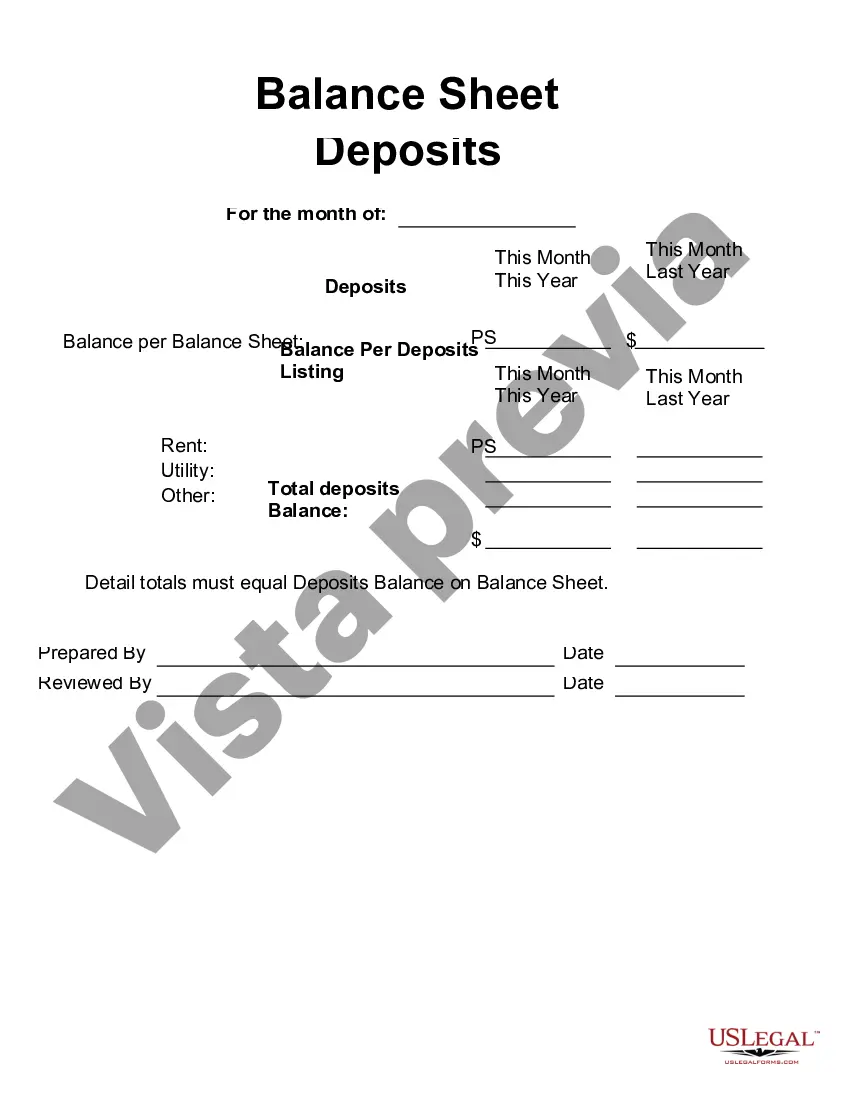

Kansas Balance Sheet Deposits are a crucial aspect of the banking system in the state of Kansas. These are the deposits made by individuals, businesses, and other entities into Kansas-based banks that are recorded on the balance sheet as liabilities of the bank. These deposits play a crucial role in the financial stability and operations of Kansas banks. They represent the funds that banks receive from customers, which are typically held in various types of deposit accounts to safeguard and grow their wealth while maintaining easy access to the funds when needed. There are various types of Kansas Balance Sheet Deposits, including: 1. Demand Deposits: These deposits consist of funds held in checking accounts where customers have the right to withdraw their money at any time without giving prior notice. They often serve as a primary transactional account for individuals and businesses, providing immediate access to funds. 2. Savings Deposits: Savings deposits are typically interest-bearing accounts that offer a slightly higher interest rate than demand deposits. These accounts are designed for customers to accumulate funds over time and also offer relatively easy access to funds when required. 3. Certificates of Deposit (CDs): These are time deposits with a fixed term, ranging from a few months to several years. CDs offer higher interest rates compared to demand and savings deposits since customers commit to leaving their funds with the bank for a specified duration. Early withdrawal may lead to penalties. 4. Money Market Accounts: Money market accounts combine elements of savings and checking accounts. They often offer higher interest rates than regular savings accounts, but they may require higher minimum balances. These accounts commonly include limited check-writing abilities and deposit limits. 5. Other Deposits: Kansas banks may also include a range of other deposit accounts on their balance sheets, such as non-interest-bearing demand deposits, foreign deposits, and time deposits above federally insured limits. These Kansas Balance Sheet Deposits reflect the level of confidence customers have in their banks, as well as the bank's ability to attract and retain depositors. They provide a stable source of funds for banks, which they use for lending activities, such as providing loans to individuals, businesses, and other entities within the Kansas community. It is important for Kansas banks to carefully manage their balance sheet deposits to ensure they have enough liquidity and resources to meet customer demands while complying with regulatory requirements. By offering various types of deposit accounts and providing competitive interest rates, Kansas banks can attract depositors, stimulate economic growth, and support the financial well-being of individuals and businesses throughout the state.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Kansas Balance Depósitos - Balance Sheet Deposits

