This is a "Right of First Refusal and Co-Sale Agreement." It is entered into by the corporation and the purchasers of preferred stock. It gives the company and the purchasers of preferred stock certain rights of refusal and options upon the transfer of stock.

Kansas Right of First Refusal and Co-Sale Agreement

Description

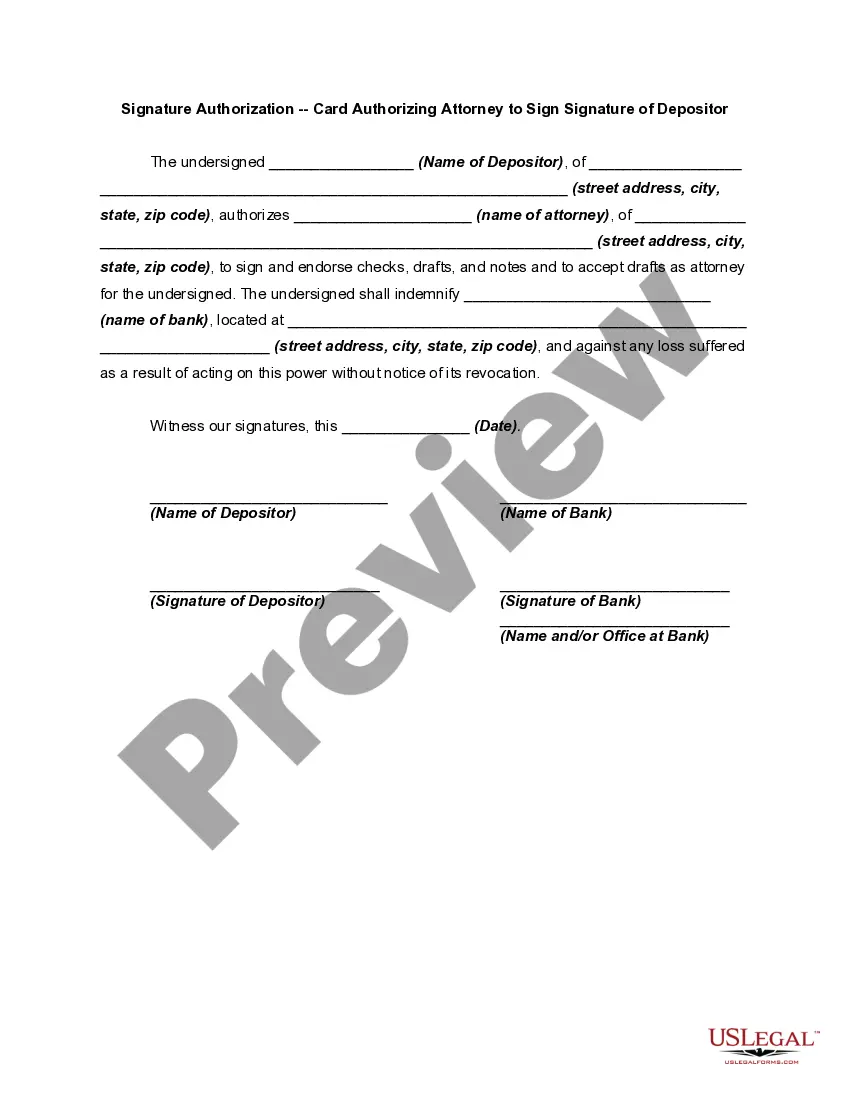

How to fill out Right Of First Refusal And Co-Sale Agreement?

If you want to full, down load, or produce legal papers layouts, use US Legal Forms, the most important selection of legal varieties, which can be found on the web. Utilize the site`s easy and handy lookup to obtain the files you require. Different layouts for business and person functions are categorized by types and states, or keywords and phrases. Use US Legal Forms to obtain the Kansas Right of First Refusal and Co-Sale Agreement in just a handful of clicks.

If you are already a US Legal Forms client, log in to your bank account and then click the Down load key to obtain the Kansas Right of First Refusal and Co-Sale Agreement. You can even gain access to varieties you formerly downloaded in the My Forms tab of your respective bank account.

If you work with US Legal Forms initially, follow the instructions below:

- Step 1. Make sure you have chosen the form for the correct metropolis/region.

- Step 2. Make use of the Review option to look through the form`s articles. Don`t neglect to see the outline.

- Step 3. If you are unhappy with the form, utilize the Search industry towards the top of the display to discover other types from the legal form format.

- Step 4. When you have located the form you require, click on the Acquire now key. Opt for the rates prepare you choose and put your references to sign up to have an bank account.

- Step 5. Process the purchase. You can use your credit card or PayPal bank account to perform the purchase.

- Step 6. Select the format from the legal form and down load it on your system.

- Step 7. Comprehensive, edit and produce or indicator the Kansas Right of First Refusal and Co-Sale Agreement.

Every single legal papers format you buy is your own eternally. You have acces to every form you downloaded within your acccount. Go through the My Forms section and decide on a form to produce or down load again.

Be competitive and down load, and produce the Kansas Right of First Refusal and Co-Sale Agreement with US Legal Forms. There are millions of expert and state-certain varieties you may use to your business or person requires.

