Kansas Revocable Trust for Estate Planning

Description

How to fill out Revocable Trust For Estate Planning?

Selecting the appropriate legal document template can be quite challenging. It goes without saying that there are numerous templates accessible online, but how do you locate the legal form you require.

Utilize the US Legal Forms website. The service offers a vast collection of templates, such as the Kansas Revocable Trust for Estate Planning, that can be utilized for both business and personal purposes. All the documents are reviewed by professionals and comply with federal and state requirements.

If you are already registered, Log In to your account and click on the Download button to obtain the Kansas Revocable Trust for Estate Planning. Use your account to browse the legal forms you have purchased previously. Navigate to the My documents section of your account and download another copy of the document you need.

Choose the document format and download the legal document template onto your device. Complete, modify, print, and sign the received Kansas Revocable Trust for Estate Planning. US Legal Forms boasts the largest repository of legal forms, where you can find a wide variety of document templates. Utilize the service to obtain professionally crafted documents that conform to state regulations.

- First, ensure that you have chosen the correct form for your jurisdiction.

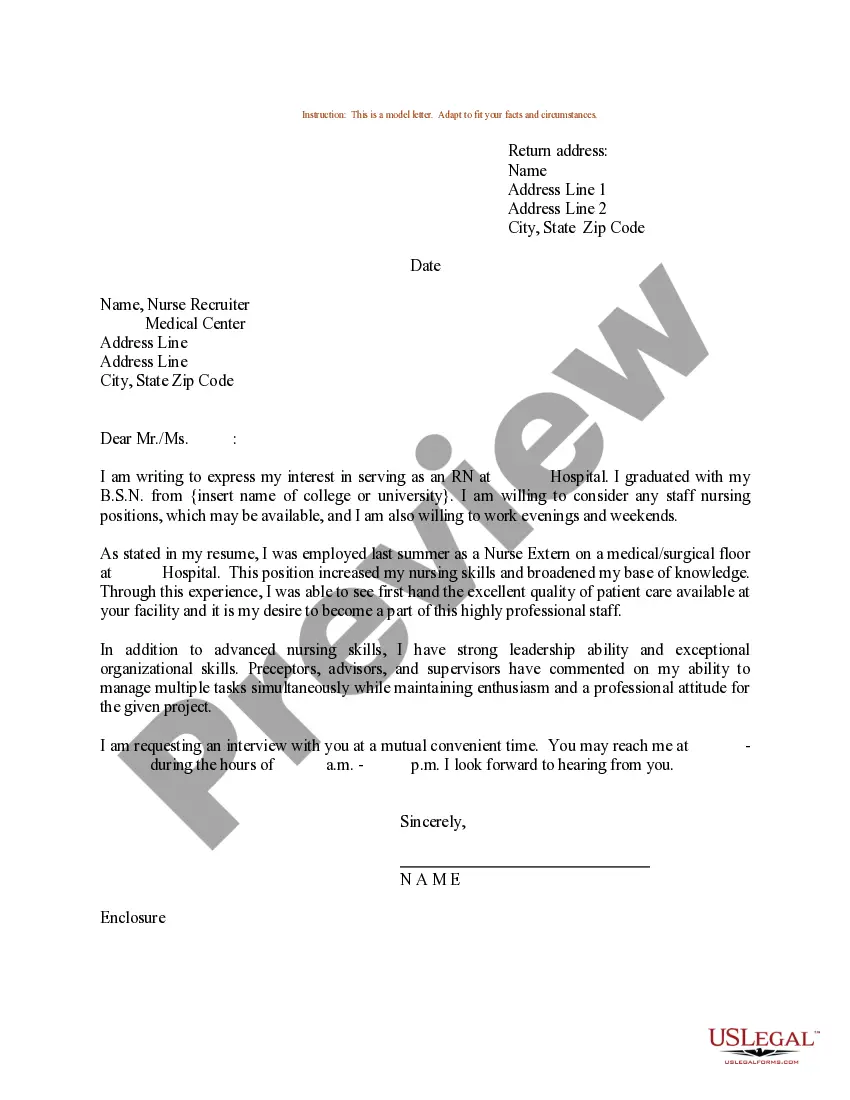

- You can preview the form using the Review button and examine the form details to confirm it is suitable for you.

- If the form does not satisfy your requirements, use the Search field to find the appropriate form.

- Once you are convinced that the form is correct, click the Buy now button to acquire the form.

- Select the pricing plan you wish to adopt and input the required information.

- Create your account and finalize the purchase using your PayPal account or credit card.

Form popularity

FAQ

To put your house in a Kansas Revocable Trust for Estate Planning, you must first create the trust document. Then, you need to execute a deed transferring ownership of your house to the trust. It is advisable to file that deed with the county register of deeds to ensure the property records reflect the trust as the owner. This process helps in managing your estate effectively and can streamline asset distribution later.

In Kansas, you do not need to register a Kansas Revocable Trust for Estate Planning with the state. However, you should create the trust document according to state laws and provide a copy to your trustee. Additionally, you may need to register specific assets, such as real estate, in the trust's name. Ensuring proper documentation can help avoid complications in the future.

The greatest advantage of a Kansas Revocable Trust for Estate Planning is the flexibility it offers. You can alter or revoke the trust at any time during your lifetime, which allows you to adapt to changing circumstances. Moreover, it provides privacy and helps avoid the public probate process, ensuring that your wishes remain private.

A significant mistake parents make is failing to fund the trust properly. Many believe that establishing a Kansas Revocable Trust for Estate Planning is enough, but forgetting to transfer assets into the trust defeats its purpose. Regularly reviewing and updating the trust is essential to ensure it meets your family's needs.

A Kansas Revocable Trust for Estate Planning is often the best option for placing your house. This type of trust allows you full control over your property during your lifetime while avoiding probate after death. It’s advisable to consult with a legal expert to help with proper titling and ensure your trust is set up effectively.

In Kansas, it often depends on your specific needs. A Kansas Revocable Trust for Estate Planning allows you to avoid probate, providing a quicker distribution of assets. However, a will can be simpler to set up initially and may suit your situation if you have fewer assets or a straightforward estate plan.

Yes, a Kansas Revocable Trust for Estate Planning becomes irrevocable upon the grantor’s death. This transition means that the trust can no longer be altered or revoked. After death, the trust assets are distributed according to the trust terms, ensuring a smooth transfer of wealth to your heirs.

Determining whether a Kansas Revocable Trust for Estate Planning is better than a will depends on your personal goals. Trusts offer privacy since they do not enter probate, meaning your assets can be distributed more quickly and without public scrutiny. Additionally, they allow for more detailed control over how your assets are managed and distributed after your passing. However, wills can be simpler and more straightforward for those with fewer assets, so consider your specific needs carefully.

When creating a Kansas Revocable Trust for Estate Planning, it’s important to understand that certain assets generally cannot be placed in a trust. This includes retirement accounts such as 401(k)s or IRAs, which usually require specific beneficiary designations. Additionally, health savings accounts and life insurance policies should also remain outside of the trust, as transferring them could lead to complications. Always consult with an estate planning professional to navigate these specifics.

Starting a trust in Kansas involves several steps. First, identify your goals, such as managing your assets or planning for taxes. Once you have a clear objective, you can create a Kansas revocable trust for estate planning. Utilizing platforms like uslegalforms can provide you with the necessary templates and expert insight throughout your journey.