Kentucky Monthly Retirement Planning

Description

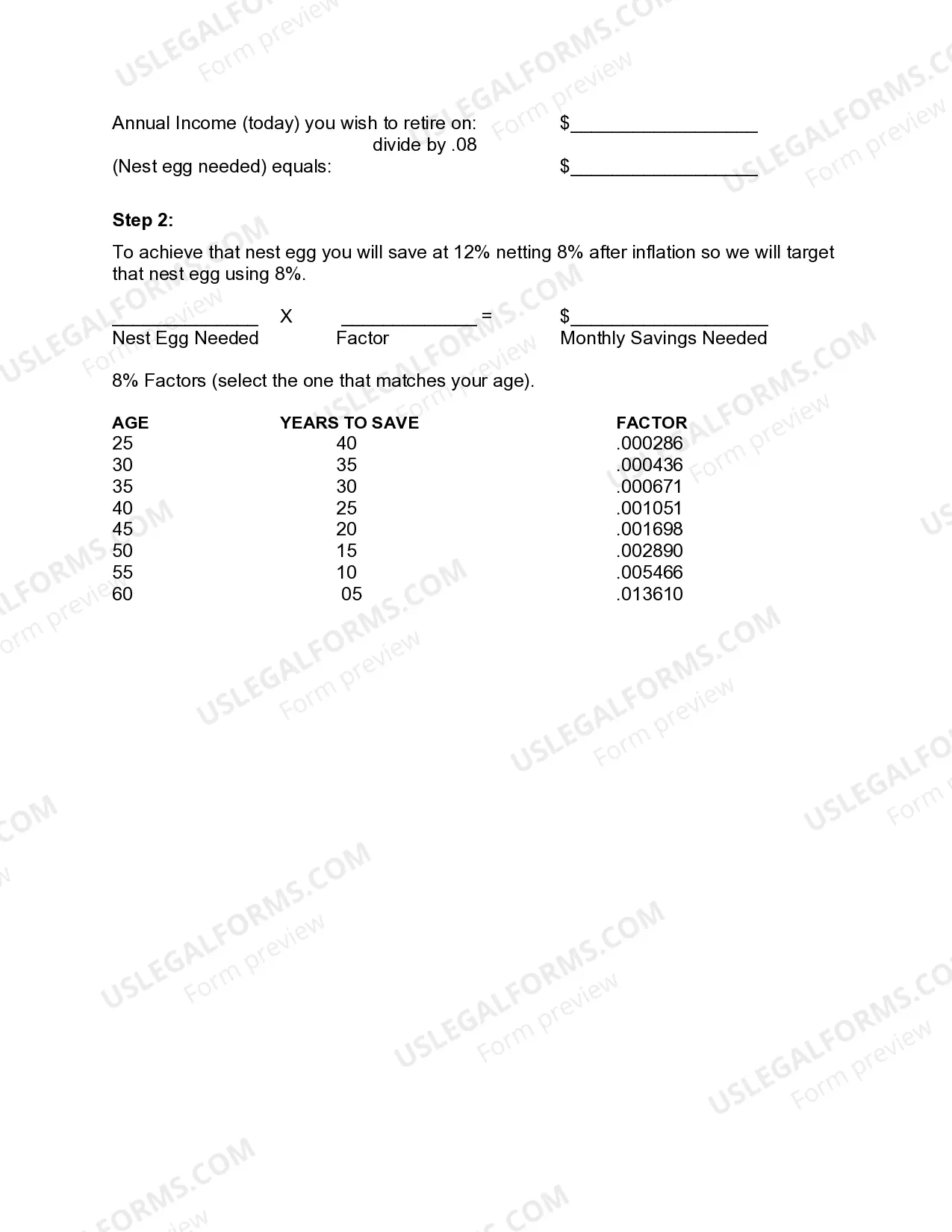

How to fill out Monthly Retirement Planning?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a diverse selection of legal document templates that you can download or print.

By using the website, you can access thousands of forms for both business and personal use, organized by categories, states, or keywords.

You can obtain the latest versions of forms such as the Kentucky Monthly Retirement Planning in just moments.

Review the form information to confirm that you have chosen the appropriate form.

If the form does not meet your requirements, use the Search field near the top of the screen to find one that does.

- If you already possess a membership, Log In and download Kentucky Monthly Retirement Planning from your US Legal Forms library.

- The Download button will appear on every form you view.

- You have access to all previously saved forms in the My documents section of your account.

- To utilize US Legal Forms for the first time, here are straightforward steps to get started.

- Ensure you have selected the correct form for your city/state.

- Click the Preview button to review the form's details.

Form popularity

FAQ

At least 25 years of service credit, up to 27 years of service, at any age.

Members pay a pre-tax 5% rate based on creditable compensation, if nonhazardous; 8% if hazardous duty. Employers pay different rates based on the member's system, and nonhazardous vs. hazardous duty. The employer contributions are paid into the Retirement Allowance Account, and are used for paying monthly benefits.

To calculate the rule of 85, companies take your age and add it to your years of service. If those numbers add up to 85, you are eligible for early retirement. For example, a 55-year-old with 30 years of service would meet the standards of the rule of 85, because her age plus her years of service equals 85.

How are my Social Security retirement benefits calculated? Social Security benefits are based on earnings averaged over most of a worker's lifetime. Your actual earnings are first adjusted or "indexed" to account for changes in average wages since the year the earnings were received.

The County Employees Retirement System (CERS) is part of the Kentucky Retirement Systems (KRS) and pays a monthly benefit upon retirement based on the type of retirement and years of credited service. Participants also contribute to the Social Security and Medicare Systems.

Kentucky is one of only five states nationwide where a 65 year old can retire and live comfortably with less than $900,000.

Your retirement benefit is calculated using a formula with three factors: Service credit (Years) multiplied by your benefit factor (percentage per year) multiplied by your final monthly compensation equals your unmodified allowance. Service Credit - Total years of employment with a CalPERS employer.

25 or more years of service may retire at any time with no reduction in benefits. Age 60 or older, with at least 60 months of service credit may retire at any time with no reduction in benefits.

A Tier One member's Final Compensation, or Salary Average, is determined by dividing the total salary earned (5-High or 3-High) by the total months worked, then multiplying by twelve (12). Nonhazardous retirement benefits are based upon a 5-High Final Compensation.

The requirements for an Unreduced Benefit are:25 or more years of service may retire at any time with no reduction in benefits. Age 60 or older, with at least 60 months of service credit may retire at any time with no reduction in benefits.