inversión Que Promete No Violar La Exención De La Oferta Intraestatal?

Have you been in the place where you need to have files for both enterprise or specific functions virtually every day? There are tons of lawful record web templates available online, but discovering kinds you can trust isn`t easy. US Legal Forms offers a huge number of kind web templates, such as the Kansas Investment Letter Promising not to Violate Exemption of Intrastate Offering, which are published to meet federal and state demands.

In case you are presently acquainted with US Legal Forms web site and get a free account, simply log in. Next, you are able to obtain the Kansas Investment Letter Promising not to Violate Exemption of Intrastate Offering web template.

Unless you have an profile and want to begin to use US Legal Forms, abide by these steps:

- Find the kind you want and make sure it is to the appropriate town/state.

- Use the Preview switch to review the form.

- Look at the outline to ensure that you have selected the proper kind.

- When the kind isn`t what you`re searching for, utilize the Lookup field to obtain the kind that suits you and demands.

- When you discover the appropriate kind, click on Buy now.

- Pick the pricing plan you desire, fill in the required information and facts to produce your money, and pay money for your order using your PayPal or bank card.

- Pick a handy file formatting and obtain your copy.

Locate each of the record web templates you may have bought in the My Forms menu. You may get a extra copy of Kansas Investment Letter Promising not to Violate Exemption of Intrastate Offering any time, if necessary. Just go through the needed kind to obtain or print out the record web template.

Use US Legal Forms, by far the most extensive variety of lawful types, in order to save efforts and prevent blunders. The services offers appropriately created lawful record web templates which you can use for a variety of functions. Create a free account on US Legal Forms and initiate generating your daily life a little easier.