Kentucky Waiver of Special Meeting of Stockholders - Corporate Resolutions

Description

How to fill out Waiver Of Special Meeting Of Stockholders - Corporate Resolutions?

Are you presently in a location where you need documents for either corporate or personal use almost every day? There are numerous legitimate form templates available online, but finding reliable ones can be challenging. US Legal Forms provides thousands of form templates, such as the Kentucky Waiver of Special Meeting of Stockholders - Corporate Resolutions, which can be downloaded to comply with state and federal regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the Kentucky Waiver of Special Meeting of Stockholders - Corporate Resolutions template.

If you do not have an account and wish to start using US Legal Forms, follow these steps.

Access all the form templates you have purchased in the My documents section. You can obtain another copy of the Kentucky Waiver of Special Meeting of Stockholders - Corporate Resolutions at any time if needed. Just select the desired form to download or print the document template.

Use US Legal Forms, one of the most extensive selections of legal forms, to save time and avoid mistakes. The service offers correctly crafted legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and start simplifying your life.

- Obtain the form you need and ensure it is for the correct city/state.

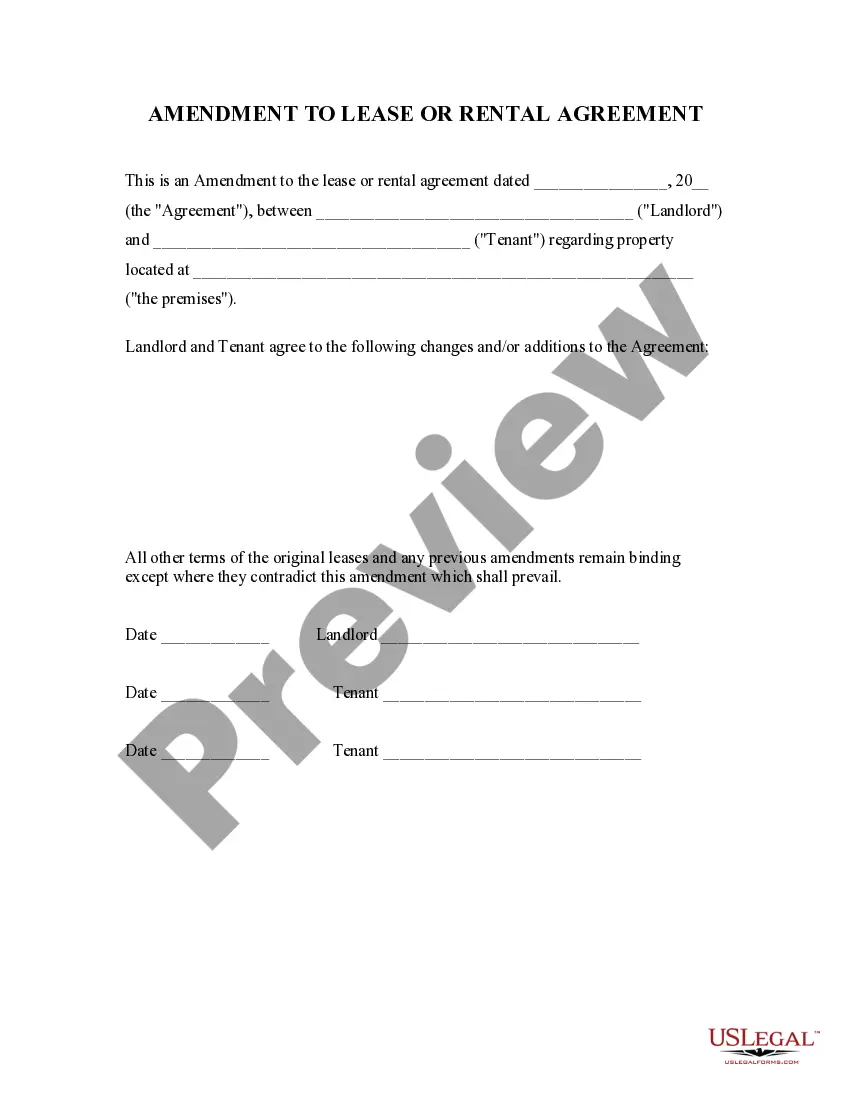

- Use the Preview button to review the form.

- Check the description to confirm you have chosen the correct form.

- If the form is not what you’re looking for, utilize the Search field to find the form that meets your needs and requirements.

- Once you find the right form, click Buy now.

- Select the pricing plan you prefer, provide the necessary information to create your account, and pay for the order using your PayPal or credit card.

- Choose a convenient document format and download your copy.

Form popularity

FAQ

A waiver of notice is a legal document that states a board member agrees to waive the formal notice, and it must be signed by the board member. Organizations will have different rules based on the type of meeting, such as the first meeting, special meetings, emergency meetings, and executive sessions.

A waiver of notice is a common document used for board of directors special meetings. Special meetings are called when there's a pressing issue that can't wait for the next scheduled meeting. If there's not enough time for a formal meeting notice, directors can opt to sign a waiver and hold the meeting without notice.

Special meetings of directors or members shall be held at any time deemed necessary or as provided in the bylaws: Provided, however, That at least one (1) week written notice shall be sent to all stockholders or members, unless a different period is provided in the bylaws, law or regulation.

A shareholder meeting will often be called when shareholder input is needed in a major decision, such as a change in directors. Investors are also able to call special shareholder meetings, subject to a specific set of rules.

The directors' must call the meeting within 21 days after the request is given to the Company and the meeting must be held no later than two months after the request (Section 249D(5)). The obligation to call the meeting is imposed on the directors, whereas the obligation to hold the meeting is imposed on the company.

Why would I need a waiver of notice for the first shareholder meeting? A waiver of notice documents that all shareholders are okay with having a meeting without being formally notified ahead of time.

Typically either the president or a majority vote of the board (or both) can call a special meeting. You need to give proper notice to members and, of course, you need a quorum to do business. The procedure should be spelled out in your bylaws.

Special meetings of the shareholders may be called for any purpose or purposes, at any time, by the Chief Executive Officer; by the Chief Financial Officer; by the Board or any two or more members thereof; or by one or more shareholders holding not less than 10% of the voting power of all shares of the corporation

Special meeting is a meeting called by shareholders to discuss specific matters stated in the notice of the meeting. It is a meeting of shareholders outside the usual annual general meeting.

Notice to Shareholders Most states require notice of any shareholder meeting be mailed to all shareholders at least 10 days prior to the meeting. The notice should contain the date, time and location of the meeting as well as an agenda or explanation of the topics to be discussed.