This form is a notice of a failure to make a required payment when due pursuant to a promissory note. The form also contains a warning to the breaching party that legal action will be taken unless the breach is remedied on or before a certain date. This form is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a notice in a particular jurisdiction.

Kansas Notice of Default in Payment Due on Promissory Note is a legal document utilized in the state of Kansas when a borrower fails to make timely payments on a promissory note. This notice serves as a formal communication from the lender to the borrower, notifying them about the default and outlining the necessary steps to rectify the situation. The Kansas Notice of Default in Payment Due on Promissory Note is typically issued when the borrower has missed one or more payments or has failed to comply with the terms and conditions outlined in the promissory note agreement. It serves as a crucial precursor to potential legal action, such as foreclosure or debt collection proceedings. Keywords associated with the Kansas Notice of Default in Payment Due on Promissory Note include: 1. Kansas: The document pertains specifically to the state of Kansas and adheres to the state's legal requirements and regulations regarding promissory notes and loan defaults. 2. Notice of Default: This term indicates that the lender is officially notifying the borrower about their failure to fulfill the repayment obligations as outlined in the promissory note agreement. 3. Payment Due: This phrase refers to the scheduled payment(s) that the borrower has failed to make, leading to the default status. 4. Promissory Note: A promissory note is a legally binding document that outlines the terms and conditions of a loan, including repayment schedules, interest rates, and other pertinent details. 5. Default in Payment: This highlights the borrower's failure to make payments as agreed upon in the promissory note. Different types or variations of the Kansas Notice of Default in Payment Due on Promissory Note may include: 1. Notice of Default in Payment Due on Residential Promissory Note: This version applies specifically to residential properties and the accompanying promissory note. 2. Notice of Default in Payment Due on Commercial Promissory Note: This variation pertains to commercial properties and the corresponding promissory note. 3. Preliminary Notice of Default: This form of notice may be issued by lenders as an initial warning before escalating to a formal Notice of Default in Payment Due on Promissory Note. 4. Demand for Payment and Notice of Default: In certain cases, the lender may combine the demand for immediate payment with the notice of default to put additional pressure on the borrower to rectify the situation promptly. It is important to consult with legal professionals to understand the specific requirements and processes involved in issuing a Kansas Notice of Default in Payment Due on Promissory Note as it varies depending on the situation and the applicable laws in Kansas.

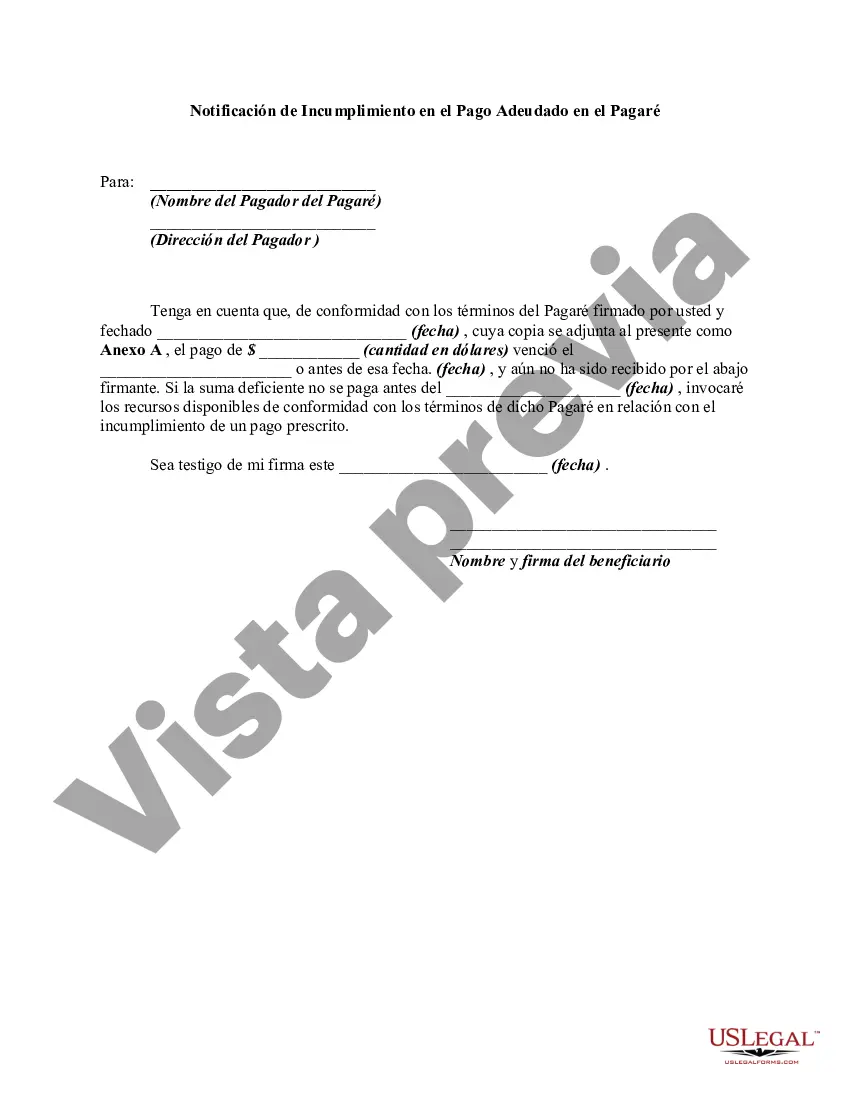

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.