Kentucky Lease of Computer Equipment with Equipment Schedule and Option to Purchase

Description

How to fill out Lease Of Computer Equipment With Equipment Schedule And Option To Purchase?

Are you currently in a situation where you frequently require documents for various business or personal activities.

There are numerous legal document templates available online, but finding reliable forms can be challenging.

US Legal Forms offers a vast collection of document templates, including the Kentucky Lease of Computer Equipment with Equipment Schedule and Option to Purchase, which can be customized to meet state and federal regulations.

Choose a suitable document format and download your copy.

You can view all the document templates you have purchased in the My documents section. You can download an additional copy of the Kentucky Lease of Computer Equipment with Equipment Schedule and Option to Purchase whenever necessary; just click the desired template to download or print it. Utilize US Legal Forms, which offers the most extensive collection of legal documents, to save time and prevent mistakes. This service provides professionally crafted legal document templates for a variety of applications. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Next, you will be able to download the Kentucky Lease of Computer Equipment with Equipment Schedule and Option to Purchase template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- 1. Locate the template you need and ensure it is for your specific state/region.

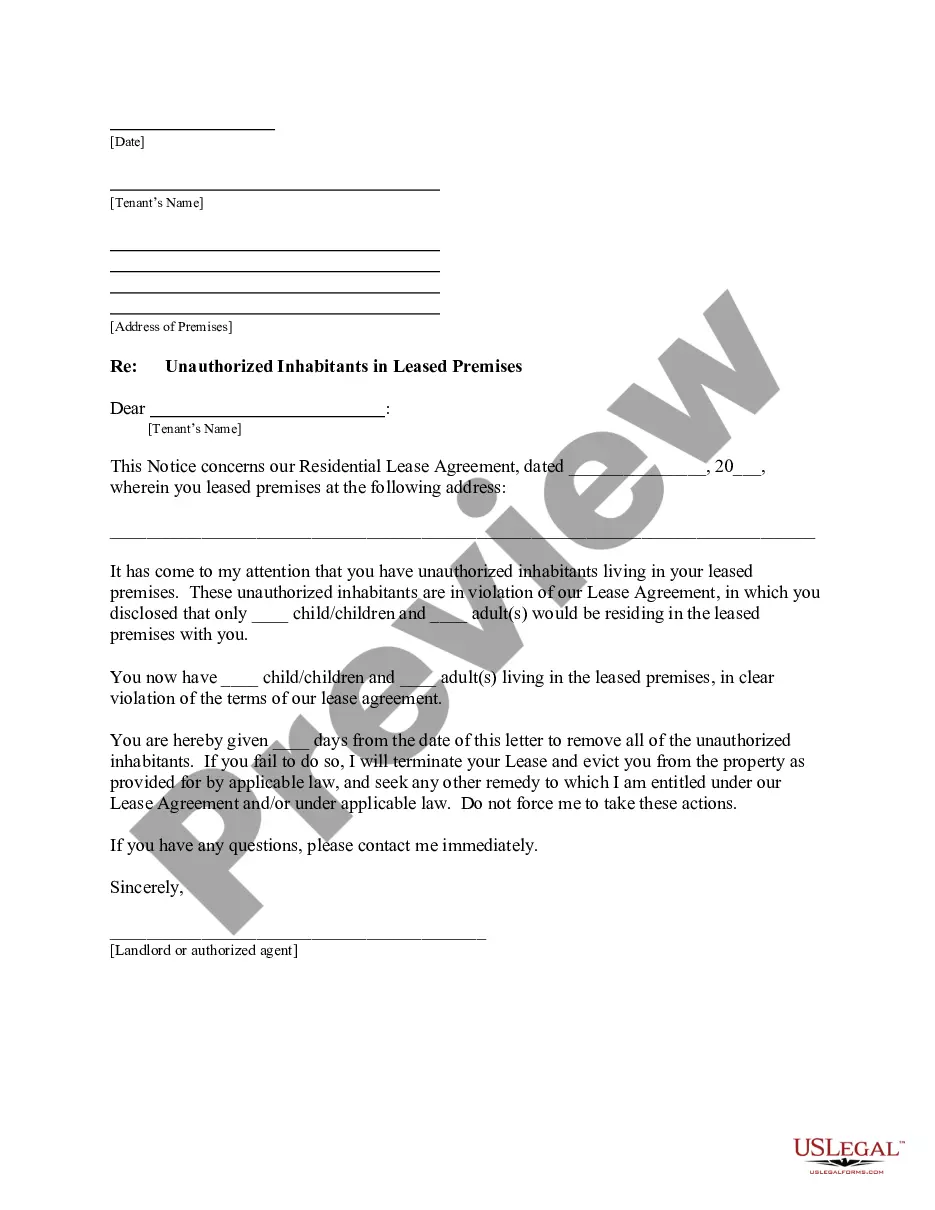

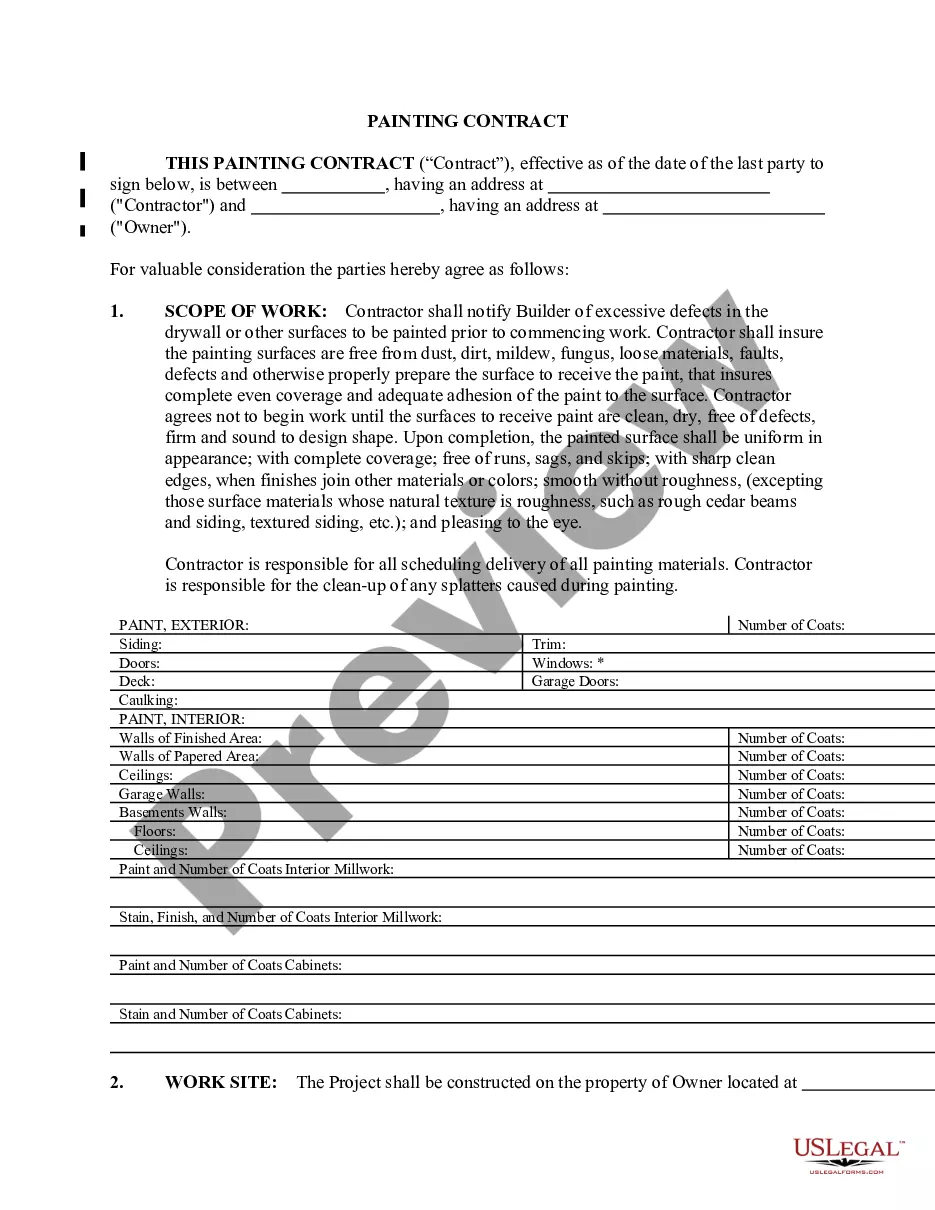

- 2. Utilize the Preview option to review the form.

- 3. Read the description to confirm that you have selected the correct document.

- 4. If the document does not match your needs, use the Lookup field to find a form that suits your requirements.

- When you find the appropriate document, click Purchase now.

- Select the pricing plan that you prefer, fill in the required details to create your account, and complete your purchase using either PayPal or a credit card.

Form popularity

FAQ

For example, if the present value of all lease payments for a production machine is $100,000, record it as a debit of $100,000 to the production equipment account and a credit of $100,000 to the capital lease liability account. Lease payments.

