Kansas Senior Debt Term Sheet

Description

How to fill out Senior Debt Term Sheet?

Are you currently within a position where you need to have paperwork for both company or specific uses virtually every time? There are tons of lawful papers templates available on the Internet, but getting ones you can rely isn`t simple. US Legal Forms provides thousands of kind templates, much like the Kansas Senior Debt Term Sheet, that happen to be composed in order to meet state and federal needs.

In case you are currently knowledgeable about US Legal Forms web site and also have an account, basically log in. Afterward, you can download the Kansas Senior Debt Term Sheet format.

Should you not provide an account and wish to start using US Legal Forms, abide by these steps:

- Obtain the kind you require and make sure it is for the right town/state.

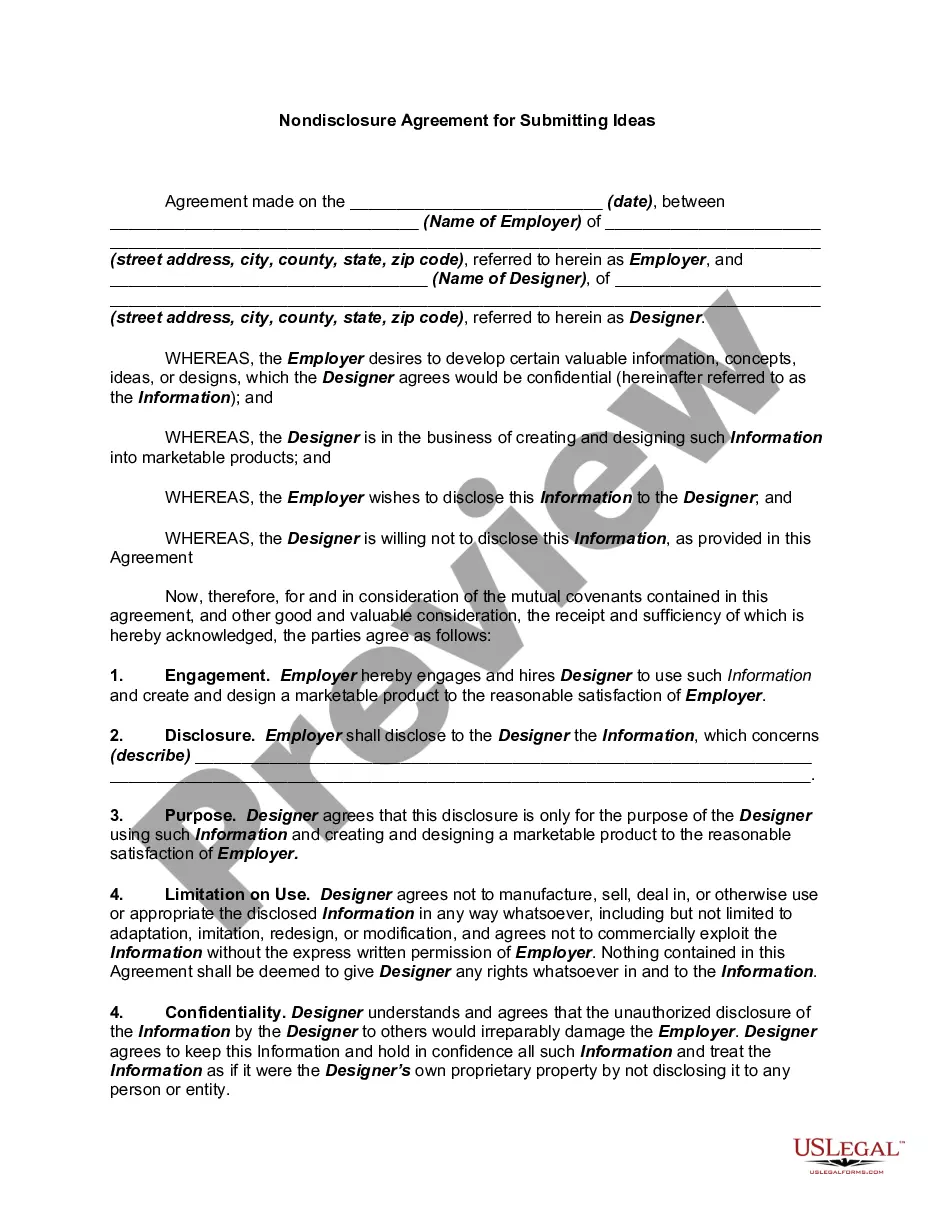

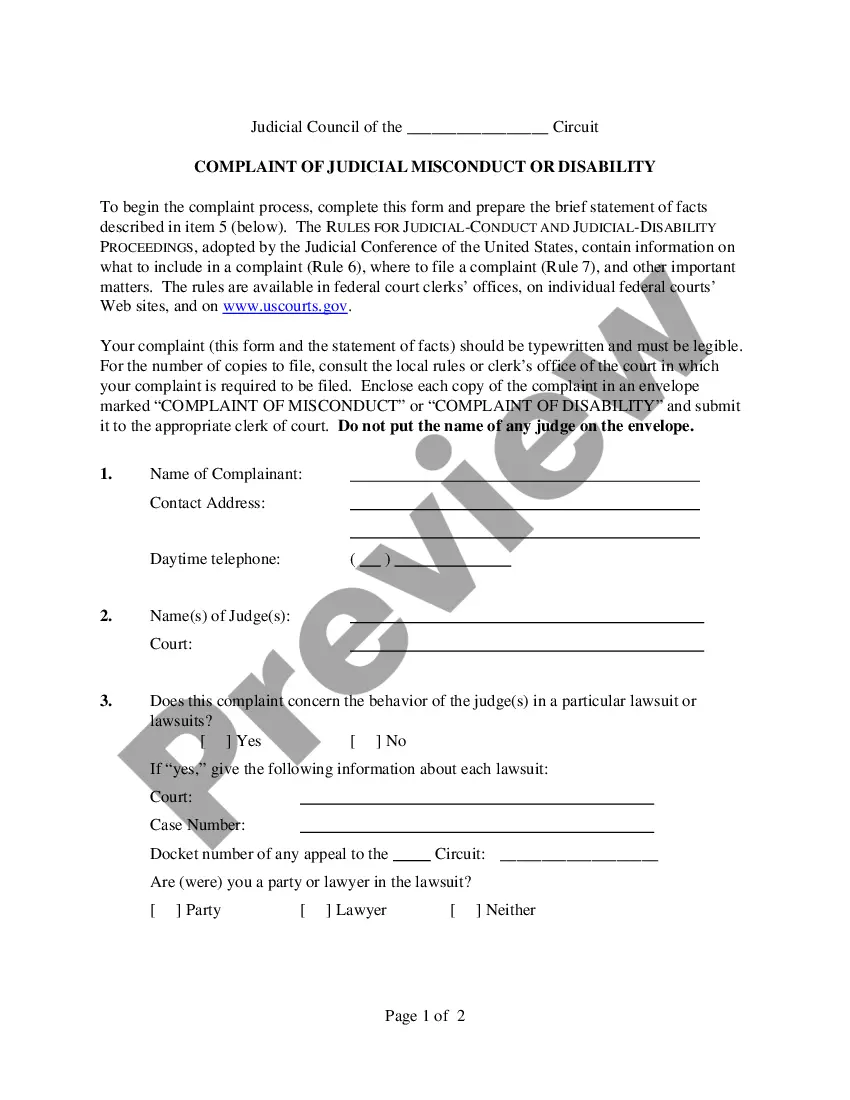

- Make use of the Preview button to check the shape.

- See the explanation to ensure that you have selected the correct kind.

- If the kind isn`t what you are looking for, take advantage of the Search area to obtain the kind that fits your needs and needs.

- When you get the right kind, click Purchase now.

- Opt for the rates program you would like, fill out the required information and facts to create your account, and buy the transaction utilizing your PayPal or Visa or Mastercard.

- Select a practical file formatting and download your copy.

Discover each of the papers templates you may have bought in the My Forms menus. You can obtain a extra copy of Kansas Senior Debt Term Sheet anytime, if required. Just click the needed kind to download or print the papers format.

Use US Legal Forms, by far the most considerable variety of lawful kinds, to conserve time as well as steer clear of blunders. The service provides professionally created lawful papers templates that you can use for a range of uses. Generate an account on US Legal Forms and commence creating your way of life easier.

