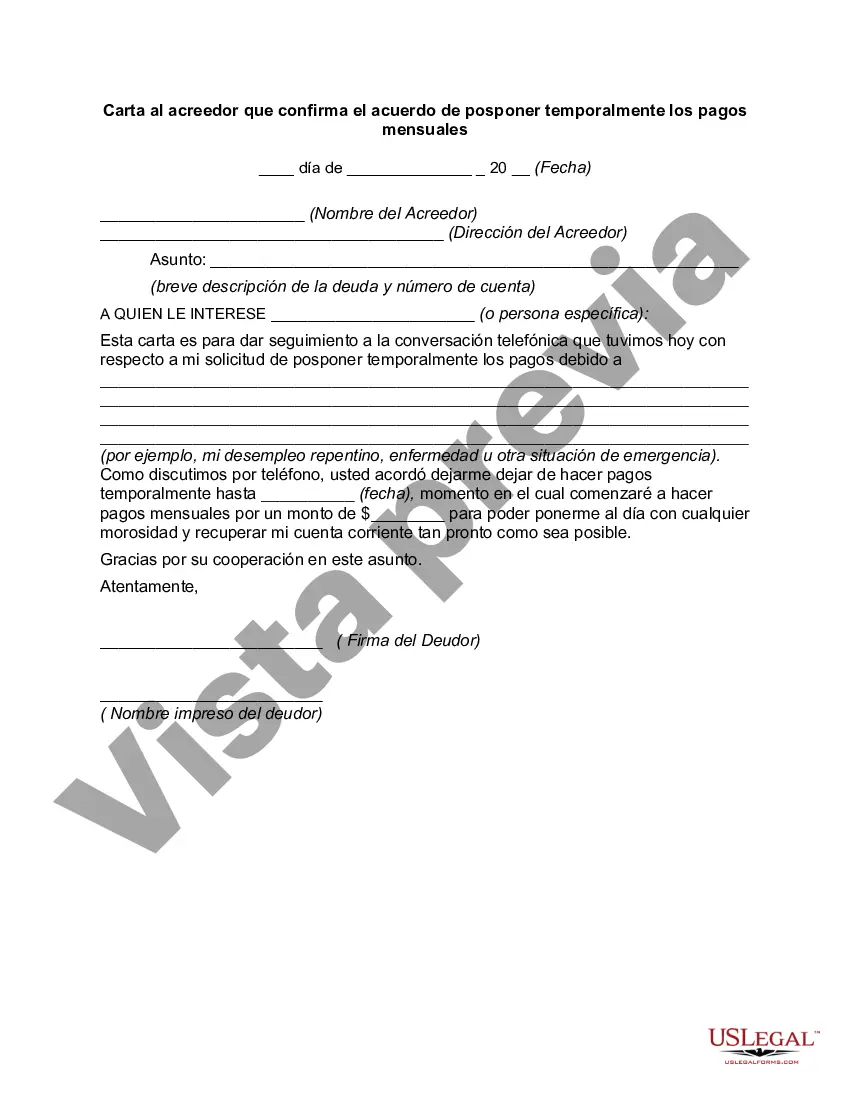

Title: Kentucky Letter to Creditor Confirming Agreement to Temporarily Postpone Monthly Payments: A Detailed Overview Introduction: In Kentucky, individuals who are facing financial hardships and struggling to meet their monthly obligations can draft a Letter to their creditors to request temporary postponement of payments. This agreement allows the debtor some relief during a difficult period and confirms the understanding between the creditor and the debtor. In this article, we will explore the key components of a Kentucky Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed, along with different types based on the specific circumstances. Key Elements of a Kentucky Letter to Creditor Confirming Agreement: 1. Contact Information: Include your name, address, phone number, and email address at the beginning of the letter. Similarly, provide the creditor's name, address, and contact details. 2. Reference to the Initial Agreement: Mention the original creditor-debtor agreement, including the account number and the date it was established. This serves as a reference point for the creditor to identify the account accurately. 3. Statement of Financial Hardship: Explain the reasons for the financial hardship causing an inability to meet the regular payment schedule. It is crucial to provide detailed information, such as job loss, medical expenses, family emergencies, or any other relevant circumstance causing financial strain. 4. Request for Temporarily Postponed Payments: Clearly state your request to temporarily postpone monthly payments towards the debt until your financial situation improves. Make it explicit that you acknowledge your obligation to catch up on missed payments once your financial situation stabilizes. 5. Proposed Duration of Payment Postponement: Specify the exact duration during which you seek postponement of payments. Whether it is a specific number of months or until a certain event occurs, be clear about the time frame. 6. Confirmation of Understanding: Ensure to emphasize your commitment to fulfilling the revised payment plan once the temporary postponement period ends. State that you understand and will comply with any new terms and conditions that may arise during this period. 7. Request for Confirmation: Kindly ask the creditor to provide written confirmation of their acceptance of the agreement by signing and returning a copy of the letter. Types of Kentucky Letters to Creditor Confirming Agreement: 1. Kentucky Letter to Creditor Confirming Agreement for Medical Expenses: This letter addresses the financial burden arising from sudden, unexpected medical expenses. It highlights the inability to pay regular bills due to mounting medical bills and requests temporary postponement of payments. 2. Kentucky Letter to Creditor Confirming Agreement for Job Loss: Designed for individuals who have lost their jobs, this letter explains the sudden loss of income and seeks temporary relief from monthly payments until new employment is secured. 