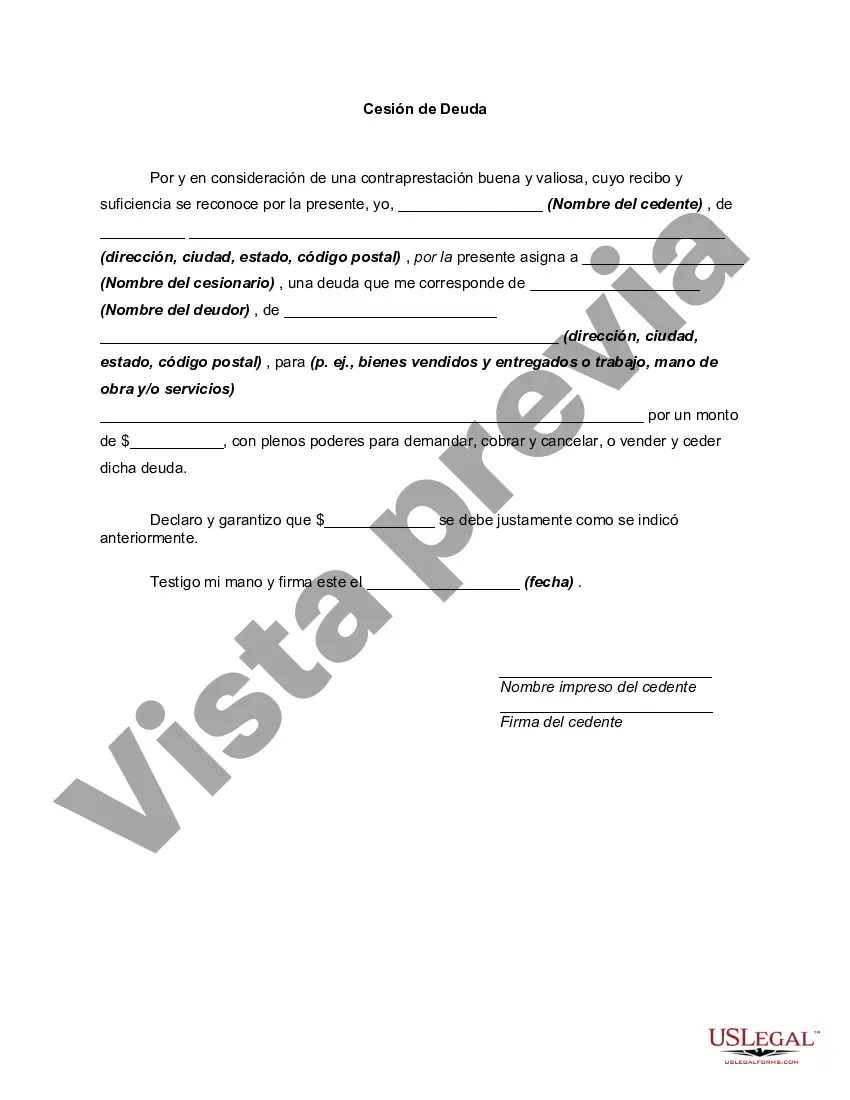

Kentucky Assignment of Debt is a legal process wherein a debt holder transfers their rights and obligations to another party. This allows the new party, known as the assignee, to step into the shoes of the original creditor and collect the debt. A Kentucky Assignment of Debt agreement typically includes essential details such as the names and contact information of the original creditor (assignor) and the new creditor (assignee), the outstanding debt amount, the effective date of the transfer, and any additional terms or conditions agreed upon by both parties. The purpose of a Kentucky Assignment of Debt is to provide an avenue for the assignor to pass over their debt responsibilities to another party due to various reasons, such as financial convenience, strategic business decisions, or debt restructuring. By assigning the debt to a third party, the assignor relinquishes their rights to collect the sum owed and transfers those rights to the assignee. In Kentucky, two main types of Assignment of Debt are commonly used: 1. Legal Assignment of Debt: In this type, the assignor has the legal right to transfer their debt to another party. Debt assignment is usually governed by the terms and conditions of the original loan agreement and any applicable state laws. 2. Equitable Assignment of Debt: This type of debt assignment occurs when the assignor does not have the legal rights to assign the debt but can transfer the rights to the assignee on a rightful expectation of receiving future payments. Equitable assignments are typically used when the assignor's debts arise from contracts that do not explicitly allow for assignment. It is important to note that a Kentucky Assignment of Debt does not discharge, cancel, or modify the debt itself. Instead, it transfers the rights and obligations related to the debt to another party. The assignee steps into the role of the original creditor and assumes the responsibility of collecting the debt, potentially using legal means if necessary. In conclusion, a Kentucky Assignment of Debt is a legal process allowing the transfer of debt rights and obligations from one party to another. It can occur through legal or equitable means, enabling the assignee to collect the debt owed.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Kentucky Cesión de Deuda - Assignment of Debt

Description

How to fill out Kentucky Cesión De Deuda?

It is possible to spend several hours online trying to find the authorized file web template that fits the state and federal requirements you need. US Legal Forms gives thousands of authorized varieties which can be evaluated by specialists. You can easily obtain or printing the Kentucky Assignment of Debt from your support.

