Kansas Receipt and Withdrawal from Partnership refers to the process and legal requirements for acknowledging and terminating a partnership association in the state of Kansas. This comprehensive procedure aims to ensure that all assets, liabilities, and legal obligations related to the partnership are adequately addressed. In Kansas, there are two main types of partnership receipts and withdrawals: 1. Receipt of Partnership: This refers to the official recognition of a partnership formation in Kansas. Partnerships can be established through various means such as written agreements, oral agreements, or even implied partnerships. However, it is highly advisable to have a written partnership agreement to avoid any disputes or legal complications in the future. The process of receiving partnership status involves the following key steps: — Choosing a unique partnership name that complies with Kansas state regulations. — Preparing a partnership agreement that outlines the rights, responsibilities, and profit-sharing arrangements of each partner. — Registering the partnership with the Kansas Secretary of State by submitting the necessary forms along with the partnership agreement. — Paying the required fees for partnership registration. Once the above steps are completed and the registration is approved, the partnership is officially recognized and gains legal standing in Kansas. Partnerships are typically regarded as separate entities from their individual partners. 2. Withdrawal from Partnership: Sometimes, partners may decide to end their partnership for various reasons, such as retirement, dissolution, or disputes. In such cases, specific procedures must be followed to ensure a smooth termination and dissolve any legal or financial ties associated with the partnership. The Kansas laws provide guidelines on the withdrawal process. The withdrawal process involves the following steps: — Reviewing the partnership agreement: Partners should carefully examine the partnership agreement to understand the terms and conditions regarding withdrawal, including notice periods, distribution of assets, and obligations to partners and creditors. — Providing proper notice: The withdrawing partner must provide written notice to the other partners, following the guidelines stipulated in the partnership agreement or Kansas partnership laws. — Compliance with legal obligations: The withdrawing partner must settle any outstanding liabilities and ensure the partnership meets all applicable tax and regulatory requirements before dissolution. — Asset distribution: Unless specified otherwise in the partnership agreement, the withdrawing partner is entitled to receive their share of partnership assets after all debts and obligations are settled. — Updating legal records: Once the withdrawal is finalized, partners should update the partnership records with the Kansas Secretary of State to reflect the change in partnership status. In conclusion, Kansas Receipt and Withdrawal from Partnership is a detailed process that requires adherence to specific legal procedures and documentation. It is crucial to consult with legal professionals familiar with Kansas partnership laws to ensure compliance and to protect the interests of all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Kansas Recepción y retiro de la sociedad - Receipt and Withdrawal from Partnership

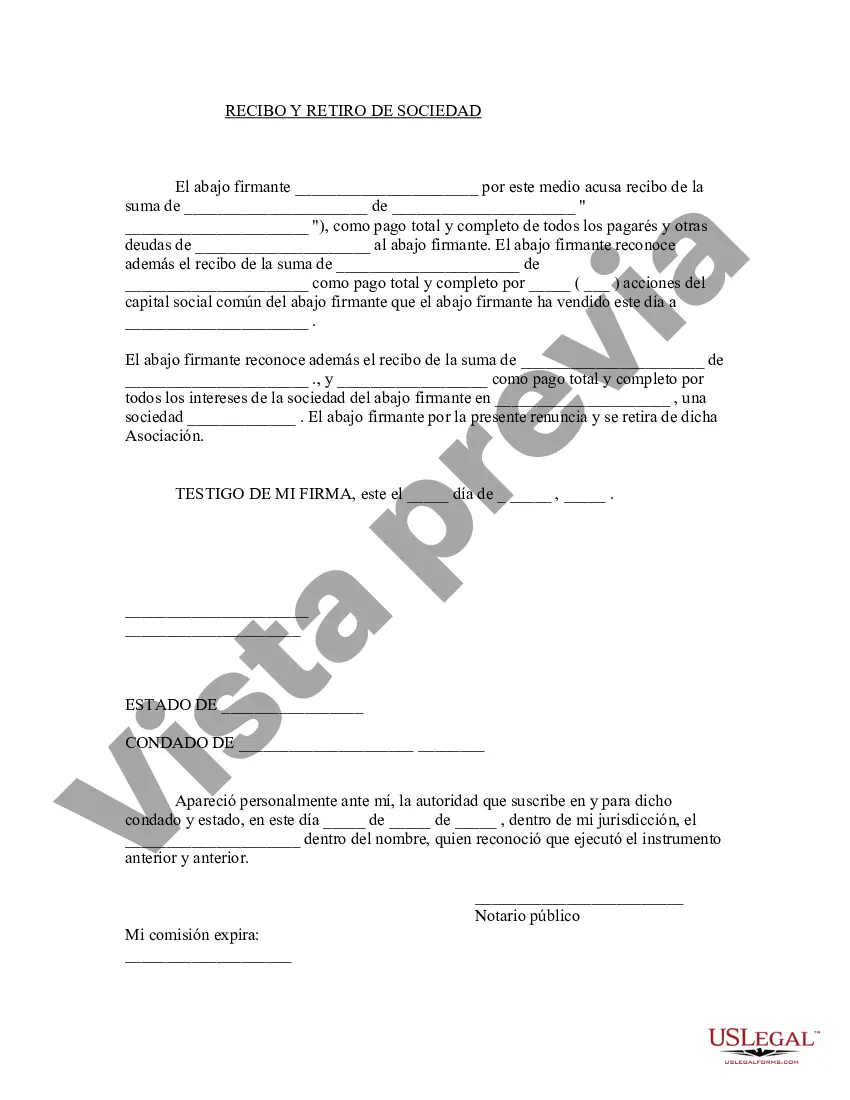

Description

How to fill out Kansas Recepción Y Retiro De La Sociedad?

Discovering the right legitimate file web template can be quite a struggle. Of course, there are a variety of web templates available on the net, but how do you find the legitimate kind you will need? Make use of the US Legal Forms web site. The support offers 1000s of web templates, including the Kansas Receipt and Withdrawal from Partnership, which can be used for company and private requires. All of the varieties are checked out by professionals and satisfy state and federal needs.

If you are currently authorized, log in to your accounts and click the Download button to get the Kansas Receipt and Withdrawal from Partnership. Use your accounts to appear through the legitimate varieties you have purchased formerly. Visit the My Forms tab of your respective accounts and get another backup of your file you will need.

If you are a fresh user of US Legal Forms, listed here are straightforward recommendations that you can stick to:

- First, be sure you have selected the proper kind to your town/area. It is possible to look over the shape utilizing the Review button and look at the shape description to guarantee this is the best for you.

- When the kind fails to satisfy your needs, use the Seach discipline to discover the right kind.

- When you are certain the shape would work, select the Purchase now button to get the kind.

- Opt for the pricing prepare you want and enter in the required information. Create your accounts and buy the transaction utilizing your PayPal accounts or Visa or Mastercard.

- Pick the file formatting and down load the legitimate file web template to your product.

- Full, modify and print and indicator the attained Kansas Receipt and Withdrawal from Partnership.

US Legal Forms is definitely the most significant collection of legitimate varieties for which you can find different file web templates. Make use of the service to down load appropriately-made documents that stick to condition needs.