Kansas Stock Option Plan which provides for grant of Incentive Stock Options and Nonqualified Stock Options to executive officers

Description

How to fill out Stock Option Plan Which Provides For Grant Of Incentive Stock Options And Nonqualified Stock Options To Executive Officers?

Are you currently in the position that you need to have documents for sometimes company or individual purposes virtually every day? There are a lot of legal document web templates available online, but discovering types you can rely isn`t simple. US Legal Forms offers a large number of kind web templates, such as the Kansas Stock Option Plan which provides for grant of Incentive Stock Options and Nonqualified Stock Options to executive officers, that happen to be published to satisfy state and federal demands.

Should you be already acquainted with US Legal Forms internet site and possess a free account, simply log in. After that, you can obtain the Kansas Stock Option Plan which provides for grant of Incentive Stock Options and Nonqualified Stock Options to executive officers design.

Should you not have an profile and want to begin using US Legal Forms, adopt these measures:

- Get the kind you need and ensure it is to the correct metropolis/county.

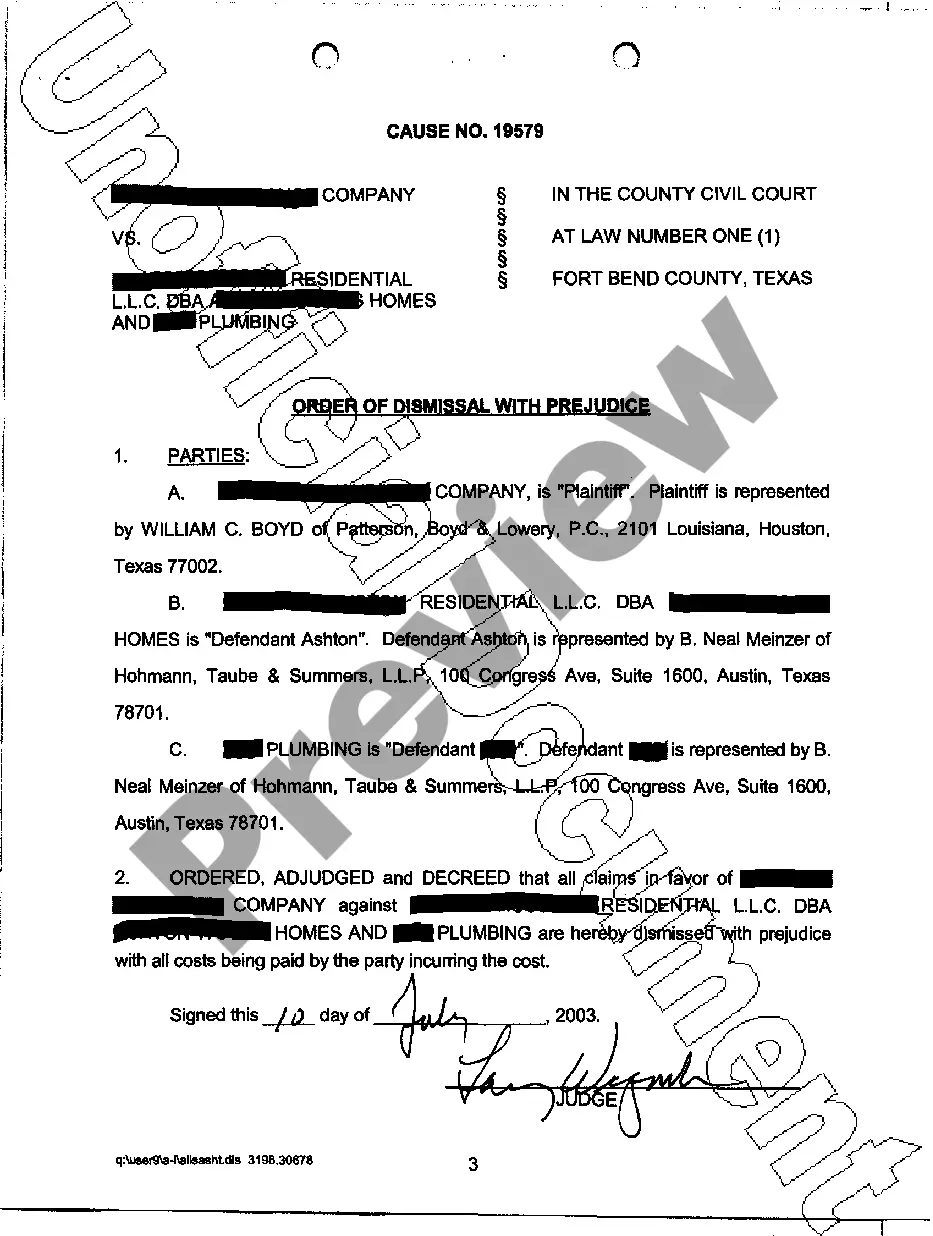

- Use the Preview key to check the shape.

- See the outline to actually have chosen the correct kind.

- In case the kind isn`t what you are seeking, use the Lookup field to find the kind that fits your needs and demands.

- Whenever you obtain the correct kind, just click Buy now.

- Choose the pricing prepare you would like, submit the desired information and facts to make your bank account, and pay for an order using your PayPal or charge card.

- Select a handy file structure and obtain your backup.

Get all the document web templates you have bought in the My Forms menus. You can get a more backup of Kansas Stock Option Plan which provides for grant of Incentive Stock Options and Nonqualified Stock Options to executive officers at any time, if required. Just click the needed kind to obtain or produce the document design.

Use US Legal Forms, the most extensive collection of legal types, in order to save efforts and avoid errors. The assistance offers expertly made legal document web templates which can be used for a range of purposes. Generate a free account on US Legal Forms and commence making your lifestyle a little easier.

Form popularity

FAQ

A stock grant provides the recipient with value?the corporate stock. By contrast, stock options only offer employees the opportunity to purchase something of value. They can acquire the corporate stock at a set price, but the employees receiving stock options still have to pay for those stocks if they want them.

Stock option grants are how your company awards stock options. This document usually includes details about: The type of stock options you'll receive (ISOs or NSOs) The number of shares you can purchase.

When you're granted stock options, you have the option to purchase company stock at a specific price before a certain date. Whether you actually purchase the stock is entirely up to you. RSUs, on the other hand, grant you the stock itself once the vesting period is complete. You don't have to purchase it.

What Is a Non-Qualified Stock Option (NSO)? A non-qualified stock option (NSO) is a type of employee stock option wherein you pay ordinary income tax on the difference between the grant price and the price at which you exercise the option.

With this type of incentive, participants are granted a right or option to purchase stock from the company at a specific price?usually the fair market value of the stock when the option is granted. The option to purchase shares continues over an extended period that is measured in years.

Restricted stock awards represent actual ownership of stock and come with conditions on the timing of their sale. An employee benefits from stock options when they buy the stock at the exercise price and then sell it at a higher price.

qualified stock option (NSO) is a type of ESO that is taxed as ordinary income when exercised. In addition, some of the value of NSOs may be subject to earned income withholding tax as soon as they are exercised. 5 With ISOs, on the other hand, no reporting is necessary until the profit is realized.

Those who receive stock grants can't sell their shares until a certain period of time, known as the vesting period. Shares that are received by using stock options can be resold at any time.