A private annuity agreement, commonly referred to as a Kentucky private annuity agreement, is a legal contract that provides a means for individuals to transfer assets to a third party in exchange for regular income payments for the remainder of their lives. This arrangement is primarily used for estate planning purposes by individuals living in Kentucky. By entering into a private annuity agreement, individuals can efficiently transfer their wealth while potentially minimizing estate taxes. This type of annuity agreement operates on the principle of exchanging assets for income streams, where the annuitant (the individual transferring the assets) agrees to receive periodic payments from the annuitant's asset purchaser (the third party). The annuitant relinquishes all ownership rights to the transferred assets, which then become the property of the asset purchaser. The Kentucky private annuity agreement is often beneficial when individuals want a combination of steady income and estate planning advantages. By transferring assets through this agreement, individuals can remove the assets from their estate, effectively reducing the size of their taxable estate upon their passing. Reduced estate taxes allow individuals to preserve a larger portion of their wealth for their beneficiaries. Different types of private annuity agreements in Kentucky include: 1. Traditional Private Annuity Agreement: This is the standard form of the private annuity agreement, where the assets are transferred to the annuity purchaser in exchange for regular annuity payments until the annuitant's death. 2. Kentucky Deferred Private Annuity Agreement: This agreement is similar to the traditional private annuity agreement, with the difference being that the annuity payments are delayed until a predetermined date or event, providing the annuitant with more control over when the income stream begins. 3. Advanced Estate Planning Private Annuity Agreement: This particular type of private annuity agreement incorporates more complex estate planning strategies, such as utilizing a trust or incorporating certain tax planning techniques, to maximize the overall benefits for the annuitant and their beneficiaries. It is crucial to consult with an experienced estate planning attorney or financial advisor before entering into any private annuity agreement in Kentucky. They can provide personalized guidance on the appropriate type of private annuity agreement and help ensure compliance with all legal and tax requirements.

