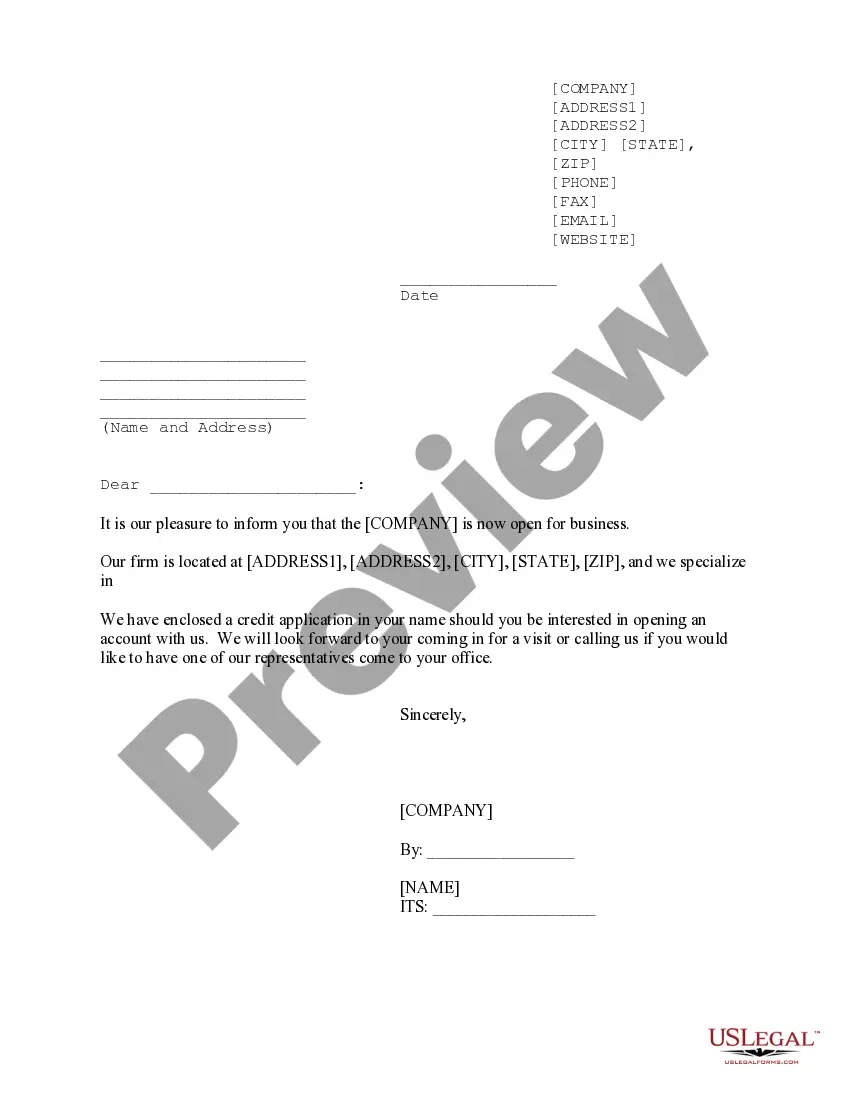

Kansas Sample Letter for New Business with Credit Application

Description

How to fill out Sample Letter For New Business With Credit Application?

Are you in a position where you require documents for possible business or personal purposes almost every working day.

There is an array of legal document templates accessible online, but finding versions you can rely on is challenging.

US Legal Forms offers thousands of form templates, such as the Kansas Sample Letter for New Business with Credit Application, designed to comply with state and federal requirements.

Once you find the correct form, click Purchase now.

Select the pricing plan you desire, enter the necessary information to create your account, and pay for the transaction using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms site and have a free account, simply Log In.

- After that, you can download the Kansas Sample Letter for New Business with Credit Application template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for your specific jurisdiction.

