In a compilation engagement, the accountant presents in the form of financial statements information that is the representation of management (owners) without undertaking to express any assurance on the statements. In other words, using management's records, the accountant creates financial statements without gathering evidence or opining about the validity of those underlying records. Because compiled financial statements provide the reader no assurance regarding the statements, they represent the lowest level of financial statement service accountants can provide to their clients. Accordingly, standards governing compilation engagements require that financial statements presented by the accountant to the client or third parties must at least be compiled.

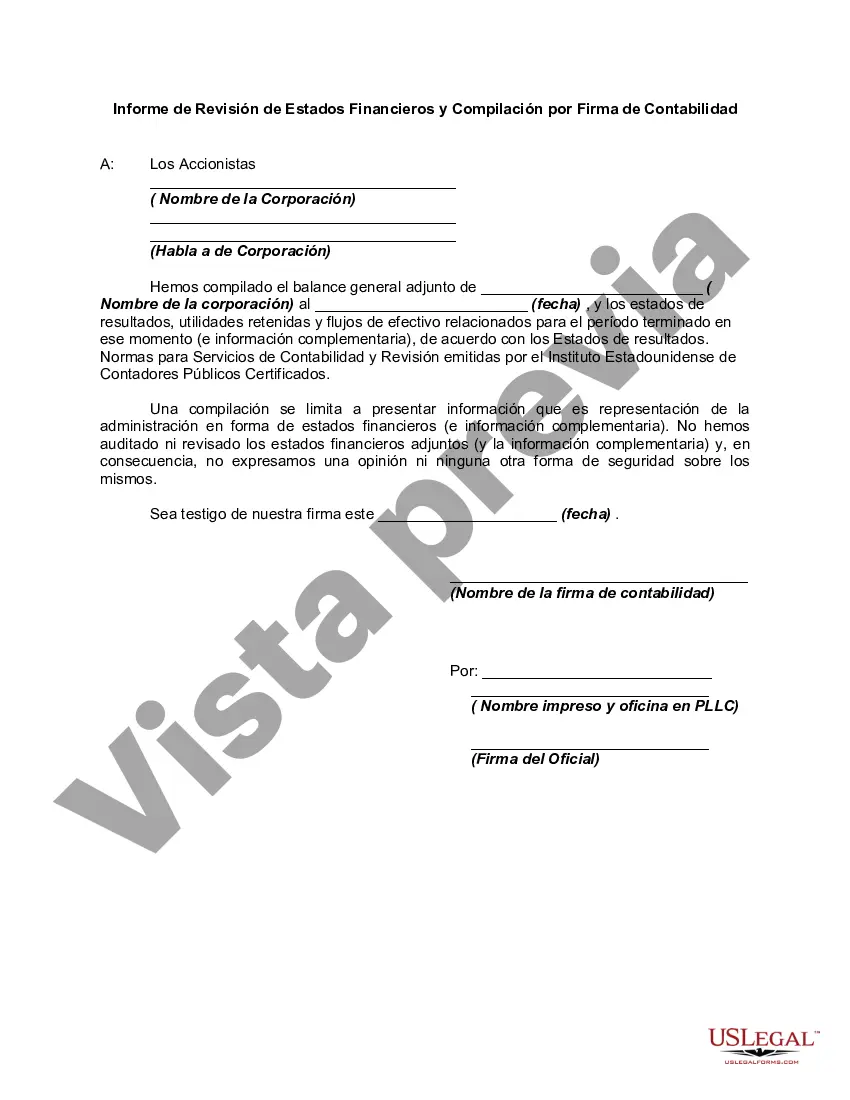

Kentucky Report from Review of Financial Statements and Compilation by Accounting Firm: A Kentucky Report from Review of Financial Statements and Compilation by an Accounting Firm is a detailed examination and assessment of the financial statements of an organization based in Kentucky. This report is prepared by a professional accounting firm to provide an independent evaluation of the financial health and performance of the entity under review. The purpose of this report is to offer stakeholders, such as investors, creditors, and management, an objective analysis of the financial statements. It helps them make informed decisions about the organization's future prospects and its ability to fulfill its financial obligations. The report is often used to gauge the entity's financial stability, profitability, and compliance with accounting standards and regulations. There are different types of Kentucky Reports from Review of Financial Statements and Compilation by Accounting Firm, including: 1. Review Report: A Review Report presents the accounting firm's limited assurance on the financial statements. It indicates that the firm has performed analytical procedures and inquiries to identify any significant issues that may suggest a material departure from accounting standards. However, the assurance provided in a review report is less than that of an audit. 2. Compilation Report: A Compilation Report is prepared when an accounting firm assembles financial data provided by the organization into financial statements. The report states that the firm has not audited or reviewed the financial statements but has only assisted the organization in presenting its financial information in the required format. These reports consist of several key sections: 1. Introduction: The report typically begins with an introduction, providing an overview of the entity and the purpose and scope of the report. 2. Responsibilities of Management and Accounting Firm: This section outlines the responsibilities of both management and the accounting firm in relation to the preparation and evaluation of the financial statements. 3. Audit Methodology: The report explains the methodology adopted by the accounting firm, including the procedures performed, the extent of testing, and the evaluation of significant accounting estimates and judgments. 4. Findings and Opinions: This section presents the findings of the evaluation, highlighting any material misstatements, weaknesses in internal controls, or non-compliance with accounting standards. The report also includes the accounting firm's professional opinion on the fairness and accuracy of the financial statements. 