The Kentucky Waiver of Qualified Joint and Survivor Annuity (JSA) is an important provision that affects retirement benefits and pension plans. This waiver is specifically applicable to residents of Kentucky who participate in pension plans governed by the state's retirement system. The purpose of the Kentucky Waiver of JSA is to provide flexibility to plan participants regarding the distribution of their retirement benefits. Normally, under federal regulations, pension plans are required to provide a Qualified Joint and Survivor Annuity (JSA) as the default benefit option. This means that if a plan participant is married, their benefits must be paid as a joint and survivor annuity, guaranteeing a continuing income stream to their surviving spouse. However, the Kentucky Waiver of Qualified Joint and Survivor Annuity allows plan participants to elect an alternate form of distribution, deviating from the standard JSA provisions. By signing the waiver, participants can choose other payment options that better suit their financial goals or circumstances. It's important to note that the Kentucky Waiver of JSA comes in different forms, meaning there are multiple types available. These options differ in terms of their impact on the participant's retirement benefits and potential survivor benefits. Some common types of Kentucky Waiver of JSA include: 1. Partial Waiver: This type allows plan participants to waive a portion of their JSA benefit, giving them flexibility to provide additional benefits to their spouse or designated beneficiary. 2. Single-Life Annuity Waiver: With this waiver, participants can choose to receive their pension as a single-life annuity, which guarantees income throughout their lifetime but does not provide survivor benefits to a spouse or beneficiary after their death. 3. Lump Sum Waiver: This waiver enables plan participants to receive their retirement benefits as a lump sum payment instead of an annuity, providing immediate access to their funds. However, it's important to consider potential tax implications and budgeting needs before selecting this option. 4. Customized Waiver: Some pension plans may allow participants to design a customized waiver specific to their circumstances. This option could involve defining unique provisions, such as allocating a fixed percentage of benefits to the spouse while retaining flexibility for the remaining amount. In summary, the Kentucky Waiver of Qualified Joint and Survivor Annuity (JSA) offers Kentucky residents participating in pension plans the ability to modify their retirement benefit distribution options to better align with their financial objectives. It's crucial for individuals to thoroughly understand the various types of waivers available and their implications to make an informed decision about their pension benefits.

