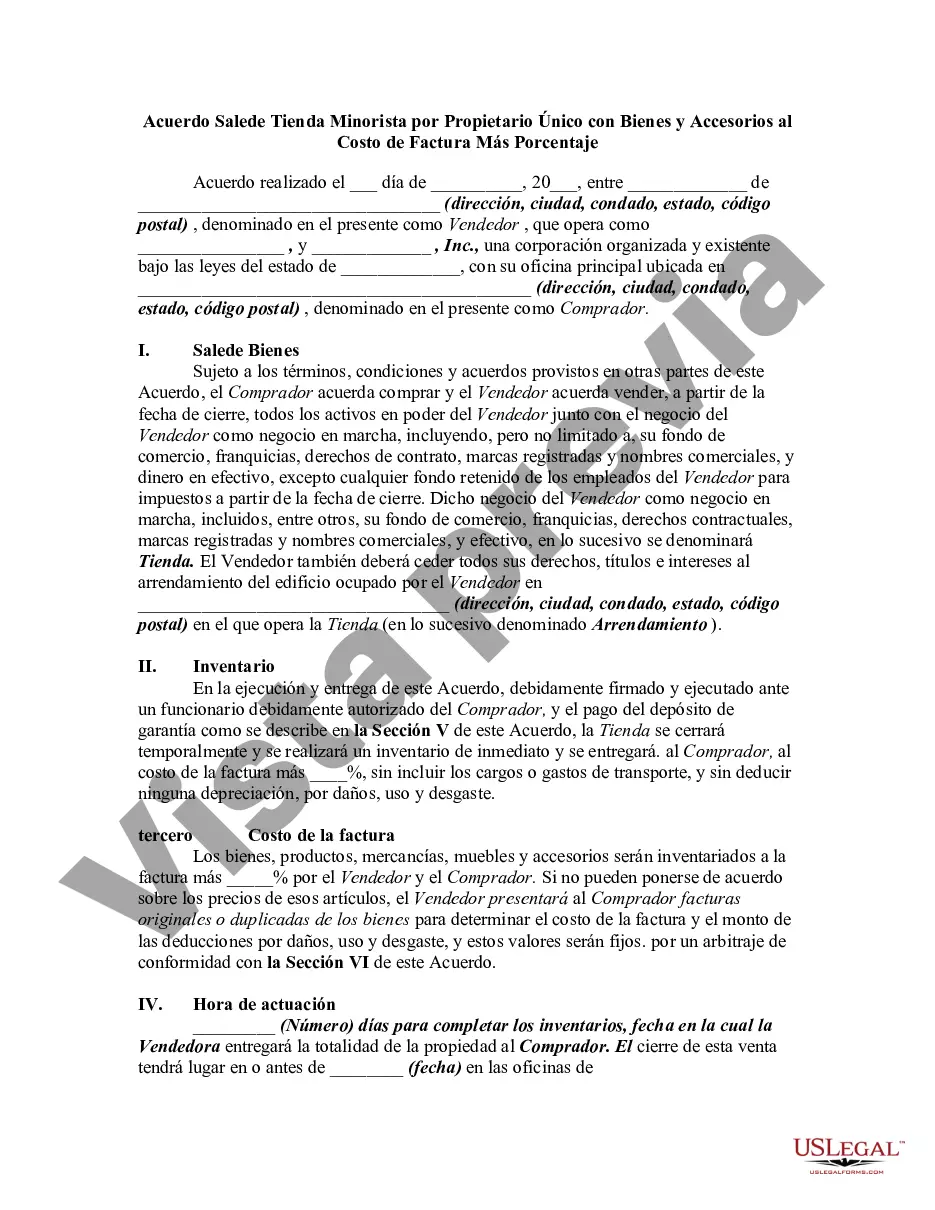

The Kentucky Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage is a legal document that outlines the terms and conditions of selling a retail store owned by a sole proprietor in the state of Kentucky. This agreement includes specific details regarding the sale of goods, fixtures, and equipment, as well as the transfer of ownership rights. Keywords: Kentucky Agreement for Sale, Sole Proprietorship, Retail Store, Goods, Fixtures, Invoice Cost, Percentage, Transfer of Ownership. This agreement is essential for both the seller and the buyer as it establishes a framework for a smooth and legal transaction. It ensures that both parties understand their rights, responsibilities, and obligations throughout the sale process. The Kentucky Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage includes various clauses, including: 1. Parties: Names and contact information of the buyer and seller, clearly identifying the sole proprietorship and the retail store being sold. 2. Sale of Goods: Detailed inventory of the goods, merchandise, and products being sold, including descriptions, quantities, and prices. It may also mention any exclusions or exceptions. 3. Fixtures and Equipment: A comprehensive list of fixtures, furniture, equipment, and other assets that are included in the sale. This section specifies the condition and value of each item. 4. Purchase Price: The agreement sets forth how the purchase price will be determined, usually based on the invoice cost of the goods and fixtures plus a percentage that accounts for the value-added by the seller. This percentage can be negotiable between both parties. 5. Payments and Terms: Clarifies the payment terms, including the amount of the down payment, installment amounts, interest rates (if applicable), due dates, and any penalties for defaulting. 6. Transfer of Ownership: Outlines the process and timeline for transferring ownership rights from the seller to the buyer. This may include obtaining necessary licenses, permits, and approvals as required by law. 7. Representations and Warranties: The seller assures the buyer that they have the legal authority to sell the retail store and its assets, and that there are no outstanding claims, liens, or encumbrances against them. This helps protect the buyer from undisclosed liabilities. 8. Breach and Remedies: Specifies the actions to be taken in case of a breach of the agreement by either party and the available remedies, such as termination, damages, or specific performance. Different types of Kentucky Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage may exist based on the specific needs and preferences of the parties involved. For instance, if the sale involves additional conditions or unique