Description

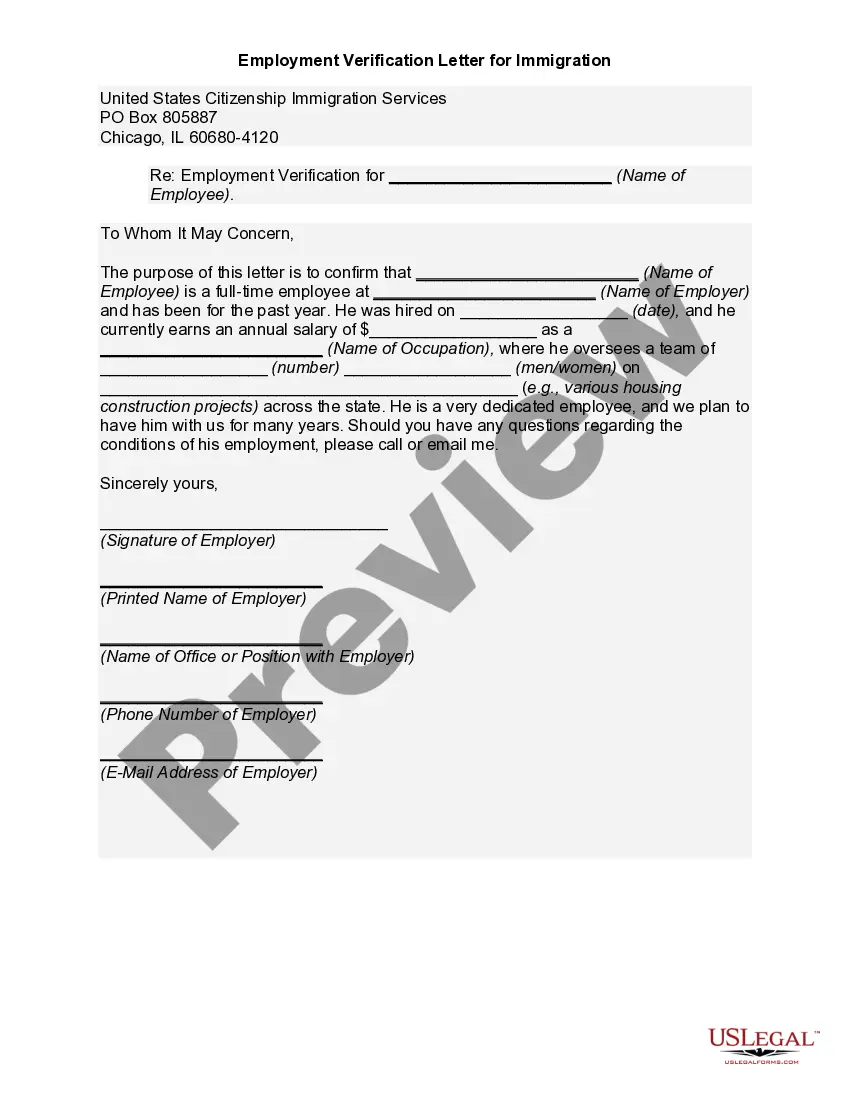

How to fill out Kansas Balance Depósitos?

If you need to total, down load, or print out authorized file layouts, use US Legal Forms, the biggest collection of authorized kinds, which can be found on the Internet. Take advantage of the site`s easy and practical lookup to obtain the papers you need. A variety of layouts for enterprise and personal reasons are categorized by classes and suggests, or keywords. Use US Legal Forms to obtain the Kansas Balance Sheet Deposits in just a few clicks.

When you are previously a US Legal Forms buyer, log in to your accounts and click on the Obtain switch to find the Kansas Balance Sheet Deposits. You can also entry kinds you previously saved in the My Forms tab of your accounts.

Should you use US Legal Forms for the first time, follow the instructions under:

- Step 1. Be sure you have chosen the shape for the right metropolis/region.

- Step 2. Use the Review solution to examine the form`s content. Never forget about to learn the description.

- Step 3. When you are unsatisfied with all the kind, utilize the Look for industry at the top of the monitor to find other models from the authorized kind template.

- Step 4. Once you have found the shape you need, click the Buy now switch. Choose the pricing strategy you choose and add your references to sign up for an accounts.

- Step 5. Procedure the purchase. You should use your Мisa or Ьastercard or PayPal accounts to finish the purchase.

- Step 6. Choose the structure from the authorized kind and down load it on the device.

- Step 7. Full, change and print out or indication the Kansas Balance Sheet Deposits.

Each and every authorized file template you acquire is yours for a long time. You possess acces to every kind you saved with your acccount. Select the My Forms section and decide on a kind to print out or down load once more.

Be competitive and down load, and print out the Kansas Balance Sheet Deposits with US Legal Forms. There are many specialist and condition-distinct kinds you can utilize for your enterprise or personal requires.