What is equipment leasing? Equipment leasing is a type of financing in which you rent equipment rather than purchase it outright. You can lease expensive equipment for your business, such as machinery, vehicles or computers.

Accounting: Lease is considered an asset (leased asset) and liability (lease payments). Payments are shown on the balance sheet. Tax: As the owner, the lessee claims depreciation expense and interest expense.

Leases are usually easier to obtain and have more flexible terms than loans for buying equipment. This can be a significant advantage if you have bad credit or need to negotiate a longer payment plan to lower your costs. Easier to upgrade equipment. Leasing allows businesses to address the problem of obsolescence.

Leasing capital equipment: Lowers upfront costs, compared to buying equipment outright. Reduces the chance that your company gets stuck with obsolete equipment, if your contract specifies upgrades. Transfers the cost of equipment maintenance to the leasing company, again according to the terms of your contract.

Learn more about Equipment Leasing!Sale/Leaseback: (allows you to use your equipment to get working capital)True Lease or Operating Equipment Leases: (Also known as fair market value leases)The P.U.T. Option Lease (Purchase upon Termination)TRAC Equipment Leases.More items...

4 Types of Equipment LeasesPUT or Purchase Upon Termination Lease. The example we provided above is a PUT option lease.Capital Lease.Operating Equipment Lease.TRAC Lease.

Use the equation associated with calculating equipment lease payments. Payment = Present Value - (Future Value / ( ( 1 + i ) ^n) / 1- (1 / (1 +i ) ^ n ) / i. In this equation, "i" represent the interest rate as a monthly decimal. Convert the interest rate to a monthly decimal.

A $1 Buyout Lease, also called a capital lease, is similar to purchasing equipment with a loan. With this type of lease, there is a higher monthly payment compared with an FMV lease, but at the end of the lease term, the lessee purchases the equipment for $1.

The equipment account is debited by the present value of the minimum lease payments and the lease liability account is the difference between the value of the equipment and cash paid at the beginning of the year. Depreciation expense must be recorded for the equipment that is leased.