A Kentucky Promissory Note — Payable on Demand is a legally binding document that outlines the terms and conditions of a loan or debt repayment agreement in the state of Kentucky. This type of promissory note is specifically designed to establish a borrower's obligation to repay a specified amount of money to a lender, upon demand. Keywords: Kentucky Promissory Note, Payable on Demand, debt repayment agreement, loan, borrower, lender, legally binding, terms and conditions, specified amount, obligation. There are several types of Kentucky Promissory Notes — Payable on Demand, depending on the specific requirements and circumstances of the borrower and the lender. Here are some common types: 1. Simple Kentucky Promissory Note — Payable on Demand: This type of promissory note is a straightforward agreement between a borrower and a lender, stipulating the repayment terms and conditions without any additional complexity. 2. With Collateral Kentucky Promissory Note — Payable on Demand: This promissory note includes an additional provision, where the borrower pledges collateral (such as real estate, vehicles, or valuable assets) as security for the loan. In case of default, the lender has the right to seize the collateral to recover the outstanding debt. 3. Variable Interest Kentucky Promissory Note — Payable on Demand: This type of promissory note enables the interest rate on the loan to fluctuate in accordance with a predetermined benchmark index, such as the prime rate. The interest rate is determined at the time of repayment demand and adjusted periodically. 4. Secured Kentucky Promissory Note — Payable on Demand: As the name suggests, this promissory note includes provisions for both collateral and a personal guarantee from the borrower or a third party. This provides an extra layer of security for the lender in case of default. 5. Unsecured Kentucky Promissory Note — Payable on Demand: Unlike the secured promissory note, this type does not require collateral or additional guarantees. The lender relies solely on the borrower's promise to repay the debt promptly. It is important for all parties involved in a Kentucky Promissory Note — Payable on Demand to carefully review and understand the terms and conditions mentioned in the document before signing. Seeking legal advice from an attorney experienced in Kentucky contract law is highly recommended ensuring compliance with state regulations and to protect the rights and interests of both the borrower and lender.

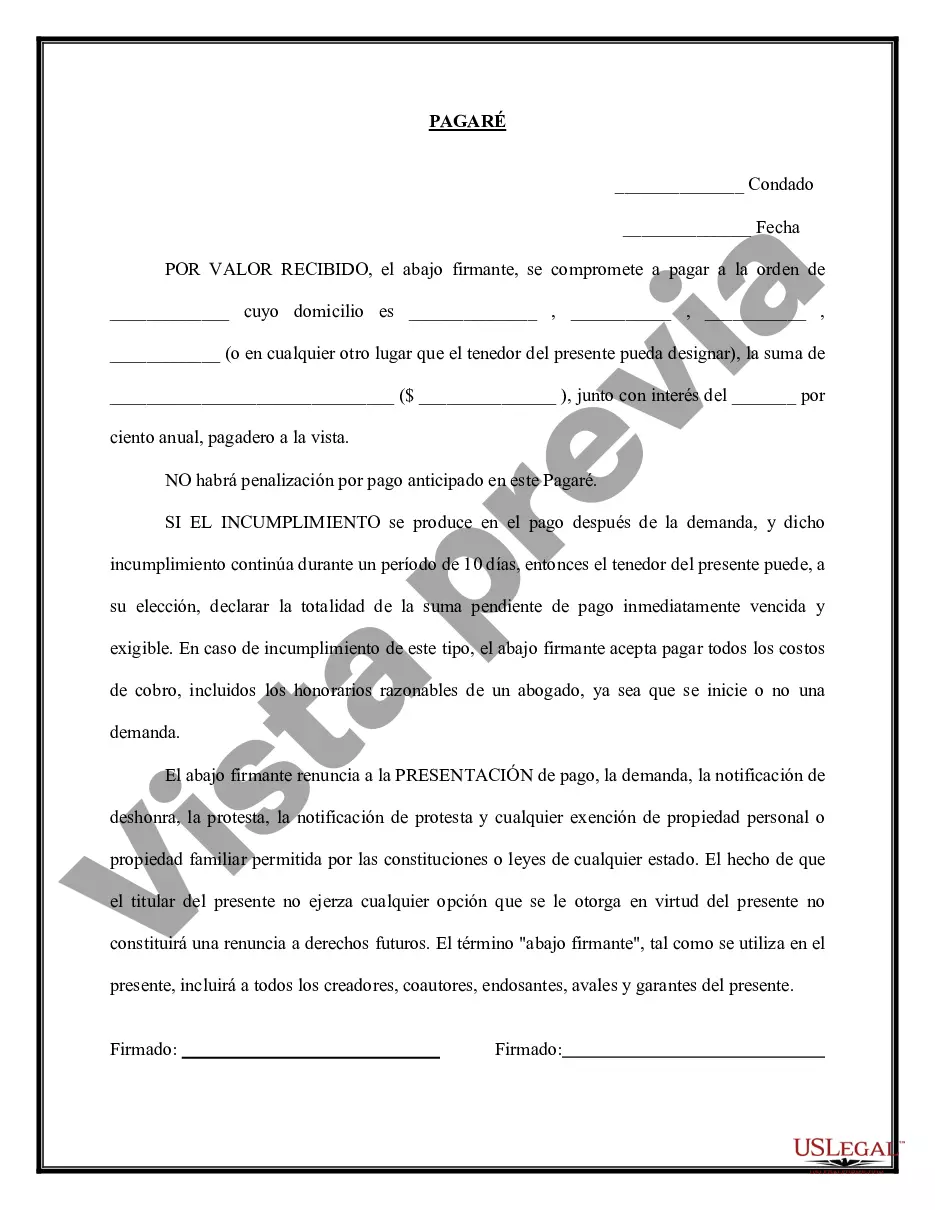

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Kentucky Pagaré - Pagadero a la vista - Promissory Note - Payable on Demand

Description

How to fill out Kentucky Pagaré - Pagadero A La Vista?

If you want to total, down load, or produce lawful papers themes, use US Legal Forms, the largest variety of lawful forms, that can be found on the Internet. Utilize the site`s simple and convenient lookup to get the documents you will need. Numerous themes for enterprise and personal reasons are sorted by categories and states, or keywords. Use US Legal Forms to get the Kentucky Promissory Note - Payable on Demand in just a couple of clicks.

If you are presently a US Legal Forms client, log in to your account and click on the Download switch to have the Kentucky Promissory Note - Payable on Demand. You can also entry forms you in the past downloaded within the My Forms tab of your account.

If you are using US Legal Forms for the first time, follow the instructions below:

- Step 1. Be sure you have selected the form for that right city/region.

- Step 2. Utilize the Preview solution to look over the form`s articles. Never forget to read the description.

- Step 3. If you are not satisfied using the form, make use of the Research industry near the top of the screen to find other variations of your lawful form design.

- Step 4. Once you have located the form you will need, select the Buy now switch. Pick the costs plan you like and add your accreditations to sign up for the account.

- Step 5. Method the purchase. You should use your bank card or PayPal account to complete the purchase.

- Step 6. Find the structure of your lawful form and down load it in your gadget.

- Step 7. Full, change and produce or indication the Kentucky Promissory Note - Payable on Demand.

Every lawful papers design you acquire is the one you have for a long time. You have acces to every form you downloaded inside your acccount. Select the My Forms segment and pick a form to produce or down load once again.

Contend and down load, and produce the Kentucky Promissory Note - Payable on Demand with US Legal Forms. There are millions of specialist and state-certain forms you can use for your enterprise or personal requires.