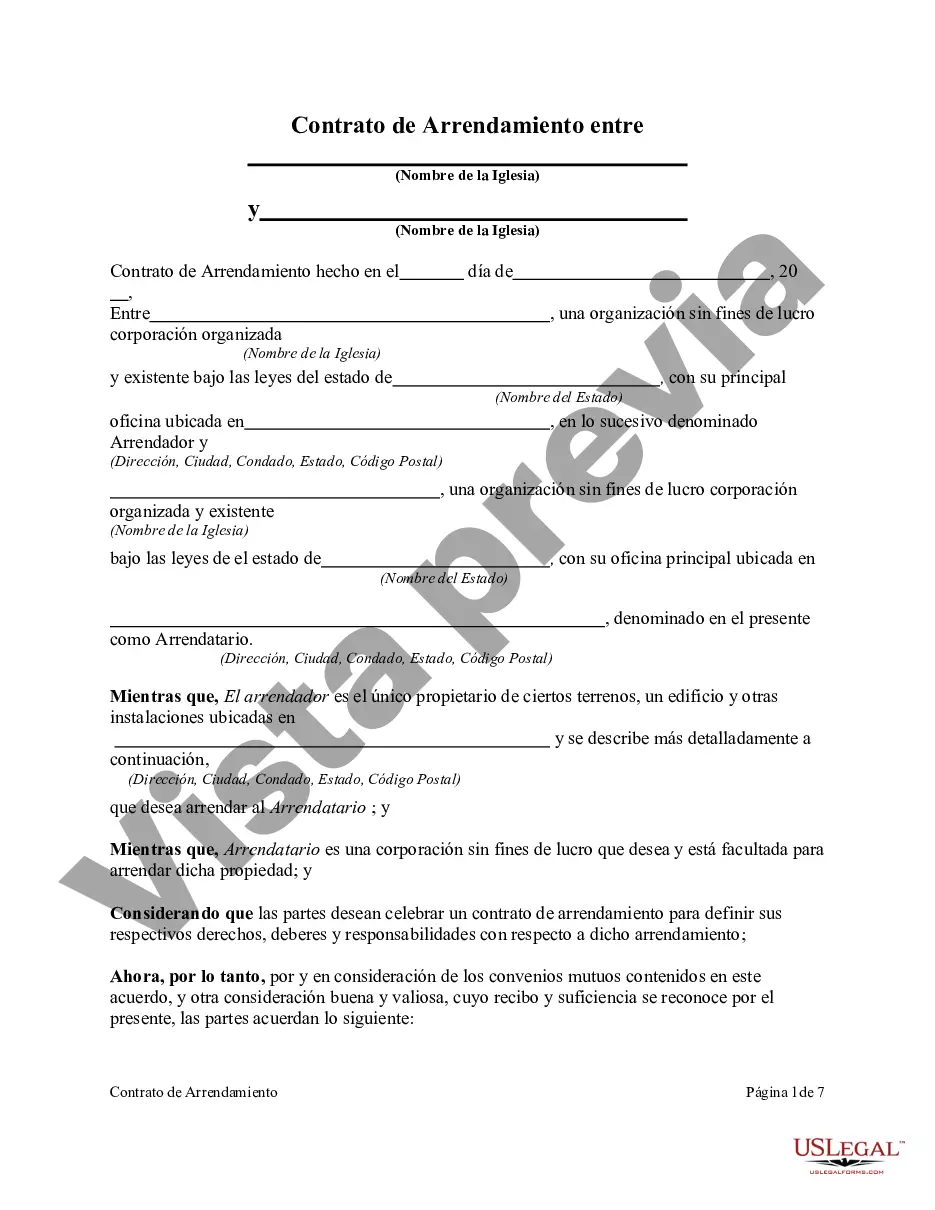

Kentucky Lease Agreement Between Two Nonprofit Church Corporations is a legally binding document that outlines the terms and conditions of a lease contract between two nonprofit church corporations in the state of Kentucky. This agreement is crucial for establishing and maintaining a transparent and mutually beneficial relationship between the involved parties. The lease agreement addresses various aspects to ensure clarity and protection of the rights and obligations of both the lessor (the church corporation that owns the property) and the lessee (the church corporation looking to lease the property). Here are some key components commonly included in this agreement: 1. Identification of Parties: The lease agreement begins by clearly identifying the involved nonprofit church corporations, providing their full legal names and addresses. This ensures that there is no confusion regarding the parties entering into the lease. 2. Property Description: The agreement provides a detailed description of the property being leased, including its address, boundaries, and any specific areas or amenities that are included within the lease. 3. Lease Term and Renewal: This section outlines the duration of the lease, specifying the start and end dates. It may also include provisions for automatic renewal or the option to extend the lease upon mutual agreement. 4. Rental Payment: The agreement specifies the rental amount, how it should be paid, and the frequency of payment (e.g., monthly, quarterly, yearly). Additionally, it may include any late payment penalties or grace periods. 5. Maintenance and Repairs: This section outlines the responsibilities of both parties for property maintenance and repairs. It may specify that the lessor is responsible for structural repairs, while the lessee is responsible for day-to-day maintenance. 6. Use of Property: The agreement details the permitted use of the property, such as for religious services, educational programs, community events, or other nonprofit activities. It may also address any restrictions on activities or alterations that may be made to the property. 7. Insurance and Liability: This section outlines the required insurance coverage for both parties, including liability insurance, property insurance, and worker's compensation. It also specifies which party is responsible for any damages or injuries that occur on the premises. 