Kentucky Declaration of Gift with Signed Acceptance by Donee

Description

How to fill out Declaration Of Gift With Signed Acceptance By Donee?

Have you ever been in a situation where you need paperwork for either business or personal purposes nearly all the time.

There are numerous legal document templates available online, but finding trustworthy ones can be challenging.

US Legal Forms provides a vast array of form templates, including the Kentucky Declaration of Gift with Signed Acceptance by Donee, designed to meet federal and state standards.

When you find the correct form, simply click Get now.

Select the pricing plan you prefer, fill in the necessary details to create your account, and complete the transaction using your PayPal or credit card.

- If you are currently familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can acquire the Kentucky Declaration of Gift with Signed Acceptance by Donee template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Find the form you need and confirm it is for the correct city/state.

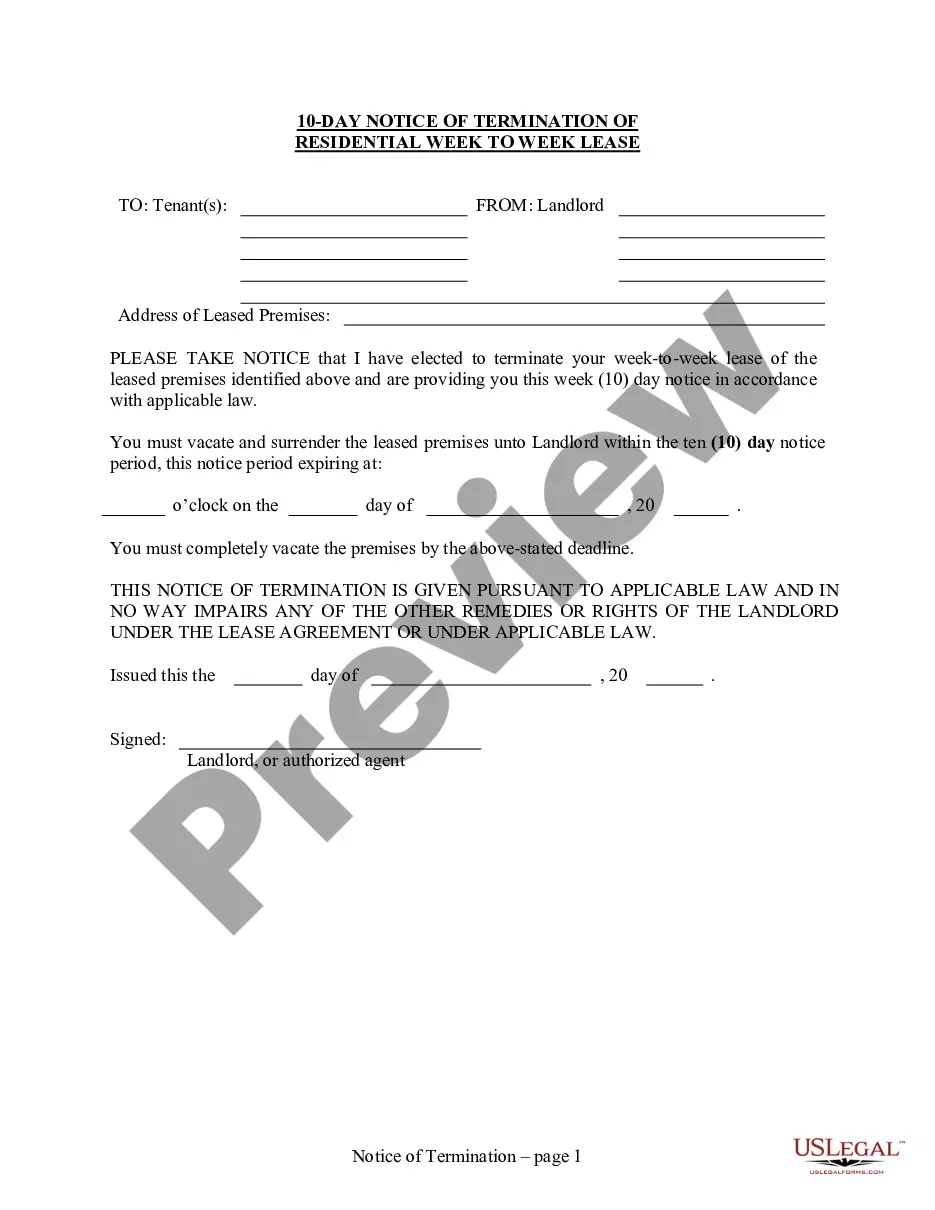

- Use the Preview button to take a look at the form.

- Read the description to ensure you have chosen the right form.

- If the form isn’t what you’re looking for, use the Search box to find the form that meets your needs.

Form popularity

FAQ

A gift under transfer of property refers to the voluntary transfer of ownership without expecting anything in return. This legal act is often formalized by a Kentucky Declaration of Gift with Signed Acceptance by Donee, which solidifies the transaction in a legal context. It ensures both parties understand their rights and responsibilities.

According to Section 122 of the Act, the acceptance of a gift should be made while the donor is still capable of giving the gift and during the donor's lifetime. The donee should also accept the gift before he dies. If the donee dies before accepting such gift, then the gift becomes invalid (or void).

For an inter vivos gift to be valid, three elements must be met:There is present donative intent. In other words, the donor intends to make a gift now.The delivery of the gift. Delivery can be a physical delivery or a constructive delivery (things that are not practical to be delivered by hand).Acceptance.

You make a gift if you give property (including money), or the use of or income from property, without expecting to receive something of at least equal value in return. If you sell something at less than its full value or if you make an interest-free or reduced-interest loan, you may be making a gift.

Who pays the gift tax? The donor is generally responsible for paying the gift tax. Under special arrangements the donee may agree to pay the tax instead.

The person who makes a gift is known as the donor. The person who receives a gift is known as the donee. There are three basic time periods during which a person can make a gift.

A donee may also be a person who is unable to express acceptance. A gift can be made to a child and could be accepted on the child's behalf. The donee must be an ascertainable person. A gift involves the process of giving and taking which are two simultaneous and reciprocal acts.

Donor agrees and acknowledges that all gifts of money or property to the Fund are accepted subject at all times to applicable law, including, but not by way of limitation, provisions for presumption of donor intent and variance from donor direction.

Acceptance The final requirement for a valid gift is acceptance, which means that the donee unconditionally agrees to take the gift. It is necessary for the donee to agree at the same time the delivery is made. The gift can, however, be revoked at any time prior to acceptance.

Legal Definition of donee : one that receives or is granted something (as a gift or power)