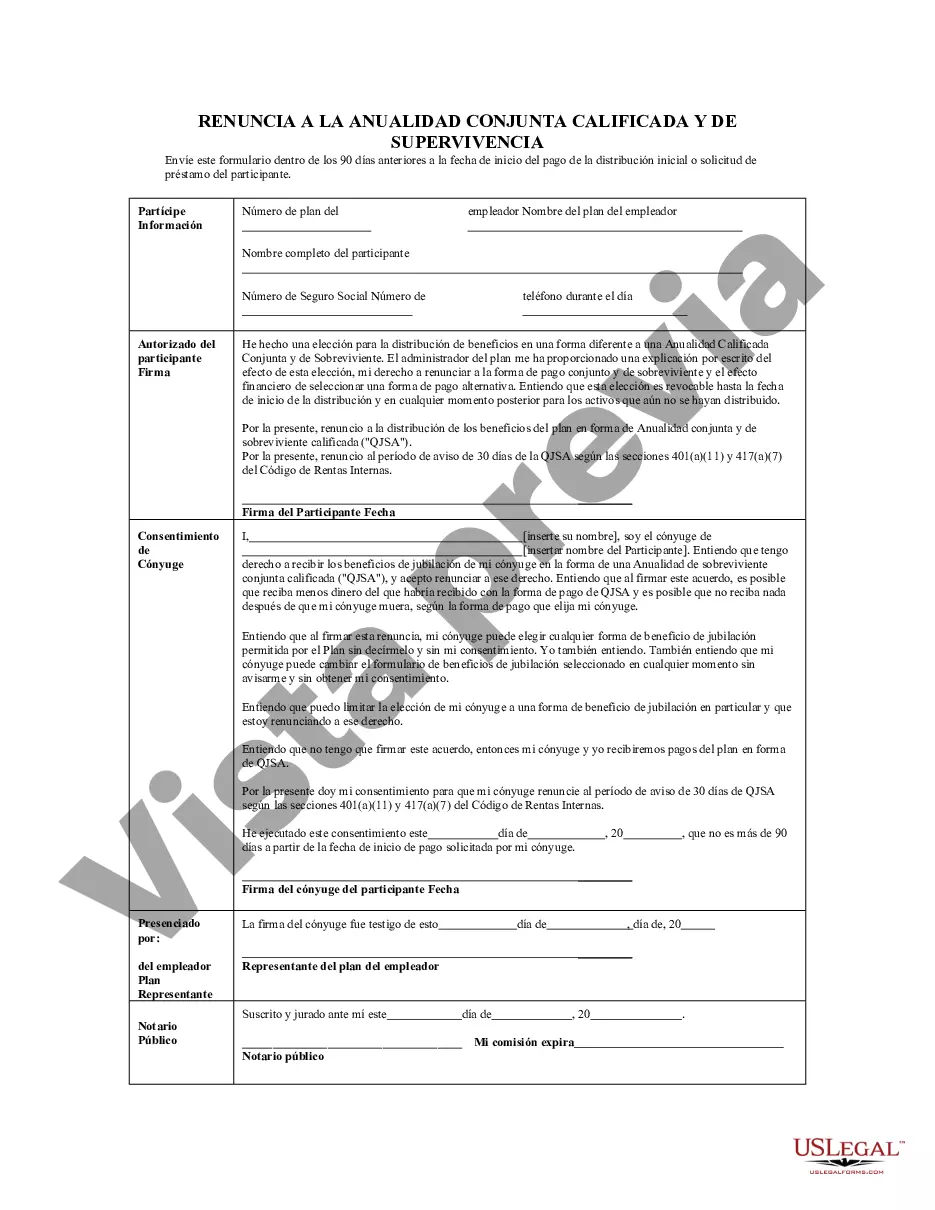

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Kentucky Renuncia a la anualidad conjunta y de sobreviviente calificada - QJSA - Waiver of Qualified Joint and Survivor Annuity - QJSA

Description

How to fill out Kentucky Renuncia A La Anualidad Conjunta Y De Sobreviviente Calificada - QJSA?

US Legal Forms - among the biggest libraries of authorized types in America - offers an array of authorized document layouts you are able to download or print out. Utilizing the website, you can get a large number of types for enterprise and specific reasons, categorized by groups, states, or search phrases.You will find the most up-to-date models of types like the Kentucky Waiver of Qualified Joint and Survivor Annuity - QJSA in seconds.

If you currently have a monthly subscription, log in and download Kentucky Waiver of Qualified Joint and Survivor Annuity - QJSA from your US Legal Forms local library. The Down load key will appear on every kind you view. You have access to all in the past delivered electronically types inside the My Forms tab of your own bank account.

In order to use US Legal Forms the very first time, listed below are basic instructions to help you get began:

- Make sure you have picked out the proper kind for your metropolis/region. Click the Review key to examine the form`s content material. See the kind explanation to actually have chosen the appropriate kind.

- In the event the kind does not suit your specifications, take advantage of the Research area on top of the display to discover the one who does.

- Should you be pleased with the shape, validate your choice by visiting the Purchase now key. Then, choose the prices prepare you want and offer your credentials to register for the bank account.

- Approach the deal. Utilize your charge card or PayPal bank account to finish the deal.

- Select the structure and download the shape on the product.

- Make modifications. Complete, change and print out and signal the delivered electronically Kentucky Waiver of Qualified Joint and Survivor Annuity - QJSA.

Each format you added to your account does not have an expiry time and is also the one you have for a long time. So, if you wish to download or print out yet another version, just proceed to the My Forms section and click about the kind you will need.

Gain access to the Kentucky Waiver of Qualified Joint and Survivor Annuity - QJSA with US Legal Forms, by far the most considerable local library of authorized document layouts. Use a large number of specialist and status-distinct layouts that fulfill your company or specific demands and specifications.