A Kansas Subscription Agreement for an Equity Fund refers to a legally binding document between an investor and an equity fund based in the state of Kansas. This agreement outlines the terms and conditions that govern the investment in the fund, establishing a contractual relationship between the investor and the fund manager. The main purpose of the Kansas Subscription Agreement for an Equity Fund is to provide clear guidelines and protect the interests of both parties involved. It serves as a tool to ensure transparency and accountability in investment transactions. This agreement covers various aspects related to the investment, including but not limited to the subscription process, contribution amounts, payment terms, and potential risks involved. The Kansas Subscription Agreement for an Equity Fund typically includes several key sections: 1. Parties: This section identifies the investor (subscriber) and the equity fund (issuer) entering into the agreement. It includes their legal names, addresses, and contact information. 2. Subscription Process: This section outlines the procedures for subscribing to the equity fund. It includes details about completing the subscription documents, payment instructions, and any specific requirements for eligibility. 3. Subscription Amount: This portion specifies the amount of money the investor is willing to contribute to the equity fund. It may also mention any minimum or maximum investment limits that apply. 4. Payment Terms: This section defines the payment schedule, including due dates or installment plans if applicable. It may also cover acceptable payment methods, such as wire transfers or checks, and any associated fees. 5. Representations and Warranties: This part includes statements made by the investor, declaring their legal capacity to invest, verifying their understanding of the risks involved, and ensuring the accuracy of the provided information. 6. Rights and Obligations: This section elaborates on the rights and obligations of both parties. It may cover topics such as voting rights, access to information, restrictions on transferability, and confidentiality clauses. 7. Termination: This part describes the circumstances under which the agreement may be terminated, such as breaches of contract, bankruptcy, or agreement expiration. Different types of Kansas Subscription Agreements for an Equity Fund may exist based on various factors, such as the fund's investment strategy, target sector, or structure. Examples may include: 1. Kansas Subscription Agreement for a Technology Equity Fund: Specifically designed for investors interested in technology-related investments. 2. Kansas Subscription Agreement for a Real Estate Equity Fund: Tailored for investors looking to invest in real estate assets within Kansas. 3. Kansas Subscription Agreement for a Renewable Energy Equity Fund: Aimed at investors focused on funding clean energy projects or renewable energy companies. 4. Kansas Subscription Agreement for a Venture Capital Equity Fund: Geared towards investors seeking high-growth investments in early-stage or startup companies. In summary, a Kansas Subscription Agreement for an Equity Fund is a crucial legal document that establishes the terms and conditions of an investment in an equity fund based in Kansas. It outlines the responsibilities, rights, and obligations of both the investor and the fund.