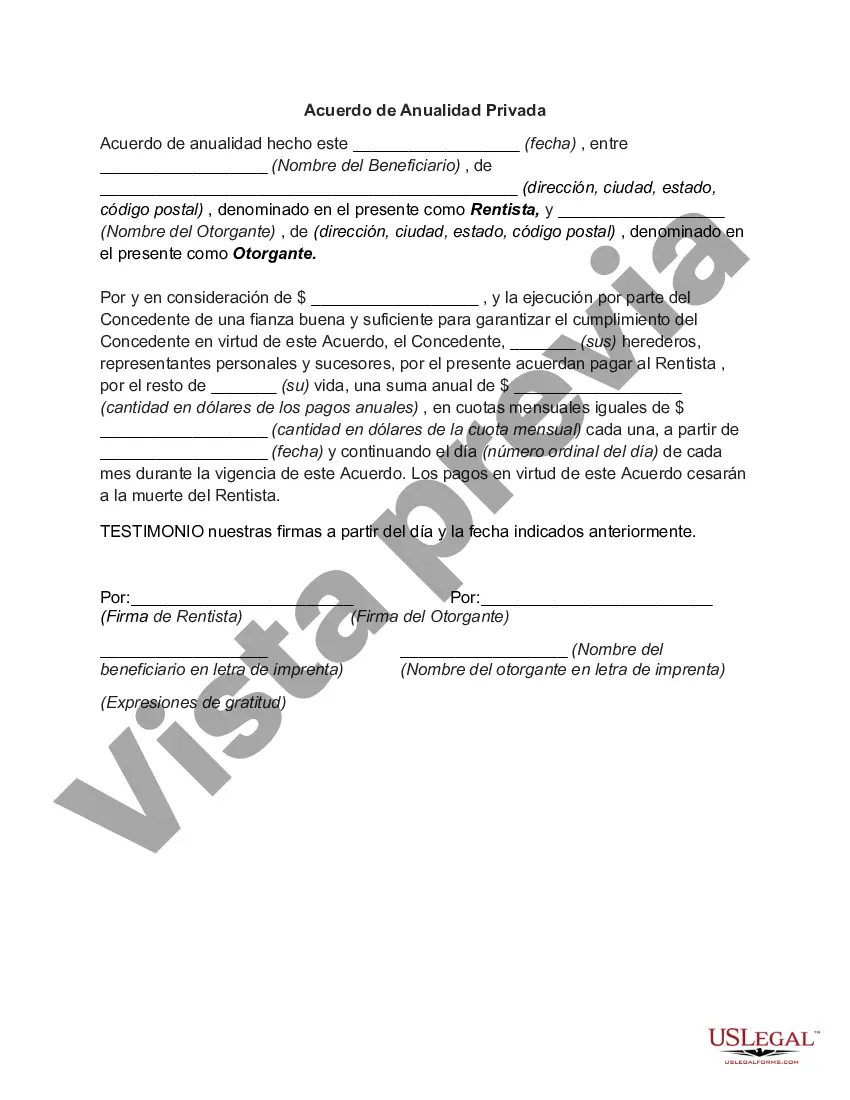

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Kentucky Acuerdo de Anualidad Privada - Private Annuity Agreement

Description

How to fill out Kentucky Acuerdo De Anualidad Privada?

Finding the right lawful papers design can be a battle. Obviously, there are plenty of layouts accessible on the Internet, but how can you obtain the lawful form you require? Utilize the US Legal Forms site. The services offers thousands of layouts, such as the Kentucky Private Annuity Agreement, which you can use for enterprise and private requires. All the varieties are inspected by pros and satisfy federal and state specifications.

In case you are currently registered, log in to your bank account and then click the Down load option to obtain the Kentucky Private Annuity Agreement. Use your bank account to look throughout the lawful varieties you possess acquired earlier. Check out the My Forms tab of the bank account and obtain yet another backup in the papers you require.

In case you are a whole new user of US Legal Forms, allow me to share straightforward instructions so that you can adhere to:

- Very first, be sure you have chosen the appropriate form for your personal area/county. You can check out the shape utilizing the Preview option and read the shape information to make sure it is the best for you.

- In case the form is not going to satisfy your requirements, use the Seach area to discover the right form.

- Once you are sure that the shape is acceptable, click on the Get now option to obtain the form.

- Opt for the costs strategy you want and type in the required info. Build your bank account and pay for the transaction using your PayPal bank account or credit card.

- Opt for the submit format and download the lawful papers design to your system.

- Comprehensive, modify and print and indication the received Kentucky Private Annuity Agreement.

US Legal Forms is definitely the most significant local library of lawful varieties for which you will find a variety of papers layouts. Utilize the company to download skillfully-made documents that adhere to express specifications.

Form popularity

FAQ

Certain goods are exempt from sales and use tax including coal and other energy-producing fuels, certain medical items, locomotives or rolling stock, certain farm machinery and livestock, certain seeds and farm chemicals, machinery for new and expanded industry, tombstones, textbooks, property certified as an alcohol

Kentucky allows pension income (including annuities, IRA accounts, 401(k) and similar deferred compensation plans, death benefits, etc.) paid under a written retirement plan to be excluded from income on the Kentucky return.

Or are a part-year Kentucky resident and:while a nonresident. File Form 740-NPR if you are a resident of a reciprocal state: Illinois, Indiana, Michigan, Ohio, Virginia, West Virginia and Wisconsin and you had Kentucky income tax withheld and had no other income from Kentucky sources.

Do you pay taxes on annuities? You do not owe income taxes on your annuity until you withdraw money or begin receiving payments. Upon a withdrawal, the money will be taxed as income if you purchased the annuity with pre-tax funds. If you purchased the annuity with post-tax funds, you would only pay tax on the earnings.

Annuities Can Be Complex.Your Upside May Be Limited.You Could Pay More in Taxes.Expenses Can Add Up.Guarantees Have a Caveat.Inflation Can Erode Your Annuity's Value.The Bottom Line.

Once your contract has matured, you can choose to keep your money in the annuity. You won't receive any checks from the life insurance company. That is, unless you opt to withdraw money on your own or start your income payments according to a definitive withdrawal schedule set by the insurer.