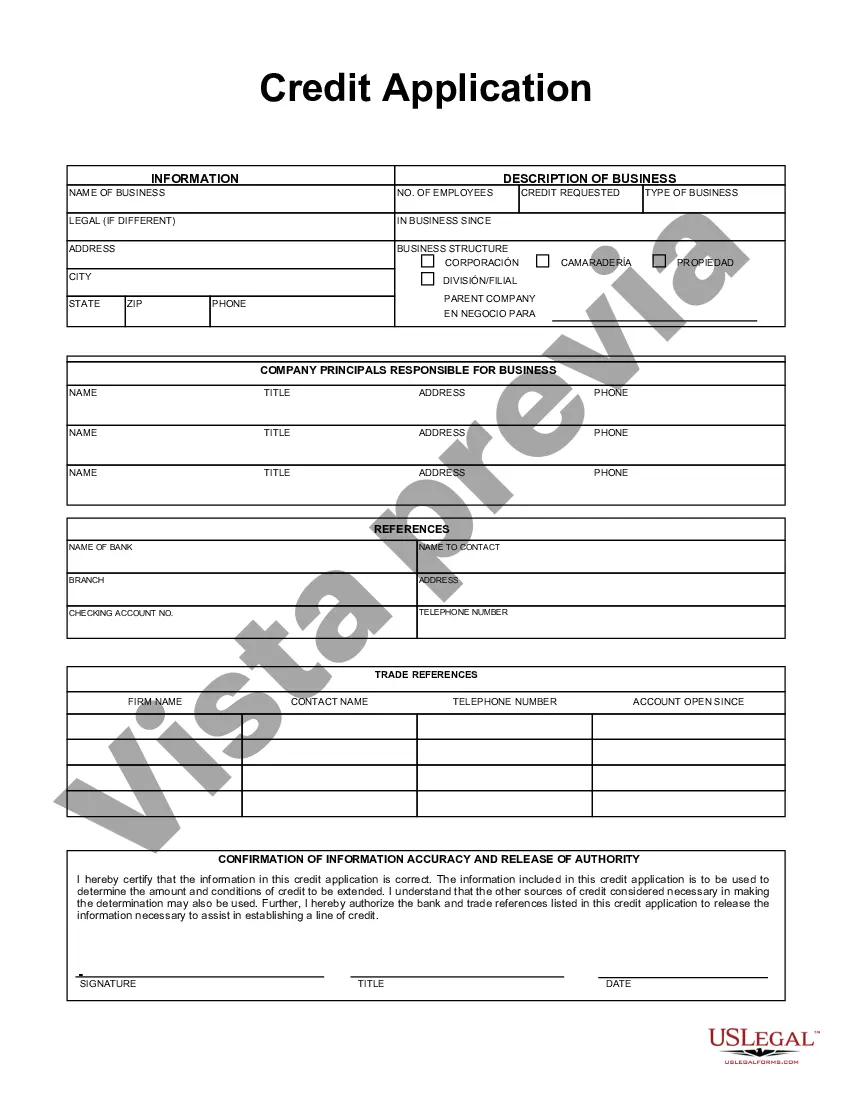

Kansas Credit Application is a standardized document used by individuals or businesses in Kansas to apply for credit from financial institutions, lenders, or credit card companies. This application serves as a formal request to obtain credit and typically requires the applicant to provide personal, financial, and employment information. The Kansas Credit Application is an essential tool for lenders to evaluate potential borrowers' creditworthiness and assess the risk associated with extending credit. It assists in determining the applicant's ability to repay the borrowed funds and helps establish terms and conditions for the credit agreement. Keywords: Kansas Credit Application, credit application, financial institution, lender, credit card companies, formal request, personal information, financial information, employment information, creditworthiness, risk assessment, ability to repay, credit agreement Types of Kansas Credit Applications: 1. Individual Credit Application: This type of credit application is used by individuals who are seeking credit for personal needs such as buying a car, financing a home, or obtaining a personal loan. 2. Business Credit Application: Businesses use this type of credit application to apply for credit in order to finance their operations, purchase inventory, or invest in expansion. 3. Credit Card Application: This application specifically focuses on individuals applying for a credit card, where they provide personal, financial, and employment information to be considered for a credit card account. Keywords: individual credit application, personal needs, car financing, home loan, personal loan, business credit application, business financing, inventory purchase, expansion, credit card application, credit card account.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Kansas Solicitud de crédito - Credit Application

Description

How to fill out Kansas Solicitud De Crédito?

If you wish to total, acquire, or printing legal record templates, use US Legal Forms, the most important variety of legal types, which can be found on-line. Utilize the site`s basic and handy look for to discover the files you will need. A variety of templates for company and individual reasons are sorted by categories and says, or key phrases. Use US Legal Forms to discover the Kansas Credit Application in just a few mouse clicks.

If you are previously a US Legal Forms customer, log in in your bank account and click on the Acquire switch to find the Kansas Credit Application. You may also access types you in the past acquired in the My Forms tab of your bank account.

Should you use US Legal Forms initially, refer to the instructions below:

- Step 1. Be sure you have selected the shape to the correct metropolis/nation.

- Step 2. Take advantage of the Review solution to look over the form`s articles. Don`t forget about to read through the description.

- Step 3. If you are unhappy with the kind, make use of the Look for field on top of the display screen to get other types of the legal kind design.

- Step 4. After you have found the shape you will need, click on the Acquire now switch. Opt for the costs plan you favor and include your references to sign up to have an bank account.

- Step 5. Method the purchase. You can use your charge card or PayPal bank account to perform the purchase.

- Step 6. Pick the formatting of the legal kind and acquire it on your system.

- Step 7. Comprehensive, modify and printing or indication the Kansas Credit Application.

Each legal record design you acquire is your own property forever. You may have acces to each and every kind you acquired with your acccount. Go through the My Forms section and pick a kind to printing or acquire yet again.

Contend and acquire, and printing the Kansas Credit Application with US Legal Forms. There are many skilled and status-distinct types you can utilize for your company or individual demands.