Kansas Subscription Agreement for an Equity Fund

Description

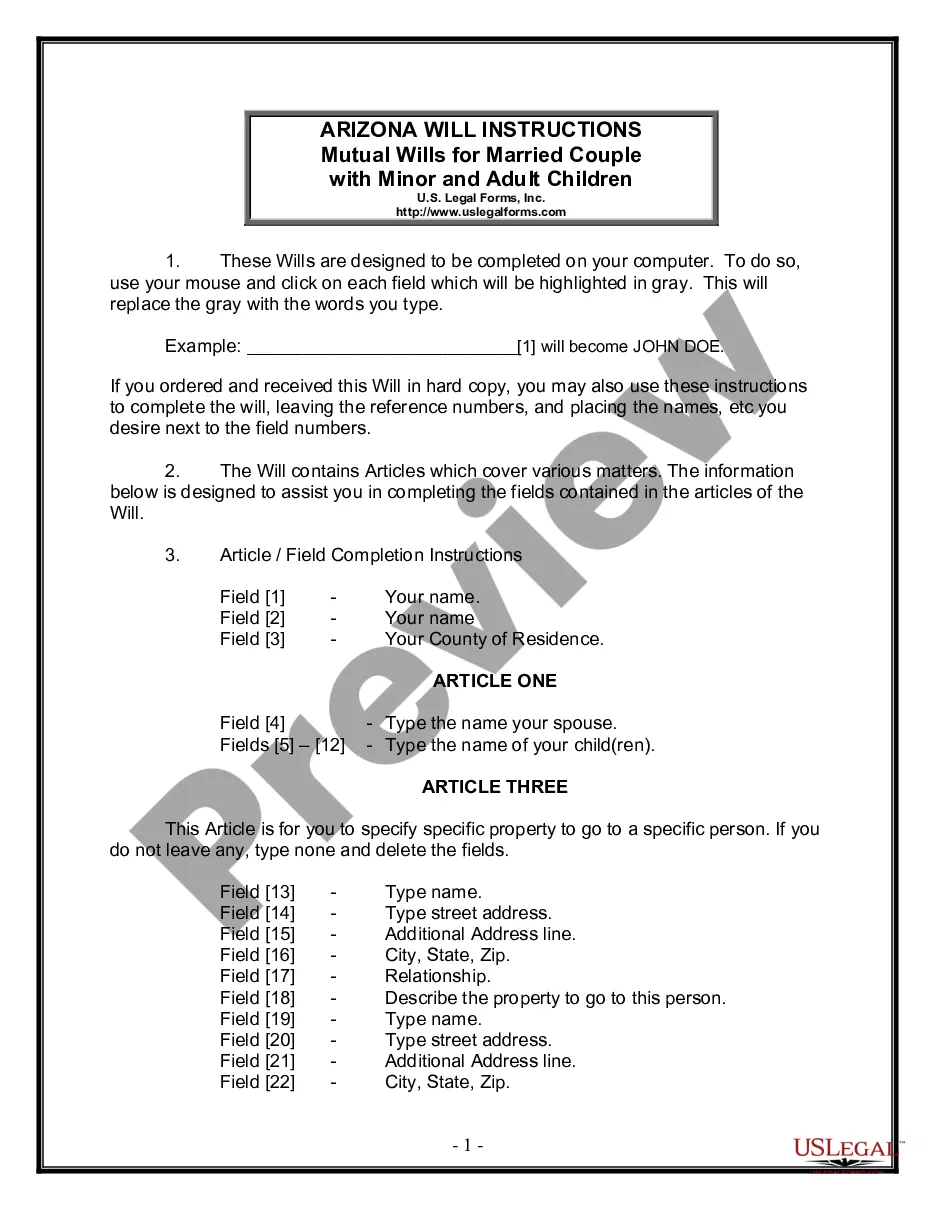

How to fill out Subscription Agreement For An Equity Fund?

If you wish to comprehensive, down load, or produce lawful file templates, use US Legal Forms, the biggest selection of lawful forms, which can be found on the Internet. Utilize the site`s basic and convenient lookup to discover the documents you require. Various templates for enterprise and personal purposes are categorized by groups and claims, or keywords and phrases. Use US Legal Forms to discover the Kansas Subscription Agreement for an Equity Fund in just a number of click throughs.

If you are presently a US Legal Forms buyer, log in for your bank account and click the Obtain option to get the Kansas Subscription Agreement for an Equity Fund. You can also accessibility forms you earlier acquired within the My Forms tab of your bank account.

If you use US Legal Forms for the first time, follow the instructions below:

- Step 1. Be sure you have chosen the shape to the appropriate metropolis/country.

- Step 2. Utilize the Review solution to look over the form`s articles. Never neglect to see the information.

- Step 3. If you are not happy with all the kind, utilize the Look for industry on top of the display screen to discover other versions of the lawful kind format.

- Step 4. Once you have discovered the shape you require, go through the Get now option. Pick the costs strategy you like and put your references to sign up for the bank account.

- Step 5. Process the financial transaction. You can use your Мisa or Ьastercard or PayPal bank account to accomplish the financial transaction.

- Step 6. Find the file format of the lawful kind and down load it in your device.

- Step 7. Total, modify and produce or signal the Kansas Subscription Agreement for an Equity Fund.

Every lawful file format you get is the one you have for a long time. You might have acces to every kind you acquired within your acccount. Click on the My Forms area and pick a kind to produce or down load again.

Be competitive and down load, and produce the Kansas Subscription Agreement for an Equity Fund with US Legal Forms. There are thousands of specialist and express-specific forms you can utilize for your enterprise or personal needs.

Form popularity

FAQ

Summary. A subscription agreement is a formal agreement between a company and an investor to buy shares of a company at an agreed-upon price. It contains all the details of such an agreement, including Outstanding Shares, Shares Ownership, and Payouts.

It is a legally binding letter needed while issuing shares and normally takes a few minutes to do all the formalities.

What is the purpose of a Subscription Agreement? Essentially, the Subscription Agreement ensures the suitability of the investor to invest and acts as a legally binding agreement between the investor and the sponsor.

Specifically, the ?Subscription Agreement for Future Equity ? Discount only? enables investors to pay in advance the subscription price for company shares/quotas (typically pre-seed and seed funding) with such shares/quotas to be issued by the company receiving the investment at a later date, so that valuation of the ...

When do you need a subscription agreement? Although a subscription agreement isn't mandatory, it is a useful document as it will clearly record the terms on which a person (the subscriber) agrees to purchase shares from the company. It can also be an important document to keep for tax purposes.

Business Model Flexibility Contracts have traditionally been the backbone of B2B relationships, providing a rigid structure for the delivery of goods and services. In contrast, subscriptions offer a more flexible and customer-centric approach, enabling businesses to tailor their offerings to better meet client needs.

While there is no legal requirement to have one, there are many important advantages to consider. A Subscription Agreement ensures that your users are fully informed about what they should (and should not) do when using your service.

Subscription agreement vs shareholders agreement? A share subscription agreement is essentially an agreement for the purchase of shares from a company. In contrast, a shareholders agreement contains terms that govern the ongoing relationship between shareholders.