Kansas Guardianship Expenditures refer to the specific expenses incurred in the process of establishing and maintaining guardianship over an individual who is deemed incapable of managing their personal and financial affairs. Guardianship is typically granted by a court and involves a legally appointed guardian who assumes responsibility for the well-being and decision-making of the protected person, known as the ward. There are different types of Kansas Guardianship Expenditures that may arise during the guardianship process, including: 1. Legal Fees: Legal expenses are typically incurred during the initial guardianship petition and subsequent court hearings. These fees include attorney fees for preparing and filing the necessary documents, representing the guardian's interests, and attending court proceedings. 2. Filing Fees: Guardianship proceedings require the filing of various documents with the court. Filing fees cover the administrative costs associated with submitting these documents for review and approval. 3. Court Costs: These expenses encompass various charges related to court processes, such as scheduling hearings, summoning witnesses, serving legal notices, and obtaining certified copies of court orders and documents. 4. Evaluation Expenses: Evaluations may be required to determine the ward's capacity or assess the suitability of a potential guardian. The costs may include fees for medical professionals, psychologists, social workers, or other experts who conduct evaluations and provide reports to the court. 5. Guardian's Compensation: If the guardian is a professional, such as an attorney or a registered guardian, they may be entitled to reasonable compensation for their services. This compensation is typically approved by the court and may involve hourly rates or percentage fees based on the ward's assets. 6. Guardian's Expenses: Guardians may incur expenses in fulfilling their responsibilities, such as travel costs for visiting the ward, monitoring their welfare, or attending court hearings on behalf of the ward. These expenditures may include transportation expenses, accommodation, meals, and other reasonable costs incurred while providing care and support. 7. Accounting Fees: Guardians are often required to maintain detailed financial records, prepare periodic reports, and submit accounting to the court. The fees associated with hiring a professional accountant or bookkeeper to assist with these tasks may be considered as guardianship expenditures. 8. Miscellaneous Expenses: Additional expenses that may arise in a guardianship situation include costs associated with securing the ward's assets, ensuring their living arrangements are suitable, managing their medical needs, or addressing any other specific requirements related to their well-being. It's important to note that the specific types and amount of Kansas Guardianship Expenditures can vary depending on the circumstances of each individual case and the complexity of the guardianship arrangement. These expenses are subject to court approval and should be documented and reported appropriately to ensure transparency and accountability in the guardianship process.

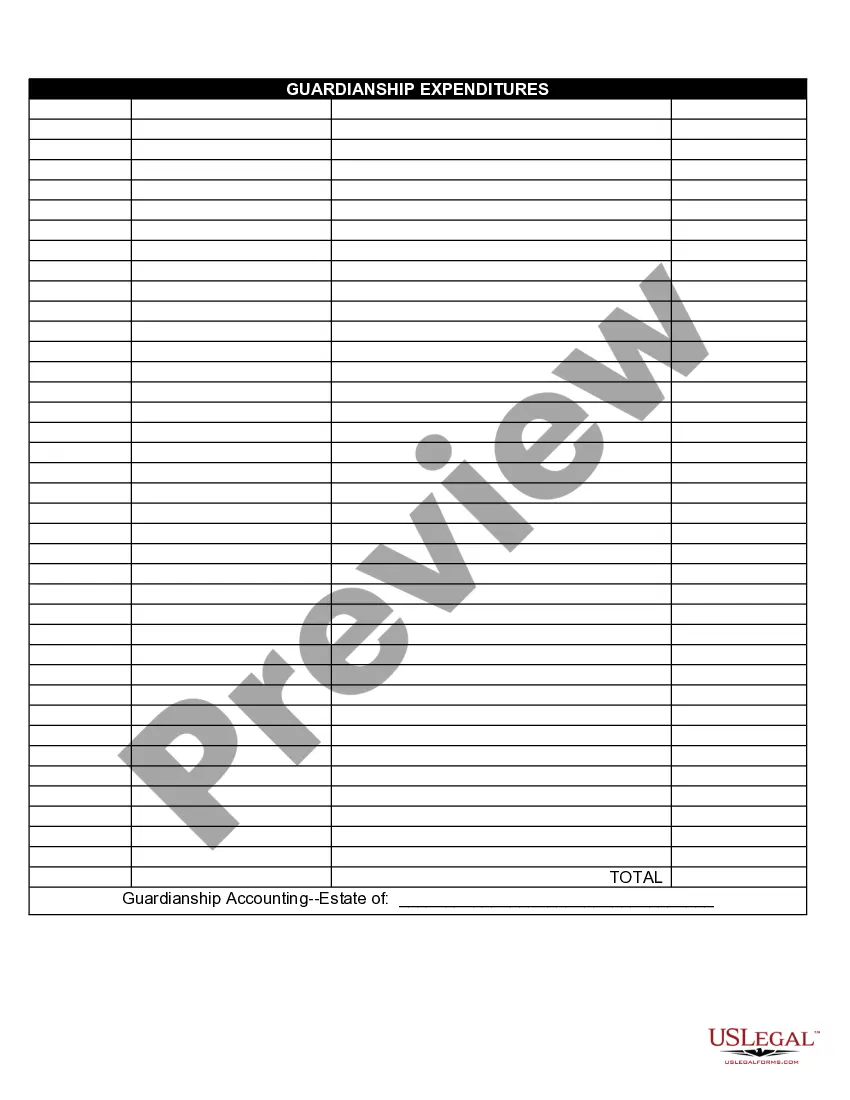

Kansas Guardianship Expenditures

Description

How to fill out Kansas Guardianship Expenditures?

You can devote hrs on the Internet attempting to find the legal record format that fits the federal and state specifications you will need. US Legal Forms offers 1000s of legal types that happen to be analyzed by specialists. It is simple to acquire or produce the Kansas Guardianship Expenditures from my services.

If you already possess a US Legal Forms profile, you may log in and click the Download switch. Next, you may comprehensive, edit, produce, or sign the Kansas Guardianship Expenditures. Every single legal record format you get is yours for a long time. To get another duplicate for any acquired develop, go to the My Forms tab and click the related switch.

If you are using the US Legal Forms web site initially, follow the basic recommendations under:

- Very first, ensure that you have chosen the best record format to the state/town of your choosing. Look at the develop outline to make sure you have picked the right develop. If accessible, use the Review switch to look from the record format also.

- In order to locate another edition from the develop, use the Look for industry to obtain the format that meets your requirements and specifications.

- Once you have found the format you would like, click Get now to carry on.

- Find the prices program you would like, type in your qualifications, and sign up for a free account on US Legal Forms.

- Complete the financial transaction. You can utilize your credit card or PayPal profile to fund the legal develop.

- Find the structure from the record and acquire it for your product.

- Make modifications for your record if required. You can comprehensive, edit and sign and produce Kansas Guardianship Expenditures.

Download and produce 1000s of record themes utilizing the US Legal Forms web site, which offers the largest collection of legal types. Use expert and state-certain themes to take on your company or personal requirements.