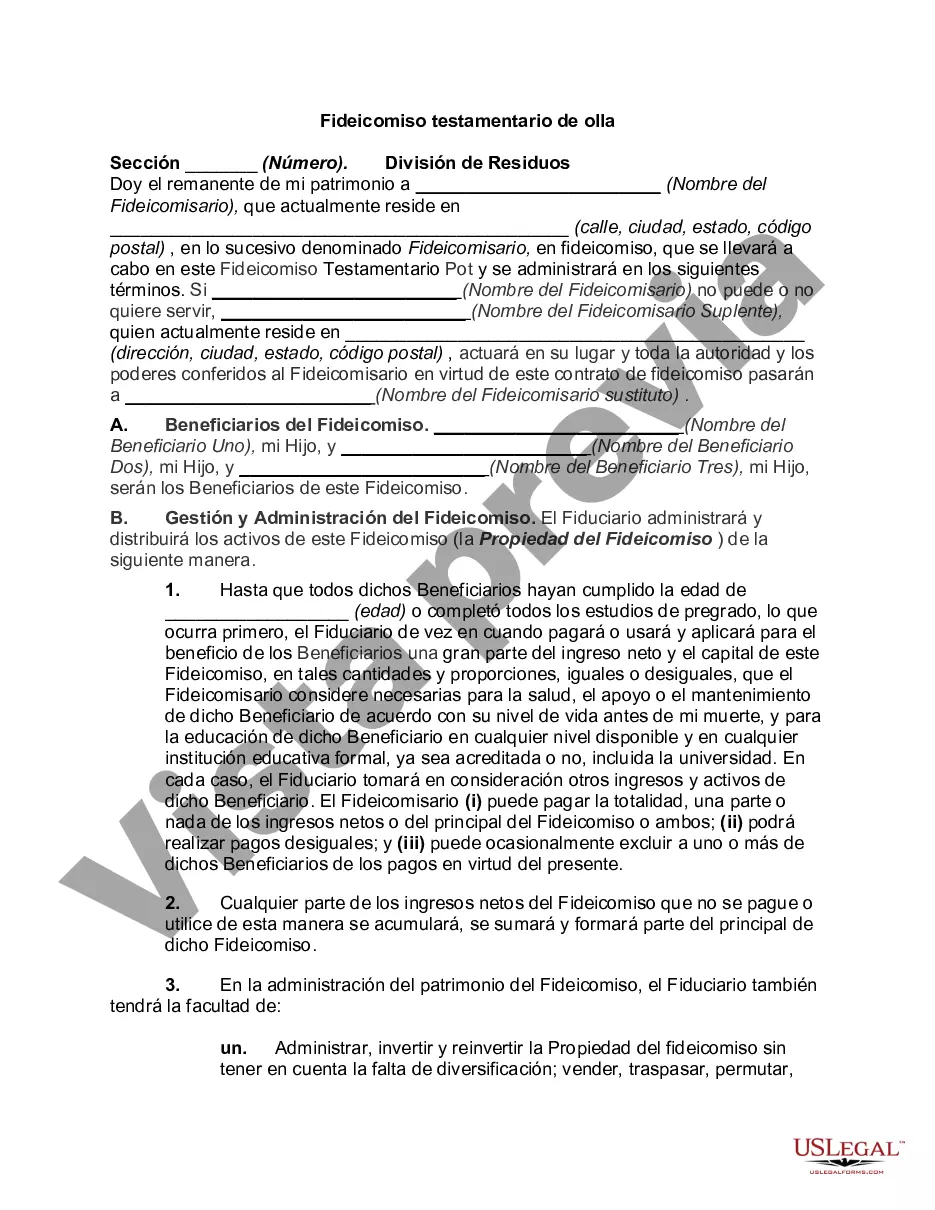

A Kentucky Pot Testamentary Trust is a type of trust that is established in Kentucky, United States, upon the death of the granter (testator). This trust is created through a Last Will and Testament and becomes effective only upon the testator's death. It is designed to hold and manage the estate assets for the benefit of the beneficiaries, who are usually the heirs and/or loved ones of the deceased. Keywords: Kentucky Pot Testamentary Trust, trust, Kentucky, granter, testator, Last Will and Testament, beneficiaries, estate assets, heirs, loved ones. There are several types of Kentucky Pot Testamentary Trusts that can be established depending on the specific goals and wishes of the granter. Some common types include: 1. Discretionary Trust: This type of trust gives the trustee (person responsible for managing the trust) full discretion over how and when to distribute the trust assets to the beneficiaries. The trustee follows the guidelines set by the granter but has the power to make decisions based on the individual circumstances of each beneficiary. 2. Support Trust: A support trust provides for the basic needs (such as food, shelter, education, medical expenses) of the beneficiaries. The trustee has the discretion to make distributions necessary for the well-being of the beneficiaries, ensuring they have the support they need throughout their lifetime. 3. Spendthrift Trust: A spendthrift trust is designed to protect the beneficiaries from creditors and potential financial mismanagement. The trust assets are managed by the trustee and cannot be accessed by creditors or seized in case of bankruptcy. The trustee has control over the distribution of funds to the beneficiaries according to the granter's instructions. 4. Special Needs Trust: This type of trust is created to benefit beneficiaries with special needs or disabilities. The trust is designed to supplement government benefits without disqualifying the beneficiary from receiving such aid. The trustee manages the assets to ensure they are used for the beneficiary's benefit, such as education, healthcare, and quality of life. 5. Charitable Trust: A Kentucky Pot Testamentary Charitable Trust is created with the purpose of benefiting charitable organizations or causes. The trust assets are devoted to supporting charitable activities, and the trustee is responsible for ensuring that the funds are distributed in line with the granter's philanthropic goals. In conclusion, a Kentucky Pot Testamentary Trust is a legal vehicle used to manage and distribute assets after the death of the granter. It offers flexibility in tailoring the trust's provisions to cater to the unique needs of the beneficiaries and provides peace of mind for the granter knowing their assets will be administered according to their wishes. Note: Please consult with an attorney or estate planning professional for specific guidance on establishing a Kentucky Pot Testamentary Trust, as laws and regulations may vary and change over time.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Kentucky Fideicomiso testamentario de olla - Pot Testamentary Trust

