The Kansas Tax Increase Clause refers to a provision in the state's legislation that regulates the modification or imposition of taxes. It establishes a framework for increasing taxes while ensuring transparency and accountability. This clause includes various types of tax increase mechanisms and guidelines, enabling the government to collect additional revenue efficiently. The different types of Kansas Tax Increase Clause are as follows: 1. Graduated Income Tax Increase: This type of tax increase clause allows for a progressive increase in income tax rates based on different income brackets. It ensures that individuals with higher incomes contribute a larger proportion of their earnings towards taxes. Kansas employs this type of clause to implement fair taxation and bridge the income gap. 2. Sales Tax Increase: This clause permits the state government to raise sales tax rates to generate additional revenue. Sales tax is levied on the purchase of goods and services, and the increase may be temporary or permanent, depending on the economic needs of the state. The revenue generated from the increase can be allocated to infrastructure development, education, healthcare, and other public services. 3. Property Tax Increase: This clause enables the government to raise property tax rates to fund public projects, such as building schools, improving transportation systems, or upgrading public facilities. Property taxes are typically based on the assessed value of real estate properties, and an increase in rates can impact homeowners, businesses, and other property owners in the state. 4. Corporate Tax Increase: The Kansas Tax Increase Clause also encompasses provisions regarding corporate tax rates. By modifying corporate tax rates, the state government can stimulate economic growth, fund public initiatives, and ensure corporations contribute their fair share to the economy. This tax increase may be implemented to adjust tax rates for specific industries or to address budget shortfalls. 5. Excise Tax Increase: Excise taxes are levied on specific goods or services, such as gasoline, alcohol, tobacco, or luxury items. Kansas Tax Increase Clause covers provisions for increasing excise taxes to generate additional revenue and regulate consumption habits. Such increases aim to discourage the use of certain products or address health and environmental concerns. To ensure the effectiveness and validity of any tax increase under these clauses, the state legislature typically has strict procedures and requirements in place. These may include public hearings, legislative approval, and adherence to constitutional limitations. The Kansas Tax Increase Clause reflects the state's commitment to maintaining fiscal responsibility while providing necessary resources to support essential services and programs.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Kansas Cláusula de aumento de impuestos - Tax Increase Clause

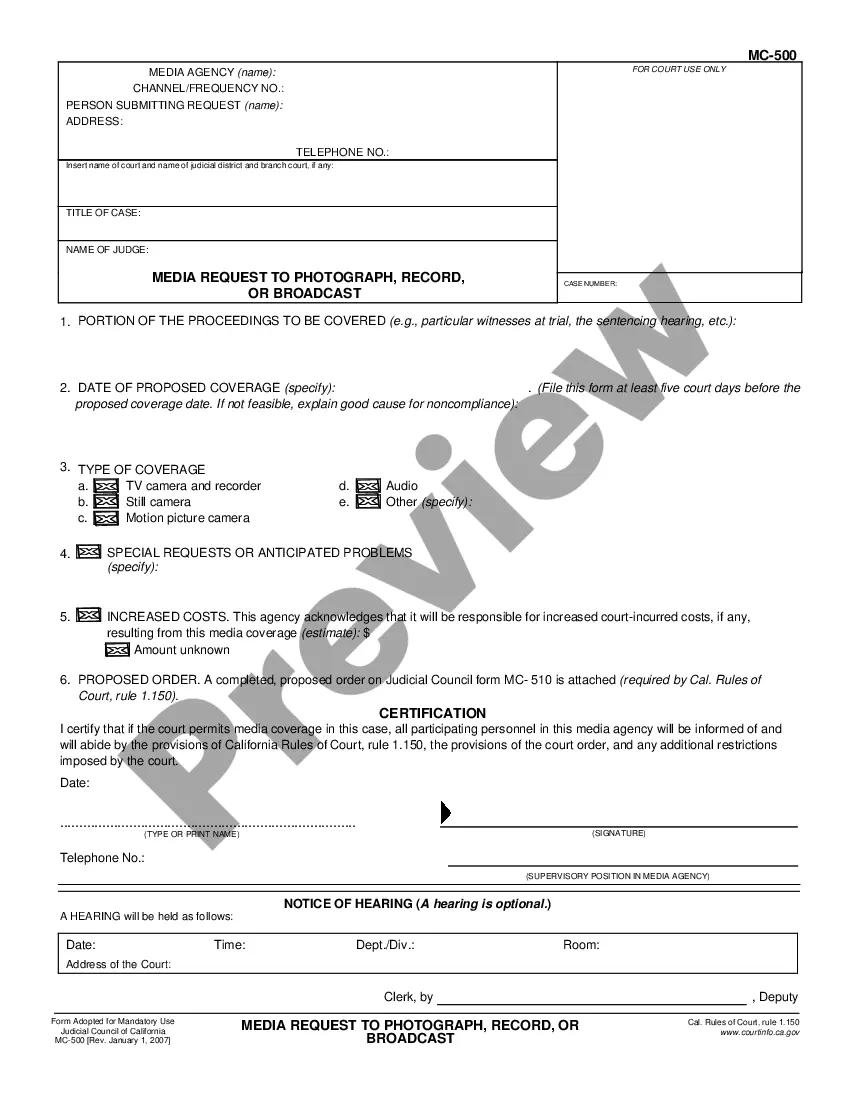

Description

How to fill out Kansas Cláusula De Aumento De Impuestos?

Are you presently in a placement the place you need to have documents for both business or person purposes just about every day time? There are a lot of lawful papers web templates accessible on the Internet, but finding types you can trust isn`t effortless. US Legal Forms provides a large number of develop web templates, much like the Kansas Tax Increase Clause, that happen to be written in order to meet state and federal specifications.

If you are previously acquainted with US Legal Forms web site and have an account, merely log in. Following that, it is possible to download the Kansas Tax Increase Clause design.

Unless you come with an accounts and would like to begin to use US Legal Forms, follow these steps:

- Get the develop you want and make sure it is for your appropriate metropolis/state.

- Take advantage of the Review option to examine the shape.

- Read the explanation to ensure that you have selected the right develop.

- In the event the develop isn`t what you`re trying to find, use the Search industry to find the develop that fits your needs and specifications.

- Once you discover the appropriate develop, simply click Buy now.

- Pick the pricing strategy you would like, complete the specified details to produce your money, and purchase the transaction utilizing your PayPal or bank card.

- Pick a convenient document formatting and download your version.

Discover each of the papers web templates you possess bought in the My Forms food list. You may get a more version of Kansas Tax Increase Clause whenever, if required. Just go through the needed develop to download or printing the papers design.

Use US Legal Forms, probably the most extensive variety of lawful varieties, to save lots of time as well as steer clear of faults. The support provides professionally produced lawful papers web templates which you can use for an array of purposes. Produce an account on US Legal Forms and commence generating your way of life a little easier.