Kentucky Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner

Description

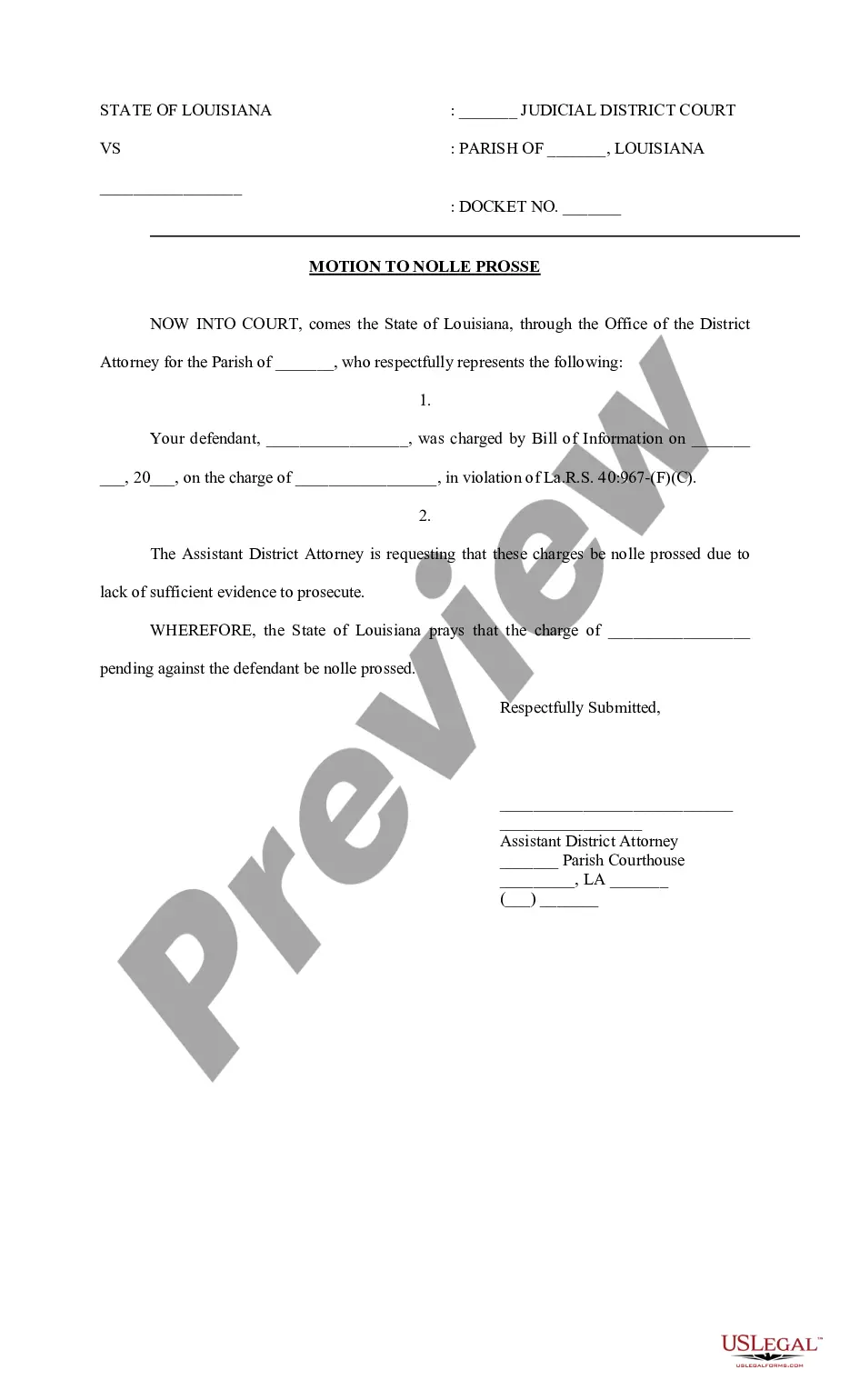

How to fill out Agreement To Dissolve And Wind Up Partnership With Sale To Partner By Retiring Partner?

Are you in a circumstance where you need documents for either business or personal uses every single day.

There are numerous legal document templates available online, but locating ones you can depend on can be challenging.

US Legal Forms offers thousands of form templates, such as the Kentucky Agreement to Dissolve and Wind Up Partnership with Sale to Partner by Retiring Partner, which are designed to comply with federal and state regulations.

Once you have secured the right form, click on Get now.

Choose the pricing plan you want, provide the necessary information to create your account, and complete the transaction with your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms site and have your account, simply Log In.

- After that, you can download the Kentucky Agreement to Dissolve and Wind Up Partnership with Sale to Partner by Retiring Partner template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for your appropriate area/county.

- Utilize the Preview button to examine the form.

- Review the details to ensure you have selected the correct form.

- If the form is not what you’re looking for, use the Search field to find the form that fits your needs and requirements.

Form popularity

FAQ

Ending a partnership gracefully requires respectful communication and careful adherence to any pre-existing agreements. Utilizing the Kentucky Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner can foster a smoother transition and help maintain professional relationships. By being open and transparent throughout the winding-up process, partners can ensure that all parties feel respected and valued.

The process of winding up a partnership typically involves settling all outstanding debts, liquidating partnership assets, and distributing remaining assets to partners based on their ownership stakes. The Kentucky Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner provides a structured approach to this process, helping partners follow legal guidelines. Completing the winding-up process correctly can protect partners from future liabilities.

To dissolve a partnership agreement, you must follow the procedures stipulated within your partnership contract, or by using a formal agreement like the Kentucky Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner. Clear communication among partners is crucial, and the necessary legal documentation must be completed to prevent disputes. Properly handling this process will ensure that all parties understand their rights and obligations.

Taking over a partnership firm requires careful negotiation and agreement from all parties involved. The Kentucky Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner can be instrumental in facilitating this transition smoothly and legally. Ensuring that all terms and conditions are clear helps avert misunderstandings and allows for a successful transfer of ownership.

Winding up a partnership firm involves several key steps, including settling debts, liquidating assets, and distributing remaining profits among partners. Utilizing the Kentucky Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner streamlines this process and provides clear guidance on legal requirements. It ensures that all necessary procedures are followed to avoid complications down the line.

A partnership may be dissolved under several circumstances, such as the expiration of the partnership term, the mutual agreement of partners, or a partner's withdrawal. Specific conditions outlined in the Kentucky Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner can clarify these scenarios. Understanding these terms helps partners make informed decisions about their business relationships.

Yes, you can wind up a partnership by following the appropriate legal steps. The Kentucky Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner can guide partners through this process to ensure all assets and liabilities are properly addressed. It is essential to communicate with all partners and document every step to minimize potential disputes.

Dissolving a partnership in the Philippines requires a careful approach that includes drafting a potential agreement that specifies the conditions of dissolution. All partners must agree on asset distribution and any outstanding liabilities. Opting for a Kentucky Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner could provide a clear framework for dealing with these complexities.

To remove a partner from a partnership, a formal agreement among the partners is essential. This process usually involves assessing the financial contributions, obligations, and any agreements stated in the partnership contract. Implementing a Kentucky Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner can assist in resolving disputes and managing the outgoing partner's assets effectively.

The conditions for dissolving a partnership generally include mutual consent of all partners, fulfillment of the partnership term, or occurrence of an event specified in the partnership agreement. Additionally, any actionable claims against the partnership should be resolved before final dissolution. A Kentucky Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner can help clarify these conditions and facilitate a smoother process.