Form popularity

FAQ

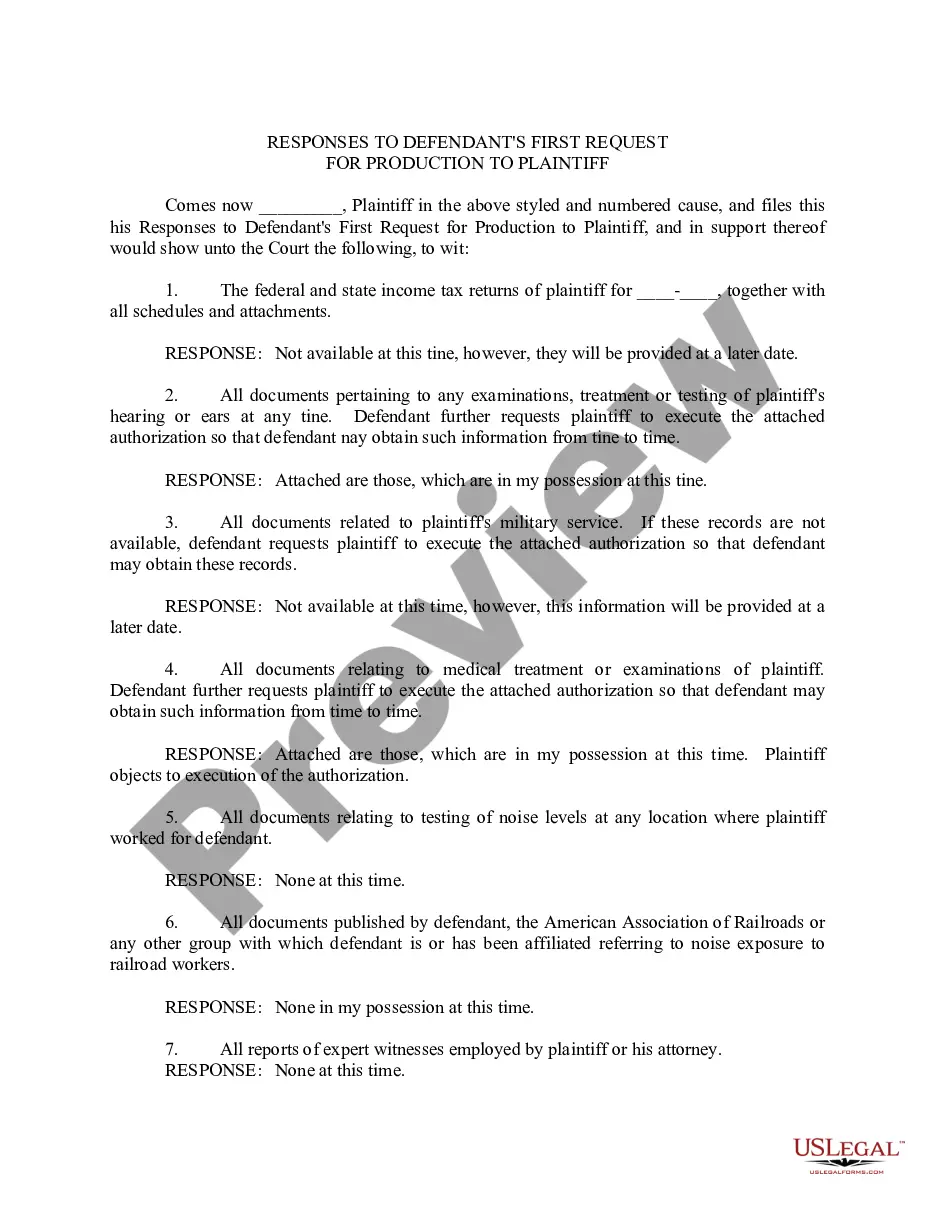

A right of first refusal provision generally means that if the parent who is designated to have custody or parenting time is unavailable due to other personal commitments, work requirements or for any other purpose, in a right of first refusal situation, the other parent would be offered time with the child or children ...

A right of first refusal?often abbreviated as ?ROFR? (pronounced ?roafer?)?gives the holder of the right ?first dibs? on any potential share sale. Also known as a ?last look? provision, ROFRs are a common feature in venture financings.

Right of first refusal and co-sale agreement or ROFR for short, involves an agreement or clause that mandates a party provides notice before a transaction. Additionally, this agreement requires that an option is provided for the other party to refuse this transaction.

Simply put: A ROFR provides the non-selling shareholders with a right to either accept or refuse an offer from a selling shareholder after the selling shareholder has received a third party offer for its shares.

Right of first refusal in real estate is a clause that gives a potential buyer the first opportunity to purchase a piece of property. It's common with, but not limited to, renters looking to buy from their landlords and families prepping for estate inheritances.

A right of first refusal is a fairly common clause in some business contracts that essentially gives a party the first crack at making an offer in a particular transaction.

Is the right of first refusal a good idea? The right of first refusal can be a good idea in that it allows a potential buyer to have first dibs on a property, providing a sense of security and control. Sellers don't have to worry about listing the property and can save it for preferred buyers.

Tag-along rights also referred to as "co-sale rights," are contractual obligations used to protect a minority shareholder, usually in a venture capital deal. If a majority shareholder sells his stake, it gives the minority shareholder the right to join the transaction and sell their minority stake in the company.