5. Additional Disclosures: If applicable, the report may include additional disclosures related to uncertainties, contingencies, or subsequent events affecting the financial statements. In conclusion, a Kentucky Report from Review of Financial Statements and Compilation by an Accounting Firm offers an independent and objective assessment of an organization's financial statements. It helps stakeholders make informed decisions and ensures transparency and accountability in financial reporting.Kentucky Report from Review of Financial Statements and Compilation by Accounting Firm: A Kentucky Report from Review of Financial Statements and Compilation by an Accounting Firm is a detailed examination and assessment of the financial statements of an organization based in Kentucky. This report is prepared by a professional accounting firm to provide an independent evaluation of the financial health and performance of the entity under review. The purpose of this report is to offer stakeholders, such as investors, creditors, and management, an objective analysis of the financial statements. It helps them make informed decisions about the organization's future prospects and its ability to fulfill its financial obligations. The report is often used to gauge the entity's financial stability, profitability, and compliance with accounting standards and regulations. There are different types of Kentucky Reports from Review of Financial Statements and Compilation by Accounting Firm, including: 1. Review Report: A Review Report presents the accounting firm's limited assurance on the financial statements. It indicates that the firm has performed analytical procedures and inquiries to identify any significant issues that may suggest a material departure from accounting standards. However, the assurance provided in a review report is less than that of an audit. 2. Compilation Report: A Compilation Report is prepared when an accounting firm assembles financial data provided by the organization into financial statements. The report states that the firm has not audited or reviewed the financial statements but has only assisted the organization in presenting its financial information in the required format. These reports consist of several key sections: 1. Introduction: The report typically begins with an introduction, providing an overview of the entity and the purpose and scope of the report. 2. Responsibilities of Management and Accounting Firm: This section outlines the responsibilities of both management and the accounting firm in relation to the preparation and evaluation of the financial statements. 3. Audit Methodology: The report explains the methodology adopted by the accounting firm, including the procedures performed, the extent of testing, and the evaluation of significant accounting estimates and judgments. 4. Findings and Opinions: This section presents the findings of the evaluation, highlighting any material misstatements, weaknesses in internal controls, or non-compliance with accounting standards. The report also includes the accounting firm's professional opinion on the fairness and accuracy of the financial statements. 5. Additional Disclosures: If applicable, the report may include additional disclosures related to uncertainties, contingencies, or subsequent events affecting the financial statements. In conclusion, a Kentucky Report from Review of Financial Statements and Compilation by an Accounting Firm offers an independent and objective assessment of an organization's financial statements. It helps stakeholders make informed decisions and ensures transparency and accountability in financial reporting.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.