Kansas Investment - Grade Bond Optional Redemption (with a Par Call)

Description

How to fill out Investment - Grade Bond Optional Redemption (with A Par Call)?

US Legal Forms - among the largest libraries of lawful forms in the States - offers a wide array of lawful document themes it is possible to obtain or printing. Making use of the website, you can find a large number of forms for enterprise and specific functions, sorted by classes, suggests, or keywords.You can get the most recent models of forms just like the Kansas Investment - Grade Bond Optional Redemption (with a Par Call) within minutes.

If you have a registration, log in and obtain Kansas Investment - Grade Bond Optional Redemption (with a Par Call) through the US Legal Forms collection. The Download key can look on each and every kind you perspective. You have access to all previously acquired forms from the My Forms tab of your own bank account.

If you would like use US Legal Forms the very first time, listed below are simple guidelines to help you get started:

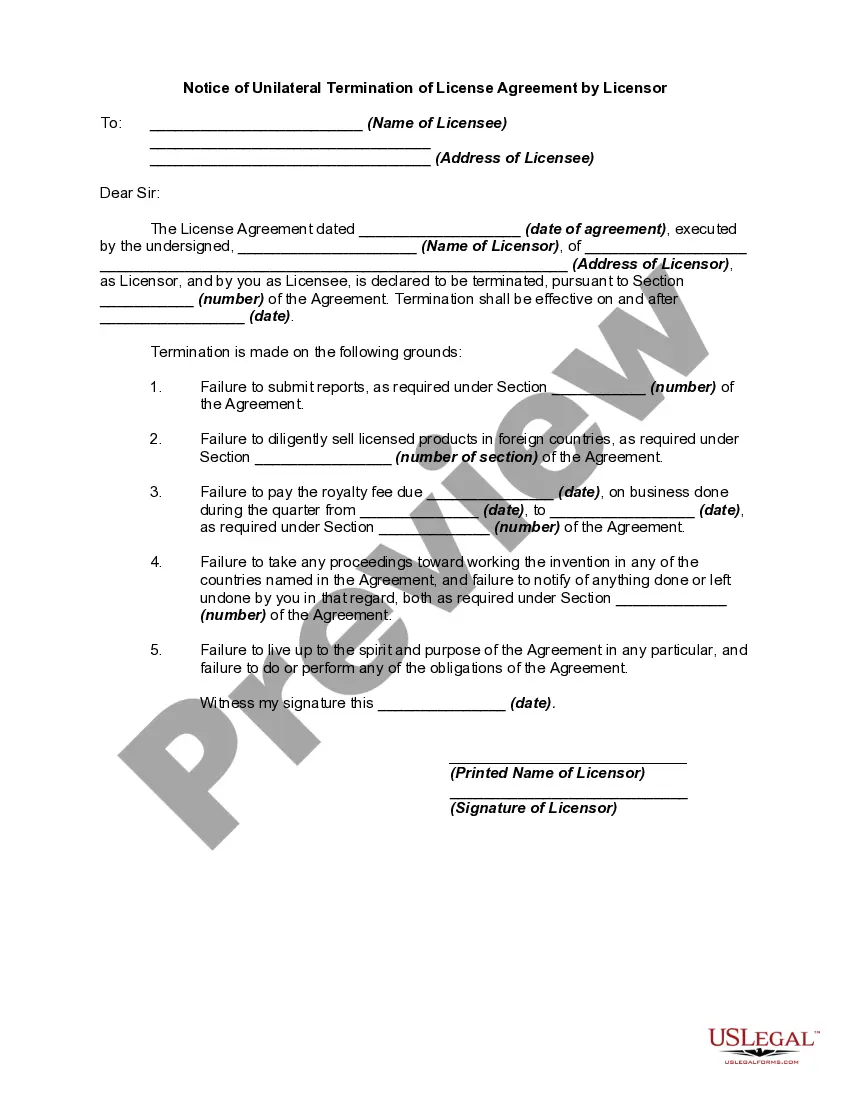

- Ensure you have chosen the proper kind for your metropolis/area. Select the Review key to check the form`s information. Browse the kind information to ensure that you have chosen the proper kind.

- In the event the kind doesn`t fit your specifications, make use of the Lookup area at the top of the display screen to discover the one which does.

- Should you be pleased with the shape, affirm your choice by clicking on the Purchase now key. Then, choose the pricing plan you favor and give your accreditations to sign up to have an bank account.

- Process the deal. Utilize your charge card or PayPal bank account to complete the deal.

- Select the formatting and obtain the shape on your system.

- Make alterations. Fill out, change and printing and indicator the acquired Kansas Investment - Grade Bond Optional Redemption (with a Par Call).

Every design you added to your bank account lacks an expiry time and is also your own permanently. So, if you would like obtain or printing another backup, just go to the My Forms section and click on on the kind you need.

Gain access to the Kansas Investment - Grade Bond Optional Redemption (with a Par Call) with US Legal Forms, by far the most considerable collection of lawful document themes. Use a large number of specialist and express-certain themes that satisfy your company or specific needs and specifications.

Form popularity

FAQ

Callable or redeemable bonds are bonds that can be redeemed or paid off by the issuer prior to the bonds' maturity date. When an issuer calls its bonds, it pays investors the call price (usually the face value of the bonds) together with accrued interest to date and, at that point, stops making interest payments.

Bond redemption is the process by which a bond issuer repays the principal amount of a bond to the bondholder on the bond's maturity date. When a bond is issued, it has a specified term or maturity date, which is the date when the bond issuer is obligated to pay back the principal amount of the bond to the bondholder.

Optional Redemption On or after the Par Call Date, the Company may redeem the notes, in whole or in part, at any time and from time to time, at a redemption price equal to 100% of the principal amount of the notes being redeemed plus accrued and unpaid interest thereon to the redemption date.

What is a make-whole call at par? A Make-Whole Call at par refers to a scenario in which an issuer decides to exercise a Make-Whole Call provision to redeem a bond early, and the redemption price is equal to the bond's par value.

Summary of a Make-Whole Call: The call price will never be below par. Although the make-whole spread is fixed, Treasury prices constantly change, thereby the call price is a moving target. The call price will never be below par.

However, a traditional call can only be exercised after a previously determined date, whereas a make-whole call provision can be exercised anytime during the bond's horizon.

Callable or redeemable bonds are bonds that can be redeemed or paid off by the issuer prior to the bonds' maturity date. When an issuer calls its bonds, it pays investors the call price (usually the face value of the bonds) together with accrued interest to date and, at that point, stops making interest payments.

Optional redemption callable bonds give issuers the option to redeem the bonds early, but often times this option only becomes available after a certain date. For example, many municipal bonds are only optionally callable 10 years after the bond was issued.

The Securities Industry and Financial Markets Association (SIFMA) is a not-for-profit trade association that represents securities brokerage firms, investment banking institutions, and other investment firms.

A bond redemption is the full repayment of the principal amount (the amount you invested) and any interest owed to date. The deadline for confirming if you would like to redeem a bond is six months before the redemption date.