circumstances, the agreement can be customized accordingly. In conclusion, the Kentucky Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage is a crucial legal document that provides a comprehensive framework for selling a retail store in Kentucky. It protects the rights and interests of both the buyer and the seller, ensuring a transparent and fair transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Kentucky Acuerdo para la Venta de Tienda Minorista por Propietario Único con Bienes y Accesorios al Costo de Factura Más Porcentaje - Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage

Description

How to fill out Kentucky Acuerdo Para La Venta De Tienda Minorista Por Propietario Único Con Bienes Y Accesorios Al Costo De Factura Más Porcentaje?

You are able to spend time on the Internet trying to find the legal record web template which fits the state and federal needs you require. US Legal Forms supplies a large number of legal kinds that are examined by professionals. It is possible to down load or printing the Kentucky Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage from your services.

If you already have a US Legal Forms account, you can log in and click the Acquire option. Afterward, you can full, change, printing, or signal the Kentucky Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage. Every legal record web template you purchase is your own eternally. To obtain another copy for any obtained form, go to the My Forms tab and click the related option.

If you are using the US Legal Forms website the first time, stick to the basic guidelines below:

- Initial, be sure that you have chosen the proper record web template for your area/city of your liking. See the form explanation to make sure you have chosen the right form. If accessible, utilize the Preview option to check from the record web template at the same time.

- If you wish to locate another variation from the form, utilize the Look for area to get the web template that fits your needs and needs.

- When you have discovered the web template you want, click on Get now to carry on.

- Find the rates program you want, enter your accreditations, and sign up for a merchant account on US Legal Forms.

- Total the purchase. You can utilize your charge card or PayPal account to purchase the legal form.

- Find the structure from the record and down load it for your gadget.

- Make modifications for your record if required. You are able to full, change and signal and printing Kentucky Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage.

Acquire and printing a large number of record layouts using the US Legal Forms web site, which offers the largest selection of legal kinds. Use professional and condition-particular layouts to deal with your company or person needs.