Description

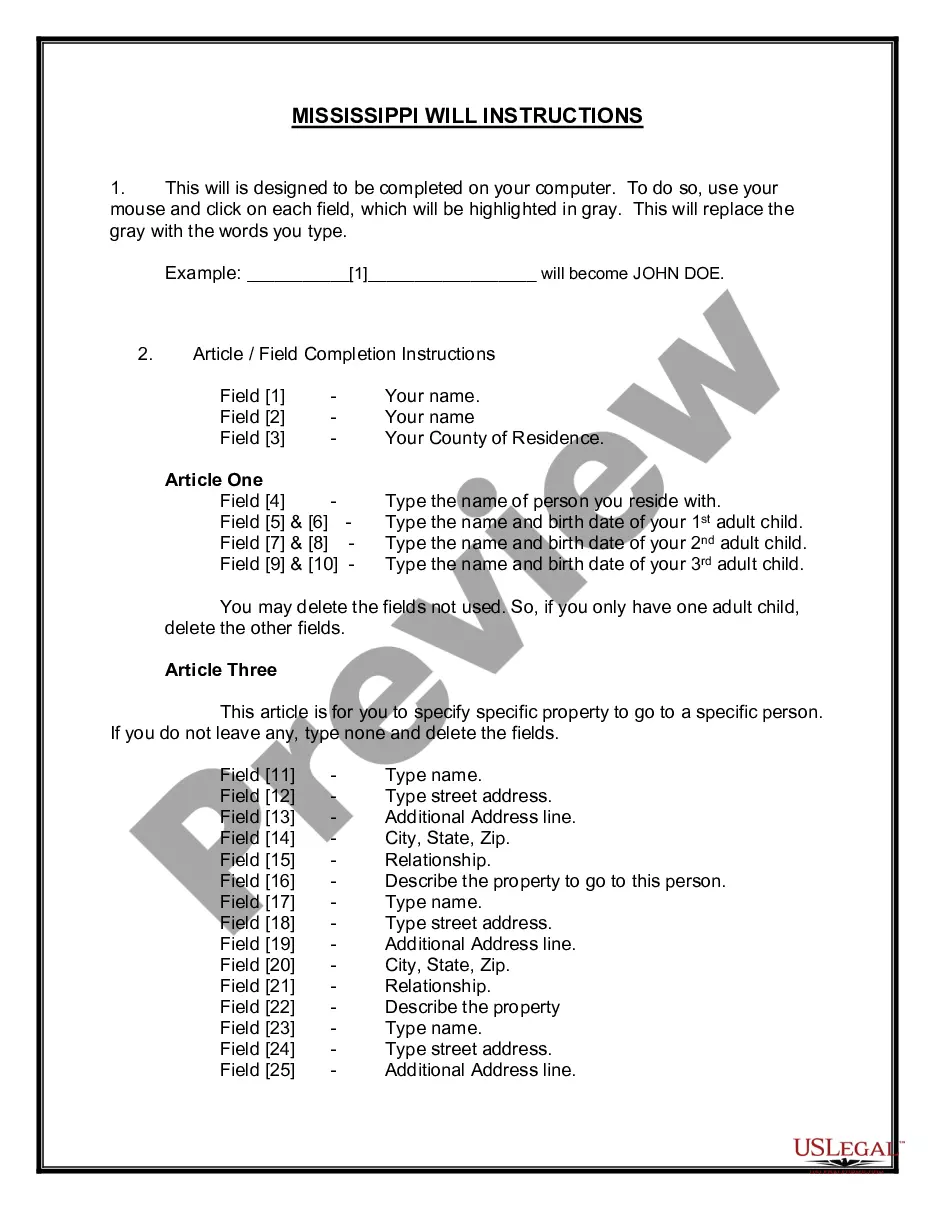

How to fill out Kentucky Fideicomiso Testamentario De Olla?

Choosing the best authorized record format can be quite a have a problem. Needless to say, there are tons of web templates accessible on the Internet, but how would you discover the authorized develop you want? Make use of the US Legal Forms web site. The service provides thousands of web templates, including the Kentucky Pot Testamentary Trust, which you can use for company and private requirements. All of the types are checked out by experts and meet up with federal and state demands.

Should you be presently authorized, log in for your profile and click the Acquire option to find the Kentucky Pot Testamentary Trust. Make use of your profile to look with the authorized types you might have purchased formerly. Go to the My Forms tab of your own profile and obtain yet another version of the record you want.

Should you be a new consumer of US Legal Forms, allow me to share basic recommendations for you to follow:

- Initially, ensure you have selected the proper develop for the city/area. You are able to examine the shape while using Preview option and browse the shape description to make certain it will be the right one for you.

- If the develop does not meet up with your expectations, use the Seach discipline to obtain the right develop.

- When you are positive that the shape would work, go through the Get now option to find the develop.

- Choose the costs prepare you desire and enter in the necessary details. Design your profile and pay for the transaction using your PayPal profile or bank card.

- Select the submit structure and obtain the authorized record format for your product.

- Comprehensive, change and print and indication the attained Kentucky Pot Testamentary Trust.

US Legal Forms is definitely the greatest library of authorized types for which you can see different record web templates. Make use of the company to obtain appropriately-produced files that follow express demands.