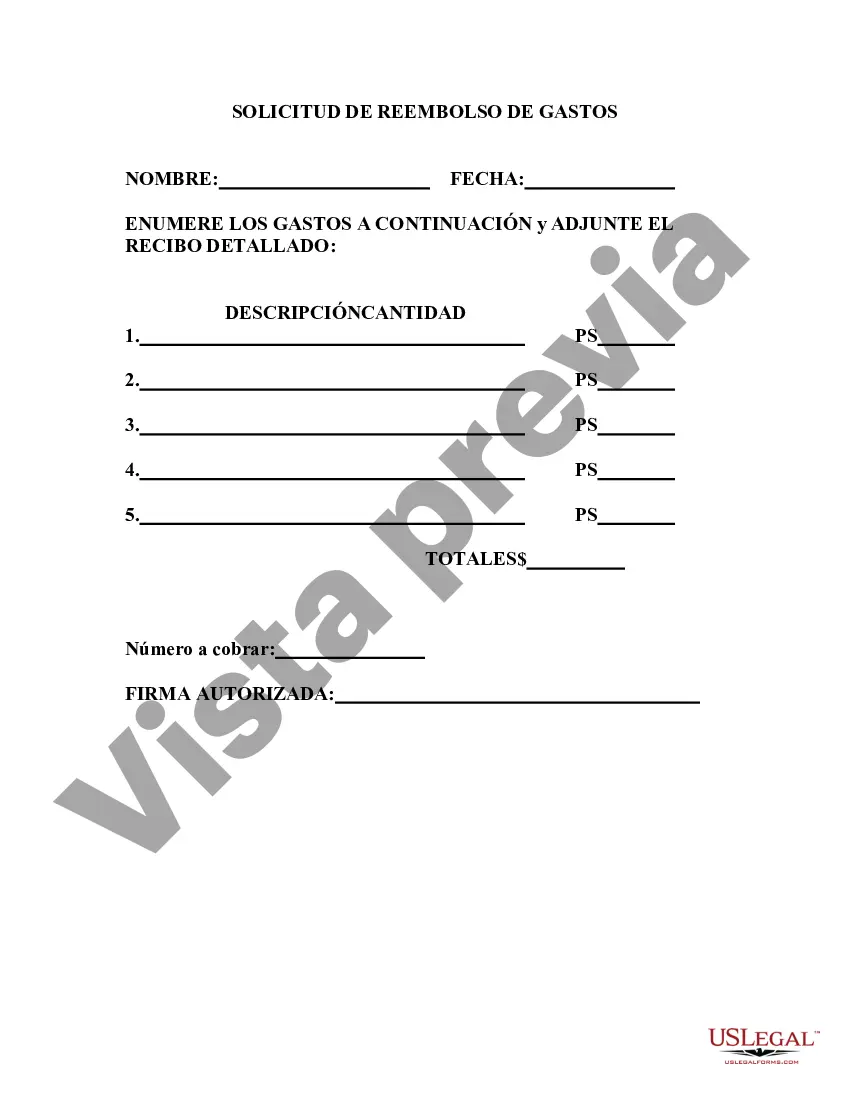

Kansas Expense Reimbursement Request is a formal procedure through which individuals or organizations in Kansas can seek reimbursement for eligible expenses incurred during official duties, business travel, or authorized activities. This process ensures that individuals are fairly compensated for their out-of-pocket expenses and promotes financial accountability in both the public and private sectors. The Kansas Expense Reimbursement Request typically involves submitting a detailed reimbursement form, along with supporting documentation such as receipts, invoices, or any other relevant proofs of expenditure. This documentation serves as evidence to validate the expenses being claimed, ensuring transparency and accuracy in the reimbursement process. The Kansas Expense Reimbursement Request form usually requires specific information, including the name of the claimant, their contact information, their organization or department, the purpose of the expenses, and the date(s) on which the expenses were incurred. Additionally, the form may include fields for itemizing individual expenses, such as transportation costs, meals, accommodation, conference fees, or other eligible expenses. It is essential to include detailed descriptions for each expenditure item and attach the corresponding receipts to substantiate the claim. The reimbursement request may also require approvals or signatures from a supervisor, manager, or authorized personnel, confirming the validity of the expenses and compliance with the organization's or institution's policies and regulations. Different types of Kansas Expense Reimbursement Requests may exist based on the specific nature of the expenses being claimed. Some common types include: 1. Travel Expense Reimbursement: This applies to expenses incurred during official business travel, such as airfare, car rentals, mileage, lodging, meals, and any other related costs. 2. Professional Development Expense Reimbursement: Individuals attending conferences, seminars, workshops, or training sessions to enhance their professional skills may submit a reimbursement request for expenses like registration fees, travel, accommodation, and meals. 3. Nonprofit or Government Program Expense Reimbursement: This type of reimbursement request is specific to organizations or individuals involved in nonprofit or government-sponsored programs. Eligible expenses may vary depending on the program but can include costs related to project implementation, event coordination, supplies, and other allowable expenditures. 4. Miscellaneous Expense Reimbursement: This category encompasses all other valid expenses that do not fall under the previously mentioned types. It may include costs such as office supplies, technology purchases, minor repairs, or any necessary miscellaneous expenses incurred while performing official duties. Submitting a Kansas Expense Reimbursement Request on time, with accurate information, and appropriate documentation is crucial to ensure efficient processing and timely reimbursement. Claimants should familiarize themselves with any policies, guidelines, or specific procedures set forth by their organization or institution to minimize delays or potential issues during the reimbursement process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Kansas Solicitud de Reembolso de Gastos - Expense Reimbursement Request

Description

How to fill out Kansas Solicitud De Reembolso De Gastos?

US Legal Forms - one of the most significant libraries of legitimate varieties in the States - provides a variety of legitimate record templates it is possible to obtain or produce. Making use of the website, you can find a huge number of varieties for enterprise and person reasons, sorted by classes, states, or keywords.You can get the most recent models of varieties such as the Kansas Expense Reimbursement Request within minutes.

If you have a monthly subscription, log in and obtain Kansas Expense Reimbursement Request from your US Legal Forms library. The Obtain button will appear on every develop you view. You have access to all in the past downloaded varieties in the My Forms tab of your account.

If you wish to use US Legal Forms for the first time, here are straightforward instructions to help you started:

- Ensure you have picked out the best develop for your city/state. Click on the Preview button to analyze the form`s content material. Read the develop outline to ensure that you have chosen the correct develop.

- In case the develop does not fit your requirements, use the Research area near the top of the screen to obtain the one that does.

- If you are content with the form, confirm your option by visiting the Buy now button. Then, opt for the costs plan you favor and provide your credentials to register on an account.

- Procedure the financial transaction. Use your Visa or Mastercard or PayPal account to complete the financial transaction.

- Choose the file format and obtain the form on your system.

- Make changes. Load, modify and produce and signal the downloaded Kansas Expense Reimbursement Request.

Every template you included in your bank account does not have an expiration particular date and it is the one you have eternally. So, in order to obtain or produce yet another copy, just visit the My Forms section and click about the develop you want.

Get access to the Kansas Expense Reimbursement Request with US Legal Forms, by far the most considerable library of legitimate record templates. Use a huge number of skilled and condition-certain templates that fulfill your business or person requires and requirements.