Kansas Lease Agreement Between Two Nonprofit Church Corporations: A Comprehensive Guide Introduction: A Kansas Lease Agreement Between Two Nonprofit Church Corporations is a legally binding contract that governs the terms and conditions of leasing a property between two nonprofit church organizations in the state of Kansas. This agreement outlines the rights and responsibilities of both parties, ensuring a fair and transparent relationship throughout the lease period. Multiple variations of this lease agreement exist to cater to different scenarios, including short-term leases, long-term leases, and more. In this article, we will delve into the key aspects and important details of such agreements, highlighting their significance and potential variations. Key Components of a Kansas Lease Agreement Between Two Nonprofit Church Corporations: 1. Parties Involved: This section of the lease agreement identifies the two nonprofit church corporations involved in the lease. It includes their official legal names, addresses, and any additional relevant information required to establish their identities. 2. Property Description: This section provides a comprehensive description of the leased property, including its physical address, legal description, and any other information necessary for clear identification. Additionally, it should outline any limitations or restrictions imposed on the property's use, such as zoning regulations or specific restrictions related to religious activities. 3. Lease Term: The lease term specifies the duration of the agreement, including the start and end dates. It may consist of a fixed term, such as three years, or an ongoing agreement subject to termination by either party upon prior notice. Careful consideration should be given to establishing appropriate renewal terms or a mechanism for renegotiation. 4. Rent and Payment Terms: This section outlines the financial aspects of the lease agreement. It specifies the monthly or annual rent amount, its due date, and acceptable payment methods. Additionally, any potential rent escalation clauses or penalties for late payment should be explicitly stated. 5. Maintenance and Repairs: This provision delineates the responsibilities of both parties concerning property maintenance and repairs. It should clarify who is responsible for routine maintenance, structural repairs, utility payments, and other related expenses. Furthermore, the agreement can establish an inspection schedule to ensure both parties uphold their obligations. 6. Insurance and Liability: This section covers insurance requirements to protect both parties from potential risks and liabilities. It often necessitates that each nonprofit church corporation carries adequate liability insurance to cover personal injury, property damage, or any other applicable risks. 7. Termination: The termination clause outlines the conditions under which either party may terminate the lease agreement. This may include default on rent payment, non-compliance with lease terms, or other breaches of agreement. Clear guidelines for providing notice and any penalties or remedies associated with termination should be included. Types of Kansas Lease Agreement Between Two Nonprofit Church Corporations: 1. Short-Term Lease Agreement: This type of lease agreement typically spans a short duration, such as a few months, and is appropriate for temporary or seasonal use of property. 2. Long-Term Lease Agreement: A long-term lease agreement encompasses an extended period, usually several years, establishing a stable and predictable lease arrangement between the parties involved. Conclusion: A Kansas Lease Agreement Between Two Nonprofit Church Corporations serves as a crucial legal document that ensures a harmonious and transparent relationship between nonprofit church organizations leasing property in Kansas. By carefully considering the key components and variations of lease agreements, nonprofits can protect their interests, maintain their financial stability, and foster a successful partnership with their leasing counterparts. It is crucial to consult with legal professionals experienced in this field to tailor the lease agreement to meet the specific needs and requirements of the nonprofit organization.

