A trust is the legal relationship between one person, the trustee, having an equitable ownership or management of certain property and another person, the beneficiary, owning the legal title to that property. The beneficiary is entitled to the performance of certain duties and the exercise of certain powers by the trustee, which performance may be enforced by a court of equity. Most trusts are founded by the persons (called trustors, settlors and/or donors) who execute a written declaration of trust which establishes the trust and spells out the terms and conditions upon which it will be conducted. The declaration also names the original trustee or trustees, successor trustees or means to choose future trustees.

A Kentucky Trust Agreement to Hold Funds for Minor Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minor is a legally binding document that establishes a trust to protect and manage the financial compensation awarded to a minor through a personal injury lawsuit. This type of trust agreement ensures that the funds are safeguarded and used responsibly for the minor's benefit, as the minor may be unable to manage the funds on their own. The purpose of this trust agreement is to provide long-term financial security for the minor, ensuring that the settlement funds are not squandered or mismanaged. It is crucial to establish such an agreement, as minors may lack the necessary financial knowledge and decision-making abilities to handle large sums of money. A Kentucky Trust Agreement to Hold Funds for Minor Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minor includes specific provisions and instructions regarding the management and distribution of the funds. It typically designates a trustee, who is responsible for overseeing the trust and making financial decisions in the minor's best interests. The trustee can be a trusted family member, friend, or a professional entity, such as a bank or attorney. The trust agreement may also outline the purposes for which the funds can be utilized, such as education, healthcare, housing, and other essential expenses. Depending on the specific circumstances and the minor's needs, the trust agreement can be tailored to meet individual requirements. There may be different types of Kentucky Trust Agreements to Hold Funds for Minor Resulting from a Settlement of a Personal Injury Action Filed on Behalf of a Minor, including: 1. Irrevocable Trust: This type of trust agreement cannot be modified or terminated without the consent of the named beneficiaries, which can provide additional protection for the minor's funds. 2. Revocable Trust: Unlike an irrevocable trust, a revocable trust can be altered or revoked by the granter during their lifetime, providing more flexibility in managing the funds. 3. Special Needs Trust: If the minor has special needs or disabilities, a special needs trust can be established to ensure that the settlement funds do not affect their eligibility for government benefits. 4. Pooled Trust: In certain cases, a pooled trust can be established, where multiple beneficiaries contribute their funds into a single trust managed by a non-profit organization. This can often lower administrative costs and provide greater investment opportunities. It is important to consult with an experienced attorney or legal professional to determine the most suitable type of trust agreement based on the specific circumstances of the minor's personal injury settlement. By using a Kentucky Trust Agreement to Hold Funds for Minor, the minor's financial future can be protected, allowing them to receive the necessary support and benefits that the settlement funds provide.A Kentucky Trust Agreement to Hold Funds for Minor Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minor is a legally binding document that establishes a trust to protect and manage the financial compensation awarded to a minor through a personal injury lawsuit. This type of trust agreement ensures that the funds are safeguarded and used responsibly for the minor's benefit, as the minor may be unable to manage the funds on their own. The purpose of this trust agreement is to provide long-term financial security for the minor, ensuring that the settlement funds are not squandered or mismanaged. It is crucial to establish such an agreement, as minors may lack the necessary financial knowledge and decision-making abilities to handle large sums of money. A Kentucky Trust Agreement to Hold Funds for Minor Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minor includes specific provisions and instructions regarding the management and distribution of the funds. It typically designates a trustee, who is responsible for overseeing the trust and making financial decisions in the minor's best interests. The trustee can be a trusted family member, friend, or a professional entity, such as a bank or attorney. The trust agreement may also outline the purposes for which the funds can be utilized, such as education, healthcare, housing, and other essential expenses. Depending on the specific circumstances and the minor's needs, the trust agreement can be tailored to meet individual requirements. There may be different types of Kentucky Trust Agreements to Hold Funds for Minor Resulting from a Settlement of a Personal Injury Action Filed on Behalf of a Minor, including: 1. Irrevocable Trust: This type of trust agreement cannot be modified or terminated without the consent of the named beneficiaries, which can provide additional protection for the minor's funds. 2. Revocable Trust: Unlike an irrevocable trust, a revocable trust can be altered or revoked by the granter during their lifetime, providing more flexibility in managing the funds. 3. Special Needs Trust: If the minor has special needs or disabilities, a special needs trust can be established to ensure that the settlement funds do not affect their eligibility for government benefits. 4. Pooled Trust: In certain cases, a pooled trust can be established, where multiple beneficiaries contribute their funds into a single trust managed by a non-profit organization. This can often lower administrative costs and provide greater investment opportunities. It is important to consult with an experienced attorney or legal professional to determine the most suitable type of trust agreement based on the specific circumstances of the minor's personal injury settlement. By using a Kentucky Trust Agreement to Hold Funds for Minor, the minor's financial future can be protected, allowing them to receive the necessary support and benefits that the settlement funds provide.