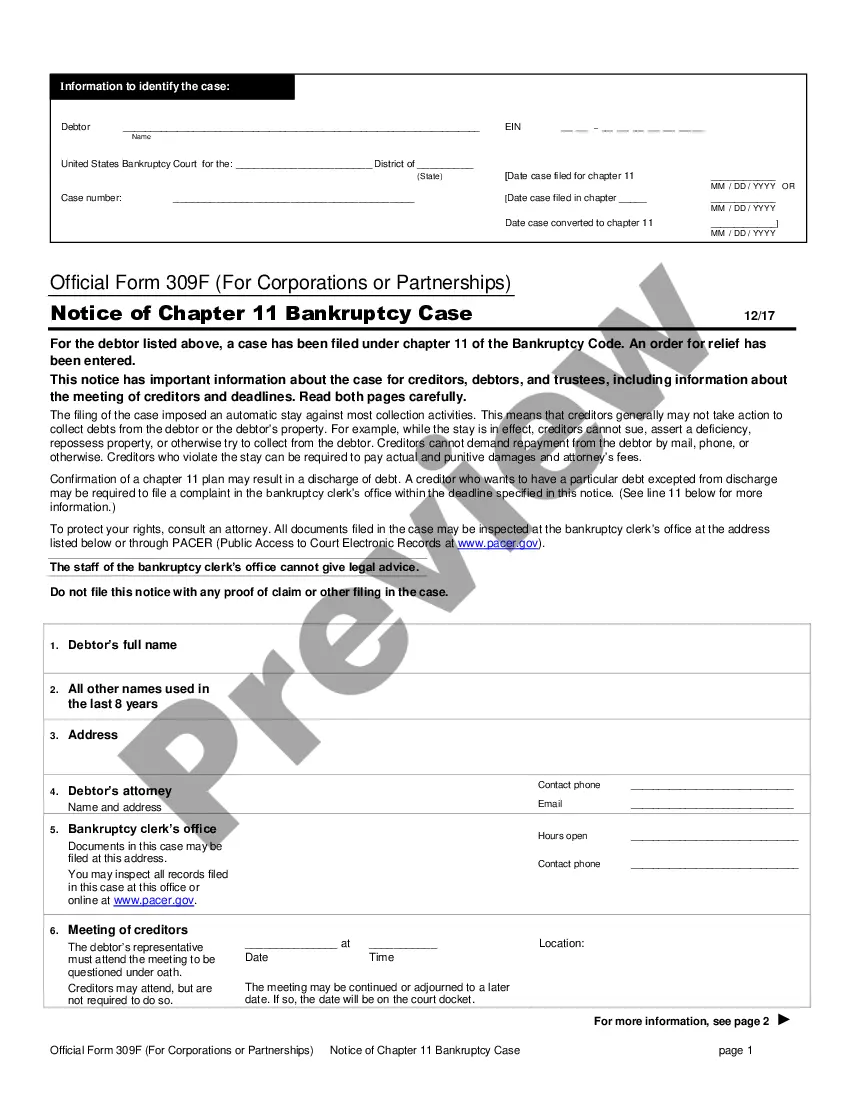

- Utilize the Review button to examine the form.

- Check the outline to confirm that you have chosen the correct form.

- If the form does not match your requirements, use the Search field to find the form that suits your needs.

Form popularity

FAQ

Filling out a letter of credit application form requires accuracy and careful attention to detail. Start by providing your business information, including its legal name, address, and contact details. If you utilize a Kansas Sample Letter for New Business with Credit Application, you can follow the outlined format to ensure you include all necessary information. Remember to specify the credit amount needed and any other pertinent details that could influence the approval process.

When filling out a credit card application, you should enter the official name of your business as registered with the state. This ensures that all financial information aligns with legal documents, making the approval process smoother. If you are using a Kansas Sample Letter for New Business with Credit Application, having the business name correct is crucial for establishing credibility. Always confirm that the name matches the one on your tax documents and bank accounts.

The fastest way to build credit for your LLC is to establish a strong business credit profile. Start by obtaining an EIN, opening a business bank account, and applying for credit with suppliers and vendors that report to credit bureaus. Additionally, using a Kansas Sample Letter for New Business with Credit Application can streamline your credit requests and enhance your credibility with lenders.

To create a business credit file, begin by establishing your business as a legal entity and obtaining an EIN. Next, open a business bank account and apply for a business credit card. Consistently using your EIN in transactions and ensuring timely bill payments will help build your file over time, and utilizing a Kansas Sample Letter for New Business with Credit Application can aid in formalizing your credit agreements.

Creating a credit application form involves several key steps. Start by gathering essential information, such as business name, address, contact details, and references. Ensure the form has clear sections for financial information and terms of credit. For templates, a Kansas Sample Letter for New Business with Credit Application can guide you in structuring your form effectively.

Yes, you can use your Employer Identification Number (EIN) to build business credit. Your EIN serves as a unique identifier for your business and helps separate personal finances from business finances. By using your EIN in financial transactions, you help establish a business credit profile. For assistance, you can utilize resources like the Kansas Sample Letter for New Business with Credit Application to create a strong credit foundation.

Registering a small business in Kansas involves several steps. First, you should choose a business structure, such as an LLC or corporation, and then file the necessary forms with the Secretary of State. It's important to obtain any required licenses or permits. For small business owners seeking to manage credit relations effectively, utilizing a Kansas Sample Letter for New Business with Credit Application can streamline your operations.

To form an LLC in Kansas, you need to file Articles of Organization with the Secretary of State. You must provide a unique name for your company, which includes 'LLC' in the title. Additionally, having a registered agent is essential to receive legal documents. If you plan to extend credit to customers, a Kansas Sample Letter for New Business with Credit Application can help establish your business's credibility.

The credit application form is typically filled out by business owners or authorized representatives of the business. This ensures that all relevant details about credit history, financial information, and business structure are accurately reported. You can assist them by providing a Kansas Sample Letter for New Business with Credit Application that guides them on what information is needed.

A letter of credit for a new business serves as a financial guarantee from a bank or financial institution, assuring the seller of payment upon meeting certain terms. This letter helps build trust between parties involved in transactions. In this context, utilizing documents like a Kansas Sample Letter for New Business with Credit Application can help outline the financial credibility necessary for such agreements.