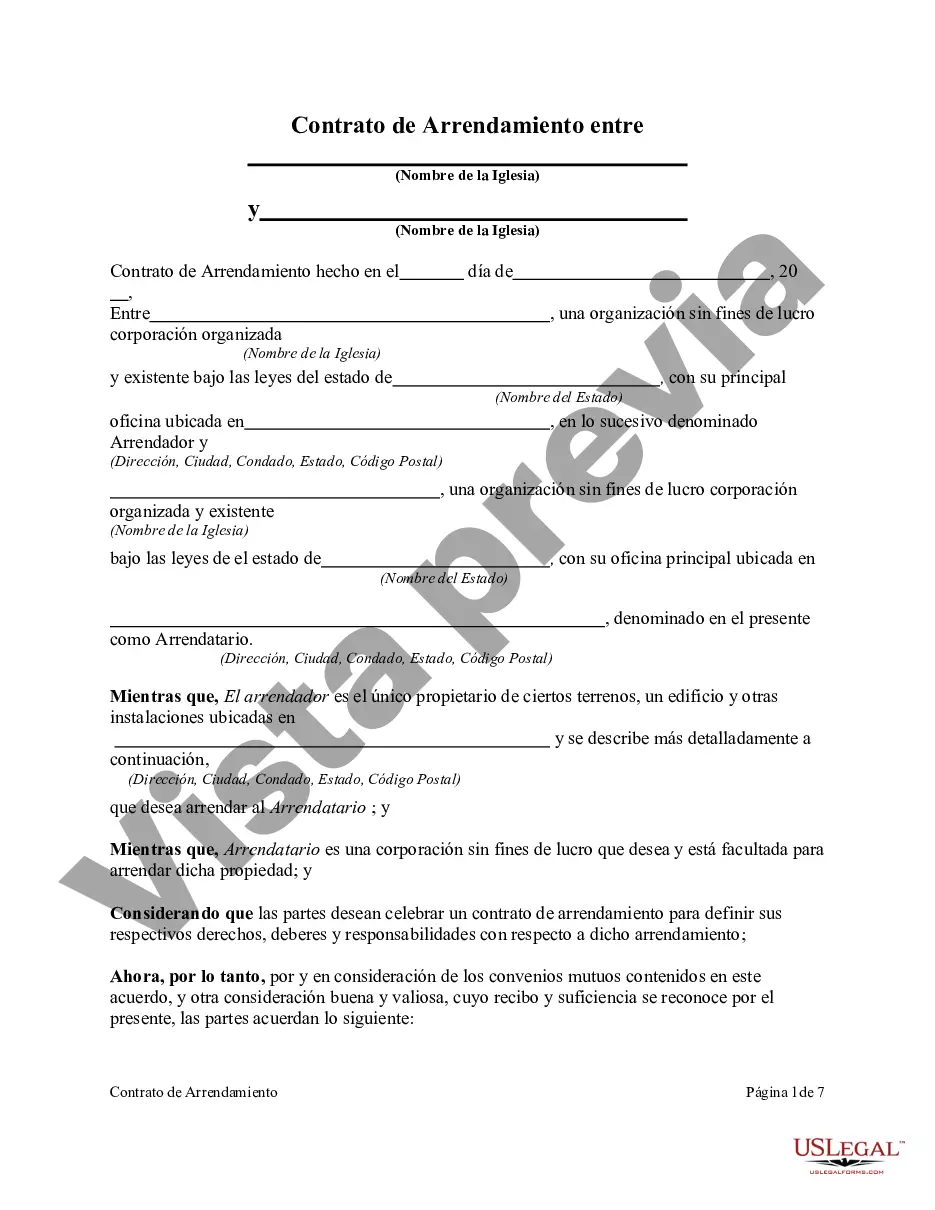

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Kansas Contrato de arrendamiento entre dos corporaciones eclesiásticas sin fines de lucro - Lease Agreement Between Two Nonprofit Church Corporations

Description

How to fill out Kansas Contrato De Arrendamiento Entre Dos Corporaciones Eclesiásticas Sin Fines De Lucro?

If you wish to total, down load, or print out authorized document layouts, use US Legal Forms, the greatest assortment of authorized kinds, which can be found on-line. Use the site`s simple and hassle-free look for to discover the papers you need. Different layouts for company and personal reasons are categorized by classes and says, or keywords and phrases. Use US Legal Forms to discover the Kansas Lease Agreement Between Two Nonprofit Church Corporations with a couple of mouse clicks.

Should you be previously a US Legal Forms client, log in to the bank account and click on the Obtain button to find the Kansas Lease Agreement Between Two Nonprofit Church Corporations. You can also access kinds you in the past delivered electronically from the My Forms tab of your own bank account.

If you work with US Legal Forms for the first time, refer to the instructions under:

- Step 1. Make sure you have chosen the form for that appropriate area/region.

- Step 2. Use the Review choice to check out the form`s content material. Don`t overlook to read the explanation.

- Step 3. Should you be not happy with the kind, make use of the Search field at the top of the monitor to find other variations of your authorized kind design.

- Step 4. When you have found the form you need, click on the Purchase now button. Opt for the prices prepare you like and add your references to register to have an bank account.

- Step 5. Procedure the transaction. You should use your bank card or PayPal bank account to perform the transaction.

- Step 6. Choose the format of your authorized kind and down load it in your gadget.

- Step 7. Comprehensive, revise and print out or sign the Kansas Lease Agreement Between Two Nonprofit Church Corporations.

Each authorized document design you acquire is yours permanently. You possess acces to each kind you delivered electronically within your acccount. Click the My Forms section and decide on a kind to print out or down load once more.

Remain competitive and down load, and print out the Kansas Lease Agreement Between Two Nonprofit Church Corporations with US Legal Forms. There are many specialist and state-specific kinds you may use for the company or personal requires.