8. Termination: The agreement includes provisions for early termination, specifying the conditions under which either party can end the lease before its natural expiration. It may also address the return of any security deposits or prepaid rent. Different types of Kentucky Lease Agreements Between Two Nonprofit Church Corporations may vary based on specific circumstances or additional provisions required by either party. Examples include short-term leases, long-term leases, lease agreements for specific areas within a property (e.g., classrooms, parking lots), or leases that include certain rights to use common areas or facilities. In summary, a Kentucky Lease Agreement Between Two Nonprofit Church Corporations is a comprehensive legal document that establishes the terms and conditions for leasing a property between two nonprofit church corporations in Kentucky. It helps ensure a clear and mutually beneficial relationship, outlining rights, responsibilities, and expectations for both parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Kentucky Contrato de arrendamiento entre dos corporaciones eclesiásticas sin fines de lucro - Lease Agreement Between Two Nonprofit Church Corporations

Description

How to fill out Kentucky Contrato De Arrendamiento Entre Dos Corporaciones Eclesiásticas Sin Fines De Lucro?

Finding the right lawful papers design can be a battle. Of course, there are tons of themes available on the net, but how can you obtain the lawful develop you need? Make use of the US Legal Forms internet site. The service delivers a large number of themes, including the Kentucky Lease Agreement Between Two Nonprofit Church Corporations, which can be used for business and private demands. Every one of the types are checked out by pros and satisfy federal and state needs.

If you are previously authorized, log in for your profile and then click the Down load switch to obtain the Kentucky Lease Agreement Between Two Nonprofit Church Corporations. Make use of your profile to check through the lawful types you have purchased in the past. Proceed to the My Forms tab of your own profile and get yet another version in the papers you need.

If you are a brand new user of US Legal Forms, listed below are basic instructions for you to comply with:

- Very first, be sure you have selected the right develop to your town/area. It is possible to look over the form utilizing the Preview switch and look at the form explanation to make sure it will be the right one for you.

- If the develop fails to satisfy your requirements, make use of the Seach discipline to get the right develop.

- Once you are sure that the form is proper, select the Buy now switch to obtain the develop.

- Choose the pricing program you would like and enter the needed info. Build your profile and pay money for an order making use of your PayPal profile or credit card.

- Opt for the file structure and acquire the lawful papers design for your device.

- Complete, change and print and sign the received Kentucky Lease Agreement Between Two Nonprofit Church Corporations.

US Legal Forms is definitely the biggest catalogue of lawful types that you will find a variety of papers themes. Make use of the service to acquire professionally-created documents that comply with condition needs.