Partnership agreements are written documents that explicitly detail the relationship between the business partners and their individual obligations and contributions to the partnership. Since partnership agreements should cover all possible business situations that could arise during the partnership's life, the documents are often complex; legal counsel in drafting and reviewing the finished contract is generally recommended. If a partnership does not have a partnership agreement in place when it dissolves, the guidelines of the Uniform Partnership Act and various state laws will determine how the assets and debts of the partnership are distributed.

A Kansas Partnership Agreement between accountants is a legal document that outlines the terms and conditions of a partnership between two or more accountants practicing in the state of Kansas. This agreement is crucial in establishing the rights, responsibilities, and obligations of each partner, and serves as a foundation for a successful and harmonious partnership. In a Kansas Partnership Agreement between accountants, there are different types to consider, such as: 1. General Partnership Agreement: This type of partnership agreement is the most common and straightforward. It establishes a partnership where all partners share equal authority and liability for the partnership's operations and debts. Each partner's contribution to the partnership, profit distribution, decision-making authority, and management responsibilities are clearly defined in this agreement. 2. Limited Partnership Agreement (LP): In this arrangement, there are two types of partners: general partners and limited partners. General partners have unlimited liability and are responsible for managing the partnership's operations. On the other hand, limited partners have limited liability, and their involvement in the day-to-day operations is restricted. Limited partners usually contribute capital and share in the profits, but they have no decision-making authority in the partnership. 3. Limited Liability Partnership Agreement (LLP): An LLP is a hybrid form of partnership that provides liability protection to all partners involved. This agreement allows each partner to limit their personal liability for the actions or negligence of other partners. However, the partners still have a significant role in managing the partnership and share in the profits. When drafting a Kansas Partnership Agreement between accountants, it is important to include several key elements and address various aspects of the partnership: 1. Business Purpose: Clearly define the purpose and nature of the partnership, whether it is offering accounting services, consultations, tax planning, or any other specific accounting services. 2. Partner Contributions: Specify each partner's contribution, whether it is in the form of capital, equipment, intellectual property, or resources. Additionally, outline the process of adding or withdrawing partners and any associated financial implications. 3. Profit Distribution: Establish a fair and equitable method for distributing profits among partners. This can be based on contributions, working hours, or a predetermined formula. 4. Decision-Making: Determine how decisions will be made within the partnership, whether it will be unanimous consent, majority vote, or a designated managing partner. 5. Roles and Responsibilities: Clearly define each partner's roles, responsibilities, and areas of expertise. This ensures clarity in terms of client management, business development, financial management, and other crucial aspects of the partnership. 6. Competition and Non-Disclosure: Address confidentiality, non-compete, and non-solicitation clauses to protect the partnership's interests and clients, ensuring partners cannot directly compete with the partnership or divulge sensitive information. 7. Dispute Resolution: Set forth a mechanism to resolve disputes, whether it involves mediation, arbitration, or litigation, and specify the jurisdiction for any legal proceedings. A well-drafted Kansas Partnership Agreement between accountants is essential in establishing a solid foundation for a successful and prosperous partnership. It ensures all partners are on the same page, and their rights, responsibilities, and expectations are clearly defined and agreed upon.A Kansas Partnership Agreement between accountants is a legal document that outlines the terms and conditions of a partnership between two or more accountants practicing in the state of Kansas. This agreement is crucial in establishing the rights, responsibilities, and obligations of each partner, and serves as a foundation for a successful and harmonious partnership. In a Kansas Partnership Agreement between accountants, there are different types to consider, such as: 1. General Partnership Agreement: This type of partnership agreement is the most common and straightforward. It establishes a partnership where all partners share equal authority and liability for the partnership's operations and debts. Each partner's contribution to the partnership, profit distribution, decision-making authority, and management responsibilities are clearly defined in this agreement. 2. Limited Partnership Agreement (LP): In this arrangement, there are two types of partners: general partners and limited partners. General partners have unlimited liability and are responsible for managing the partnership's operations. On the other hand, limited partners have limited liability, and their involvement in the day-to-day operations is restricted. Limited partners usually contribute capital and share in the profits, but they have no decision-making authority in the partnership. 3. Limited Liability Partnership Agreement (LLP): An LLP is a hybrid form of partnership that provides liability protection to all partners involved. This agreement allows each partner to limit their personal liability for the actions or negligence of other partners. However, the partners still have a significant role in managing the partnership and share in the profits. When drafting a Kansas Partnership Agreement between accountants, it is important to include several key elements and address various aspects of the partnership: 1. Business Purpose: Clearly define the purpose and nature of the partnership, whether it is offering accounting services, consultations, tax planning, or any other specific accounting services. 2. Partner Contributions: Specify each partner's contribution, whether it is in the form of capital, equipment, intellectual property, or resources. Additionally, outline the process of adding or withdrawing partners and any associated financial implications. 3. Profit Distribution: Establish a fair and equitable method for distributing profits among partners. This can be based on contributions, working hours, or a predetermined formula. 4. Decision-Making: Determine how decisions will be made within the partnership, whether it will be unanimous consent, majority vote, or a designated managing partner. 5. Roles and Responsibilities: Clearly define each partner's roles, responsibilities, and areas of expertise. This ensures clarity in terms of client management, business development, financial management, and other crucial aspects of the partnership. 6. Competition and Non-Disclosure: Address confidentiality, non-compete, and non-solicitation clauses to protect the partnership's interests and clients, ensuring partners cannot directly compete with the partnership or divulge sensitive information. 7. Dispute Resolution: Set forth a mechanism to resolve disputes, whether it involves mediation, arbitration, or litigation, and specify the jurisdiction for any legal proceedings. A well-drafted Kansas Partnership Agreement between accountants is essential in establishing a solid foundation for a successful and prosperous partnership. It ensures all partners are on the same page, and their rights, responsibilities, and expectations are clearly defined and agreed upon.