3. Kentucky Letter to Creditor Confirming Agreement for Family Emergency: When an unforeseen family emergency, such as a natural disaster or a personal crisis, affects an individual's financial stability, this letter allows for a temporary postponement of payments until the emergency situation is resolved. Conclusion: A Kentucky Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed provides debtors with an opportunity to communicate their financial hardships and seek temporary relief. By following the essential components mentioned above and adapting them to the specific circumstance, individuals in Kentucky can engage in a transparent and mutually beneficial agreement with their creditors.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Kentucky Carta al acreedor que confirma el acuerdo de posponer temporalmente los pagos mensuales - Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed

Description

How to fill out Kentucky Carta Al Acreedor Que Confirma El Acuerdo De Posponer Temporalmente Los Pagos Mensuales?

If you want to full, download, or printing legitimate document web templates, use US Legal Forms, the largest assortment of legitimate types, which can be found on the web. Make use of the site`s simple and easy convenient research to obtain the paperwork you need. Different web templates for organization and person uses are categorized by categories and says, or search phrases. Use US Legal Forms to obtain the Kentucky Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed in just a number of mouse clicks.

Should you be presently a US Legal Forms consumer, log in for your profile and click on the Acquire button to have the Kentucky Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed. Also you can access types you formerly downloaded within the My Forms tab of your respective profile.

If you are using US Legal Forms initially, follow the instructions below:

- Step 1. Ensure you have chosen the shape to the correct town/land.

- Step 2. Make use of the Review method to check out the form`s information. Never neglect to see the information.

- Step 3. Should you be not satisfied with all the form, use the Research field on top of the display screen to find other types of your legitimate form template.

- Step 4. When you have discovered the shape you need, click on the Buy now button. Pick the costs strategy you like and include your accreditations to sign up for the profile.

- Step 5. Process the financial transaction. You may use your credit card or PayPal profile to accomplish the financial transaction.

- Step 6. Select the structure of your legitimate form and download it on your own device.

- Step 7. Complete, modify and printing or sign the Kentucky Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed.

Every legitimate document template you acquire is your own property forever. You might have acces to each and every form you downloaded within your acccount. Click on the My Forms area and decide on a form to printing or download again.

Remain competitive and download, and printing the Kentucky Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed with US Legal Forms. There are thousands of professional and express-specific types you can utilize for your personal organization or person needs.