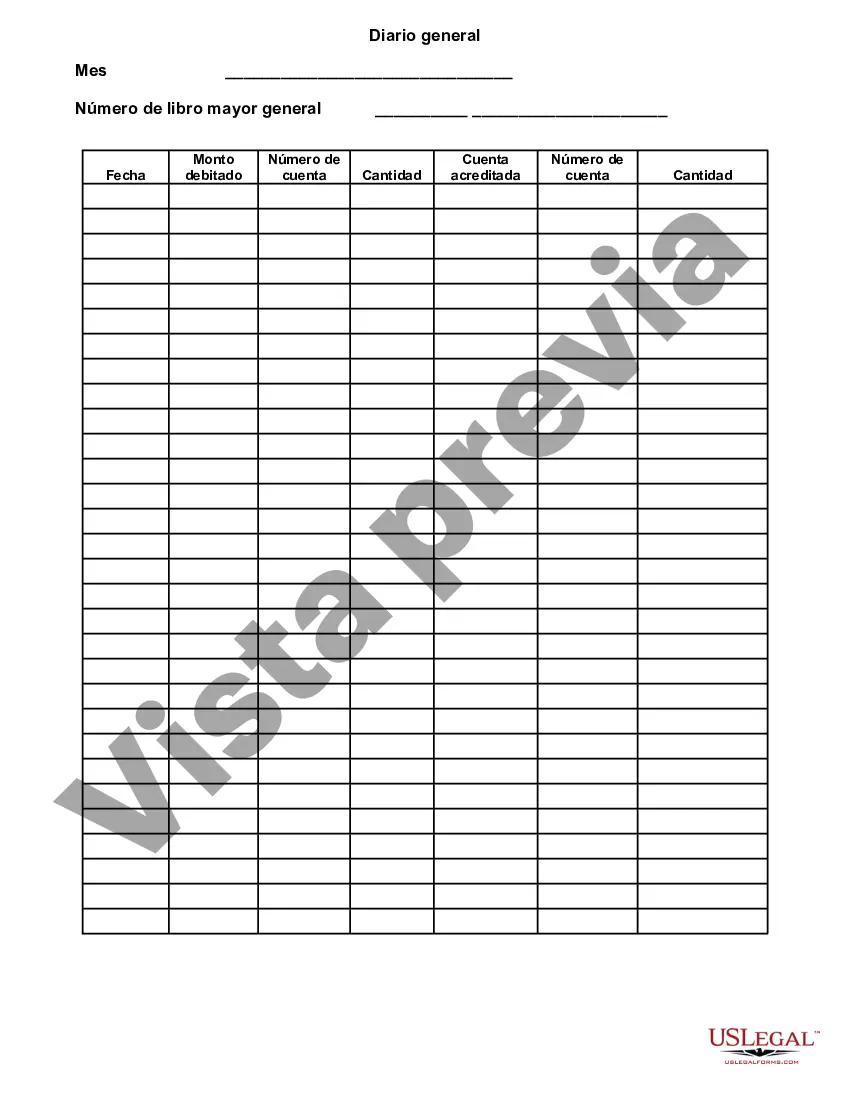

Kansas General Journal is a financial document that records all the day-to-day transactions of a business or organization operating in the state of Kansas. It serves as a chronological record of all financial activities and provides a comprehensive overview of the company's financial position. The Kansas General Journal includes various types of financial transactions such as sales, purchases, expenses, revenues, and other related activities. Each entry in the journal includes details such as the date, description, account names, debit and credit amounts, and any additional supporting information. This journal is an essential component of the overall accounting system and forms the basis for preparing financial statements, analyzing financial data, and ensuring accurate and timely reporting. It provides a clear audit trail and allows for detailed scrutiny of financial transactions, facilitating effective financial management and decision-making. In Kansas, there are different types of general journals that cater to specific business needs or industries. Some of these specialized journals include: 1. Sales Journal: This journal records all sales transactions, including cash and credit sales. It tracks customer information, sales amounts, dates, and any other pertinent details specific to sales-related activities. 2. Purchase Journal: The purchase journal is used to record all purchases made by a business or organization. It includes information such as vendor names, purchase amounts, dates, and other relevant purchase-related data. 3. Cash Receipts Journal: This journal tracks all cash inflows received by the business, including cash sales, payments from customers, and any miscellaneous cash receipts. It provides an easy way to monitor the company's cash flow and reconcile it with bank records. 4. Cash Disbursements Journal: The cash disbursements journal, also known as the cash payments journal, records all cash outflows or payments made by the business. It includes expenses, purchases, vendor payments, and other cash-related transactions. 5. General Ledger Journal: This journal is used to record any adjustments, corrections, or other necessary entries that are not captured in the specialized journals mentioned above. It ensures the accuracy and completeness of the financial records by posting any necessary changes to relevant accounts. Kansas General Journal plays a crucial role in maintaining accurate financial records, ensuring compliance with accounting standards and regulations, and providing insights into the financial health of a business or organization. It serves as a vital tool for financial analysis, budgeting, and strategic decision-making.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Kansas Diario general - General Journal

Description

How to fill out Kansas Diario General?

Have you been in the position in which you need to have paperwork for possibly company or individual functions nearly every working day? There are tons of lawful papers themes available on the net, but discovering kinds you can rely is not simple. US Legal Forms gives a huge number of kind themes, like the Kansas General Journal, which can be published in order to meet federal and state needs.

If you are presently knowledgeable about US Legal Forms site and get an account, basically log in. Afterward, you may obtain the Kansas General Journal format.

If you do not come with an accounts and would like to begin using US Legal Forms, adopt these measures:

- Get the kind you require and make sure it is for your proper area/area.

- Take advantage of the Preview switch to examine the shape.

- Browse the information to actually have selected the right kind.

- In the event the kind is not what you`re trying to find, make use of the Look for industry to obtain the kind that fits your needs and needs.

- Once you find the proper kind, click on Buy now.

- Pick the costs program you desire, fill out the required information and facts to create your money, and buy an order utilizing your PayPal or charge card.

- Select a practical paper file format and obtain your backup.

Discover all of the papers themes you may have bought in the My Forms menu. You may get a more backup of Kansas General Journal any time, if required. Just select the essential kind to obtain or produce the papers format.

Use US Legal Forms, the most comprehensive selection of lawful kinds, to save time as well as prevent errors. The assistance gives appropriately made lawful papers themes that can be used for a variety of functions. Create an account on US Legal Forms and commence generating your life a little easier.