If you have a US Legal Forms accounts, you may log in and click on the Obtain button. Afterward, you may full, edit, printing, or indicator the Kentucky Assignment of Debt. Every authorized file web template you acquire is your own eternally. To acquire another copy of the obtained kind, go to the My Forms tab and click on the corresponding button.

If you work with the US Legal Forms web site for the first time, adhere to the simple recommendations listed below:

- Very first, be sure that you have chosen the best file web template for your area/city of your liking. Read the kind information to make sure you have chosen the right kind. If accessible, utilize the Preview button to appear throughout the file web template as well.

- In order to find another model of the kind, utilize the Look for discipline to discover the web template that fits your needs and requirements.

- When you have discovered the web template you desire, click on Get now to carry on.

- Choose the rates strategy you desire, type in your references, and sign up for a merchant account on US Legal Forms.

- Total the purchase. You should use your charge card or PayPal accounts to fund the authorized kind.

- Choose the format of the file and obtain it for your gadget.

- Make alterations for your file if necessary. It is possible to full, edit and indicator and printing Kentucky Assignment of Debt.

Obtain and printing thousands of file layouts using the US Legal Forms site, that offers the most important collection of authorized varieties. Use specialist and condition-distinct layouts to take on your organization or specific demands.

Form popularity

FAQ

To assign debt in Kentucky, you need to draft a Kentucky Assignment of Debt document, clearly outlining the debt amount and the parties involved. It is crucial to include relevant details about the original debt agreement to ensure clarity. Once the assignment is executed, the debtor must be notified so that they are aware of the new creditor. You can simplify this process by utilizing USLegalForms, which offers templates and guidance tailored for Kentucky Assignment of Debt.

The debt collection law in Kentucky includes various protections for consumers against unfair or deceptive practices. Creditors are required to follow state and federal regulations, ensuring fair treatment. When facing challenges related to a Kentucky Assignment of Debt, knowing these laws can empower you. Utilizing resources from US Legal Forms can help you navigate the complexities of debt collection effectively.

Yes, Kentucky offers legitimate options for debt relief, including counseling and settlement services. However, it’s vital to choose reputable organizations to avoid scams. By using platforms like US Legal Forms, you can find the necessary forms and guidance to assist with your Kentucky Assignment of Debt. Always conduct thorough research before committing to any service.

Debts in Kentucky generally become uncollectible after a period of five years due to the statute of limitations. After this time, a creditor may not pursue legal action to collect the debt. Understanding the implications of a Kentucky Assignment of Debt can be beneficial in managing your financial obligations and planning your next steps. It’s wise to consult with experts when navigating these situations.

In Kentucky, the statute of limitations for suing over credit card debt is typically five years. This period starts when you fail to make a payment, not when the debt is created. If someone threatens legal action after this period, it's crucial to understand that such claims may be unenforceable based on Kentucky Assignment of Debt laws. Knowing this can help you manage your debt more confidently.

In Kentucky, debt collectors must follow the Fair Debt Collection Practices Act, which protects consumers from abusive practices. They cannot harass you, lie, or use threats when trying to collect a debt. If you are dealing with a debt collector regarding a Kentucky Assignment of Debt, it’s important to know your rights. You can report any violations to the appropriate authorities.

An assignment for the benefit of creditors in Kentucky is a legal process that allows an individual or business to transfer assets to a trustee. This trustee then sells the assets and distributes the proceeds to creditors. This approach can provide a structured solution for handling debts. Learning about the Kentucky Assignment of Debt can help you determine if this option fits your financial situation.

Creditors typically have one year to collect debts from an estate in Kentucky. This timeframe begins upon the appointment of an executor or administrator for the estate. It’s essential for heirs to be aware of this time limit to manage financial responsibilities beneficially. Utilizing the Kentucky Assignment of Debt can help navigate these legal obligations effectively.

Debts in Kentucky generally become uncollectible after five to fifteen years, depending on the type of debt. For example, written contracts have a five-year limit, while promisory notes can last longer. Once this period passes, your obligation to repay may diminish. Familiarity with the Kentucky Assignment of Debt process can further clarify your options in managing uncollectible debts.

In Kentucky, collectors can pursue debts for a limited time referred to as the statute of limitations. Typically, debt from a written agreement is collectible for five years, while verbal agreements may have a shorter timeframe. After this period, a debt may become uncollectible. Knowing about the Kentucky Assignment of Debt can help you understand your rights regarding older debts.

More info

When you are complaining about someone you have a complaint to, what do you want to be said? When you have a problem, what is the cause? Does the problem have a solution? How are you making your problem a complaint? How can you communicate your concerns? Debt Collection FAQs What about your privacy? What can I do about debt collection calls? Does my name and personal information keep others from my financial record? What can I do about a debt collector harassing me? Does my financial institution notify the debt collection agency if I no longer owe the debt? Is there an exception for military members? Please explain to me if the bank is charging me extra fees to avoid collection? Who can collect delinquent debt on my behalf? What happens if I don't pay the original amount listed on my bill? How do I keep my credit information from being sold to others? I don't owe the debt in question, but my landlord has the wrong address for me, so now his name is on the credit report.