Form popularity

FAQ

A term sheet is designed to help the parties to the loan to set out clearly and in advance, the terms on which the loan will be made. It serves as a non-binding letter of intent which summarises all the important financial and legal terms as well as quantifying the amount of the loan and its repayment.

Any debt with higher priority over other forms of debt is considered senior debt. For example, a company has debt A that totals $1 million and debt B that totals $500,000. Debt A is senior debt, and debt B is subordinated debt. If the company files for bankruptcy, it must liquidate all of its assets to repay the debt.

On the other hand, senior debt financing is a high-priority loan backed by collateral and offered at a lower interest rate. How is senior debt calculated? Senior loan or debt is 2 to 3 times EBITDA (Earnings before Interest, Taxes, Depreciation, and Amortization).

Senior debts are loans secured by collateral (assets) that must be paid off before any other debts when a company goes into default. The lender in this case is paid out of the sale of the company's assets in priority sequence. Their priority position makes senior debts less risky for lenders.

Senior Debt Ratio means, with respect to any Loan, the ratio of Senior Total Funded Debt to TTM EBITDA of the related Obligor, calculated in ance with the corresponding amount or ratio in the underlying Related Documents for such Loan utilizing the most recently delivered financial results for the related Obligor ...

Senior debt is debt and obligations which are prioritized for repayment in the case of bankruptcy. Senior debt has the highest priority and therefore the lowest risk. Thus, this type of debt typically carries or offers lower interest rates.