Kentucky Employment Verification Letter for Bank

Description

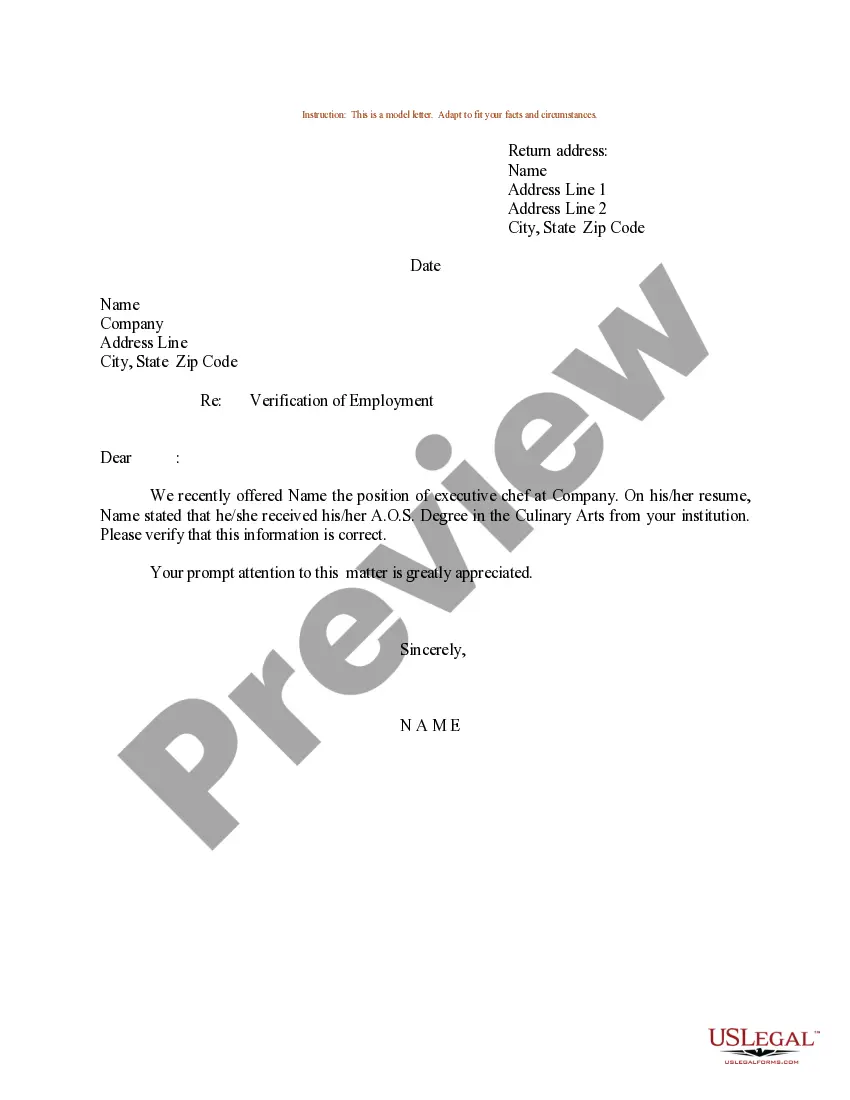

How to fill out Employment Verification Letter For Bank?

It is feasible to spend time online trying to locate the valid document format that complies with the state and federal regulations you need.

US Legal Forms offers thousands of valid forms that have been reviewed by professionals.

You can obtain or print the Kentucky Employment Verification Letter for Bank from your services.

If available, utilize the Preview option to review the document format as well.

- If you already have a US Legal Forms account, you can Log In and select the Download option.

- After that, you can complete, modify, print, or sign the Kentucky Employment Verification Letter for Bank.

- Every valid document format you purchase is yours indefinitely.

- To get an additional copy of any purchased form, go to the My documents section and click on the relevant option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have chosen the correct document format for the area/region of your preference.

- Review the form description to confirm you have selected the right type.

Form popularity

FAQ

A payment confirmation letter is a document that verifies a transaction has been completed successfully. This letter typically outlines details such as the payment amount, date, and transaction type. If you are dealing with a bank, a Kentucky Employment Verification Letter for Bank might complement this by confirming your employment status, which can add credibility to your financial transactions.

To request an employment verification letter, communicate directly with your human resources department or your manager. Clearly state the purpose of the request and, if possible, provide any necessary information the bank may require. Utilizing a Kentucky Employment Verification Letter for Bank template can simplify this process and ensure you include all required details.

A confirmation letter from an employer to a bank is a specific document that confirms an employee's work status and income for the bank’s records. This letter typically includes crucial details like job title, employment duration, and salary. Using a Kentucky Employment Verification Letter for Bank guarantees that the bank receives reliable information, which supports your financial requests.

A confirmation letter from an employer is a formal document that verifies an employee's job position, salary, and employment dates. This letter is important for various scenarios, including loans, housing applications, and other financial situations. The Kentucky Employment Verification Letter for Bank specifically caters to the needs of financial institutions, ensuring accurate information is provided for your needs.

When responding to an employment verification request, ensure you provide accurate information about the employee's role, salary, and employment dates. You can issue a formal Kentucky Employment Verification Letter for Bank that includes all requested details, which helps maintain professionalism and transparency. Make sure to verify the requester's identity before sharing sensitive information.

Writing a verification of employment letter involves stating the employer's official address, followed by the date and recipient's information. Include the employee's details, such as their job title and employment duration, then conclude with the employer's contact information for any follow-up. This format is essential when crafting a Kentucky Employment Verification Letter for Bank, as clarity and precision matter.

To write a simple letter of employment, start with your company's letterhead followed by the date and the recipient's information. Clearly state the employee's name, job title, dates of employment, and salary in the body. Including a quick note about the employee’s performance can also add value to the Kentucky Employment Verification Letter for Bank.

An example of a letter of confirmation of employment typically includes the employee's name, job title, employment dates, and salary details. It may also state that the employee is in good standing with the company. For a precise format, you can refer to templates available at UsLegalForms to create a Kentucky Employment Verification Letter for Bank that meets specific requirements.

A bank letter for employment is an official document issued by an employer to confirm an employee's job status and financial information. This letter usually includes details like the employee's role, salary, dates of employment, and sometimes, their work performance. Utilizing a Kentucky Employment Verification Letter for Bank can effectively communicate your employment situation when applying for loans or other financial services.

US banks typically verify employment by contacting your employer directly or through third-party services. They look for confirmation of your job title, income, and duration of employment. Providing a Kentucky Employment Verification Letter for Bank can speed up this process and ensure banks have accurate information regarding your employment status.