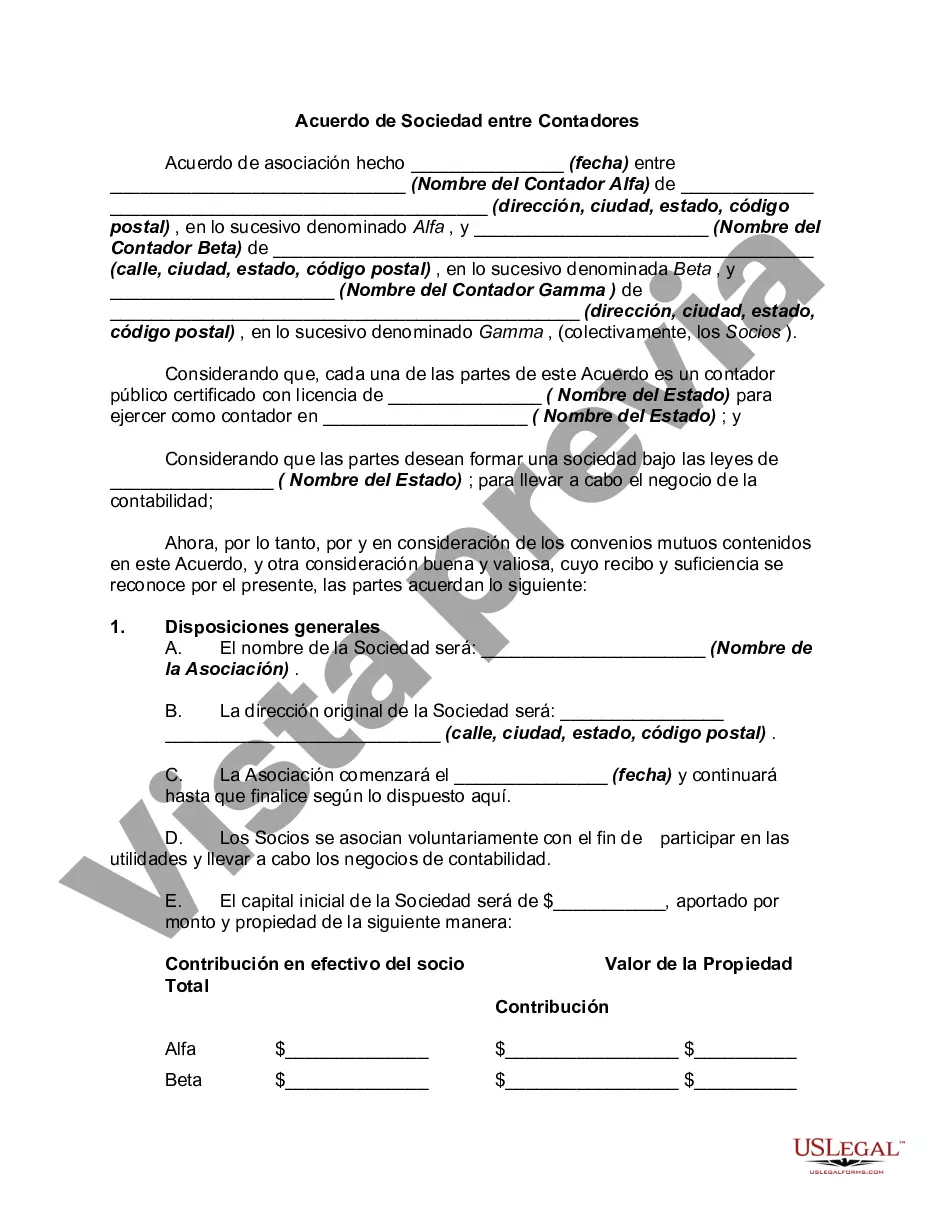

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.