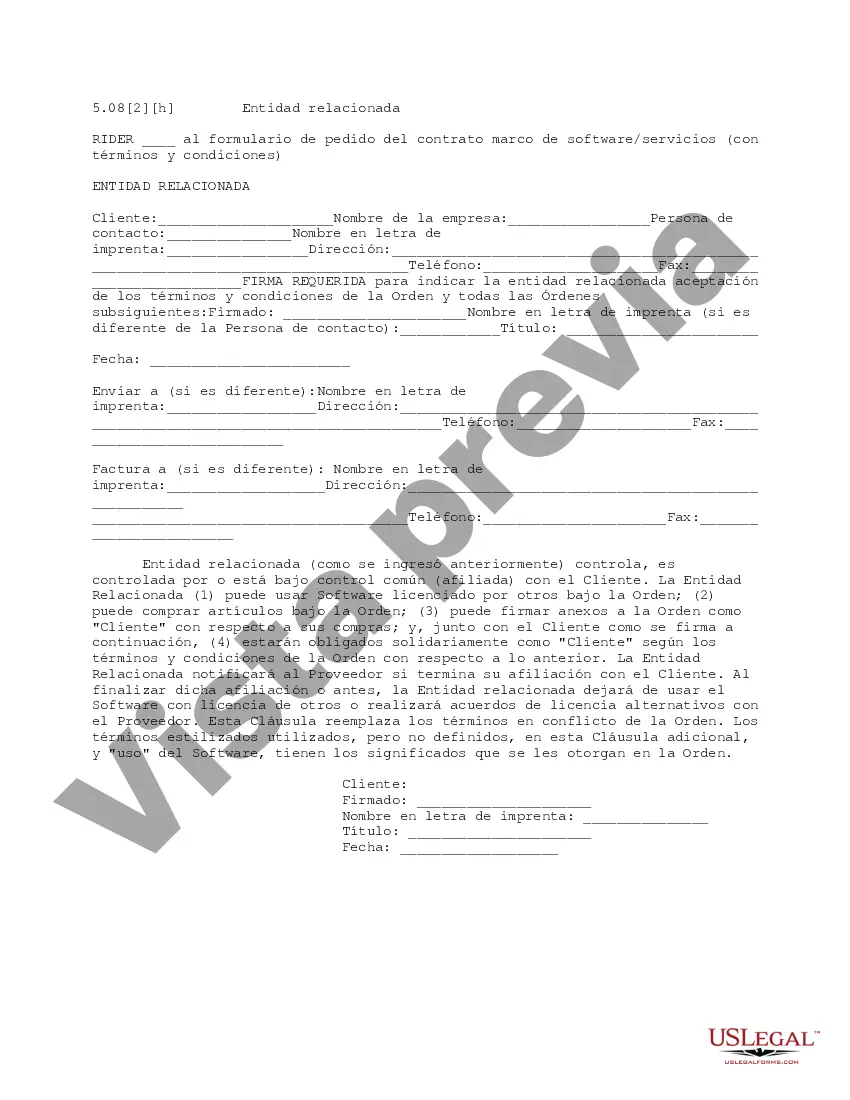

This is a rider to the software/services master agreement order form. It provides that a related entity of the customer may use the software purchased from the vendor.

Kansas Related Entity is a legal term that refers to a company or organization that is associated with or has connections to the state of Kansas in the United States. This term is primarily used in the context of law and business to identify entities that are formed, registered, or operate within the boundaries of Kansas. There are several types of Kansas Related Entities, each with its own characteristics and legal requirements. Some common types are as follows: 1. Kansas LLC: A Kansas Limited Liability Company (LLC) is a popular business structure that offers flexibility, limited liability protection, and pass-through taxation for its members. These entities must be registered with the Kansas Secretary of State and follow the state's specific regulations governing LCS. 2. Kansas Corporation: A Kansas Corporation refers to a legal entity that is formed under the state's corporate laws. Corporations in Kansas are separate legal entities from their shareholders and offer limited liability protection. They must comply with the Kansas Business Corporation Act and file the necessary documents with the Secretary of State. 3. Kansas Partnership: A Partnership is a business structure in which two or more individuals or entities agree to share profits and losses. Kansas recognizes different types of partnerships, including general partnerships, limited partnerships, and limited liability partnerships. Partnerships must file a Certificate of Partnership with the Secretary of State. 4. Kansas Nonprofit Organization: Kansas allows the formation of nonprofit organizations, commonly known as non-stock corporations. Nonprofit organizations pursue activities or charitable purposes that benefit the community, and they must qualify for tax-exempt status with the Internal Revenue Service (IRS) to receive certain benefits. Nonprofits must comply with the Kansas Nonprofit Corporation Act. 5. Kansas Sole Proprietorship: A Sole Proprietorship is the simplest and most common type of business entity, where an individual operates a business under their own name or a fictitious name. This entity does not have separate legal status, and the owner is personally liable for all business obligations. Sole proprietors are not required to file formation documents with the state. In conclusion, a Kansas Related Entity refers to various types of companies and organizations that are formed, registered, or operating within the state of Kansas. Whether it is a Kansas LLC, Kansas Corporation, Kansas Partnership, Kansas Nonprofit Organization, or Kansas Sole Proprietorship, each entity has its own legal framework, requirements, and benefits.Kansas Related Entity is a legal term that refers to a company or organization that is associated with or has connections to the state of Kansas in the United States. This term is primarily used in the context of law and business to identify entities that are formed, registered, or operate within the boundaries of Kansas. There are several types of Kansas Related Entities, each with its own characteristics and legal requirements. Some common types are as follows: 1. Kansas LLC: A Kansas Limited Liability Company (LLC) is a popular business structure that offers flexibility, limited liability protection, and pass-through taxation for its members. These entities must be registered with the Kansas Secretary of State and follow the state's specific regulations governing LCS. 2. Kansas Corporation: A Kansas Corporation refers to a legal entity that is formed under the state's corporate laws. Corporations in Kansas are separate legal entities from their shareholders and offer limited liability protection. They must comply with the Kansas Business Corporation Act and file the necessary documents with the Secretary of State. 3. Kansas Partnership: A Partnership is a business structure in which two or more individuals or entities agree to share profits and losses. Kansas recognizes different types of partnerships, including general partnerships, limited partnerships, and limited liability partnerships. Partnerships must file a Certificate of Partnership with the Secretary of State. 4. Kansas Nonprofit Organization: Kansas allows the formation of nonprofit organizations, commonly known as non-stock corporations. Nonprofit organizations pursue activities or charitable purposes that benefit the community, and they must qualify for tax-exempt status with the Internal Revenue Service (IRS) to receive certain benefits. Nonprofits must comply with the Kansas Nonprofit Corporation Act. 5. Kansas Sole Proprietorship: A Sole Proprietorship is the simplest and most common type of business entity, where an individual operates a business under their own name or a fictitious name. This entity does not have separate legal status, and the owner is personally liable for all business obligations. Sole proprietors are not required to file formation documents with the state. In conclusion, a Kansas Related Entity refers to various types of companies and organizations that are formed, registered, or operating within the state of Kansas. Whether it is a Kansas LLC, Kansas Corporation, Kansas Partnership, Kansas Nonprofit Organization, or Kansas Sole Proprietorship, each entity has its own legal framework, requirements, and benefits.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.