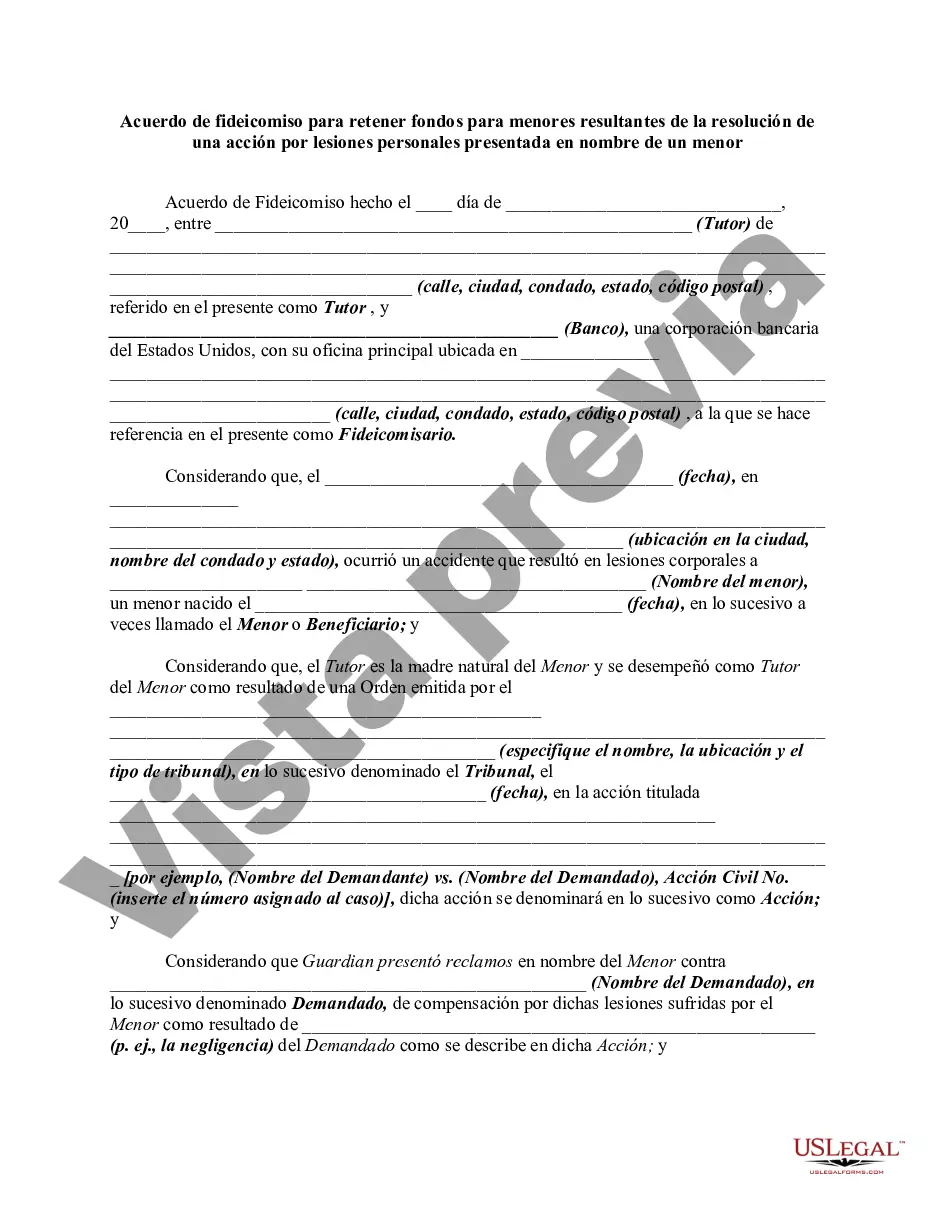

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.